News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

Central Banks and Bitcoin: Inside the Czech National Bank’s Groundbreaking Custody Experiment

Odaily星球日报·2025/12/19 07:38

Fed's Chris Waller Signals Support for Rate Cuts

AiCryptoCore·2025/12/19 07:31

Upcoming Crypto Presale: Apeing Leads as XRP, Ethereum Wait

AiCryptoCore·2025/12/19 07:31

Vanguard Increases MicroStrategy Stake to $3.2 Billion

AiCryptoCore·2025/12/19 07:31

Ethereum’s Growing State Threatens Long-Term Decentralization

Cryptotale·2025/12/19 07:30

Magic Eden’s Bold Evolution: Transforming into a Premier Crypto Entertainment Platform

Bitcoinworld·2025/12/19 07:27

Ripple CTO Makes Notable Confirmation for XRP Holders

TimesTabloid·2025/12/19 07:21

Catfish effect? Are stablecoins really not the enemy of bank deposits?

BlockBeats·2025/12/19 07:18

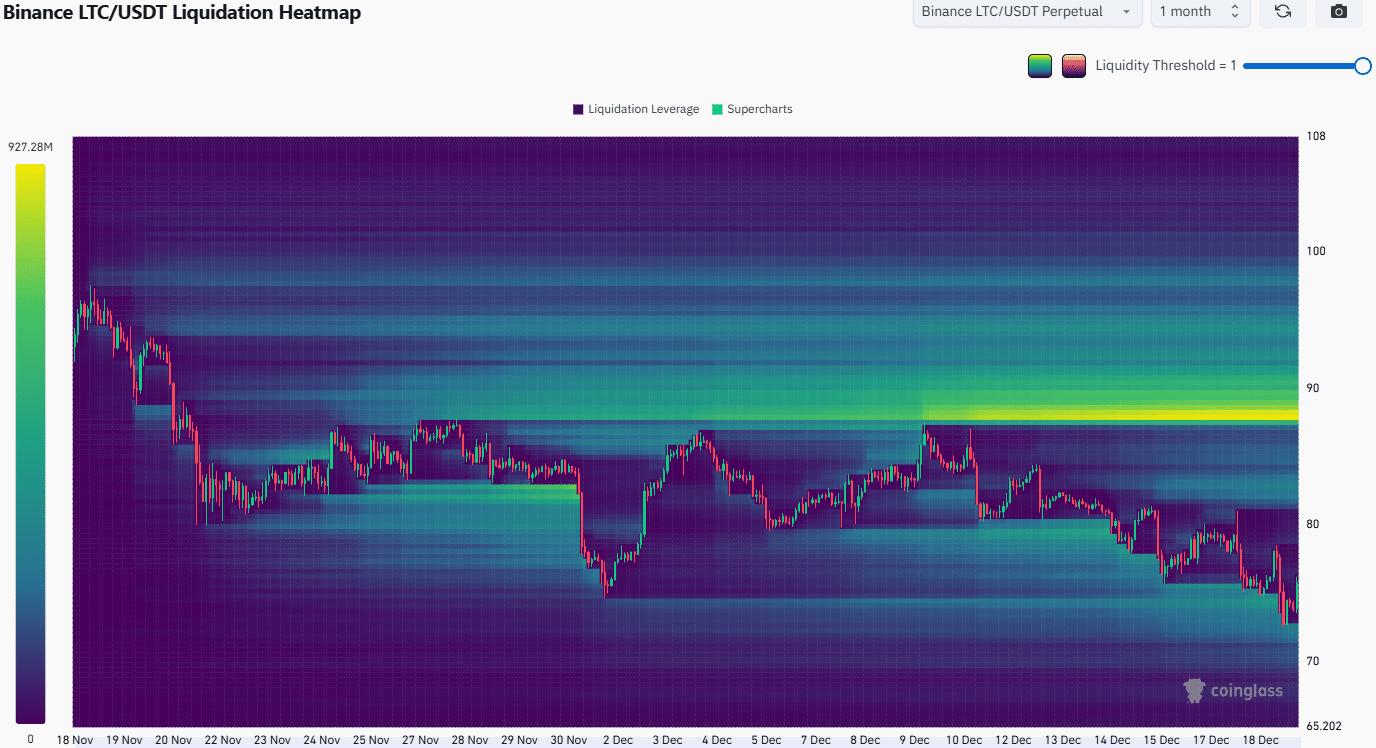

What next for Litecoin’s price after its $80-floor cracks?

AMBCrypto·2025/12/19 07:03

Flash

07:35

The Bank of Japan Governor's speech was "hawkish," stating that if the economy develops as expected, interest rates will continue to be raised, with specific decisions to be made after assessing the impact of the current rate hike.BlockBeats News, on December 19, Bank of Japan Governor Kazuo Ueda stated at this afternoon's monetary policy press conference in the East 8th District that while Japan's economy shows some signs of weakness, it is moderately recovering. If the economy and prices develop as expected, and as both improve, the Bank of Japan will continue to raise policy interest rates. After this rate hike, Japan's benchmark interest rate has risen from 0.50% to 0.75%, reaching its highest level since 1995 and marking Japan's official departure from the ultra-low interest rate era that lasted for 30 years. Regarding this, Kazuo Ueda commented: "There is no special significance to short-term interest rates being at a 30-year high; we will closely monitor the impact of the latest rate changes." Regarding future plans, Kazuo Ueda stated: "The pace of monetary adjustment will depend on the outlook for the economy, prices, and finance. There is still some distance to the lower bound of the neutral interest rate range. Currently, there is no sign of the strong tightening effect seen in previous rate hikes. We will decide whether to raise rates again after assessing the impact of the increase to 0.75% on the economy and prices. If wage increases continue to be passed on to prices, further rate hikes are indeed possible."

07:35

CryptoQuant: BTC valuation reset underway, market gradually returning to fundamentalsPANews, December 19 — According to CryptoQuant analyst MorenoDV_, a valuation reset for bitcoin is underway. By observing the bitcoin NVT Golden Cross indicator (smoothed by the 100-day moving average), it is possible to assess the relationship between market valuation and on-chain economic activity. NVT is regarded as bitcoin’s price-to-earnings ratio, where transaction volume replaces earnings, aiming to answer whether the network’s market capitalization aligns with actual economic activity. Currently, the NVT Golden Cross indicator shows that the short-term NVT is significantly below the long-term trend, indicating that bitcoin’s market value is discounted relative to on-chain activity. Historically, when the indicator deviates deeply into negative territory, it typically reflects bearish market sentiment and structural undervaluation of the network. In this cycle, the indicator dropped to a historic low of -0.58 and has now rebounded to around -0.32, suggesting that the price is gradually realigning with transaction-driven fundamentals, but still remains within a conservative valuation range. This phenomenon usually occurs during deleveraging and risk aversion phases, after which the market enters an accumulation period and drives healthier price discovery. The current market is transitioning from deep undervaluation to equilibrium, with more selective capital allocation, which may signal structural improvement and long-term opportunities in the crypto market.

07:33

The Governor of the Bank of Japan's speech leans toward the "hawkish" side. If the economy continues to develop as expected, the central bank will further raise interest rates. The specific decision will be made after assessing the impact of this rate hike.BlockBeats News, December 19th. Haruhiko Kuroda, Governor of the Bank of Japan, stated in today's afternoon monetary policy press conference that, to some extent, the Japanese economy is experiencing weakness but is undergoing a mild recovery. If the economy and prices develop as expected and improve along with the economic and price conditions, the Bank of Japan will continue to raise the policy rate.

After this rate hike, the Japanese benchmark interest rate has increased from 0.50% to 0.75%. This level marks the highest point since 1995, signaling Japan's formal departure from the era of maintaining ultra-low interest rates that has lasted for 30 years. Regarding this, Kuroda stated: "The short-term interest rate reaching a 30-year high does not have any special meaning, and we will closely watch the impact of the latest rate changes."

Regarding future plans, Kuroda mentioned: "The pace of monetary adjustment will depend on the economic, price, and financial outlook. There is still some distance from the lower limit of the neutral interest rate range. We have not observed a strong tightening effect as seen in previous rate hikes. We will decide on a further rate hike after evaluating the impact of raising the rate to 0.75% on the economy and prices. If wage increases continue to transmit to prices, a rate hike is indeed possible."

Trending news

MoreCentral Banks and Bitcoin: Inside the Czech National Bank’s Groundbreaking Custody Experiment

The Bank of Japan Governor's speech was "hawkish," stating that if the economy develops as expected, interest rates will continue to be raised, with specific decisions to be made after assessing the impact of the current rate hike.

News