News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitcoin Community Split Over Purpose May Coincide With Outperformance Versus Major Assets, Mow and JAN3 Say2Ethereum Near $4,475: Clearing $4,500 or Holding $4,362–$4,200 Could Determine Next Direction3Must-Read Before WLFI Launch: 20 Q&As Fully Explain the Governance Model

Going Global: Architecture Selection and Tax Optimization Strategies

How important is having an appropriate corporate structure?

深潮·2025/09/02 07:03

The Evolution of Altcoin Investment from the Perspective of $HYPE

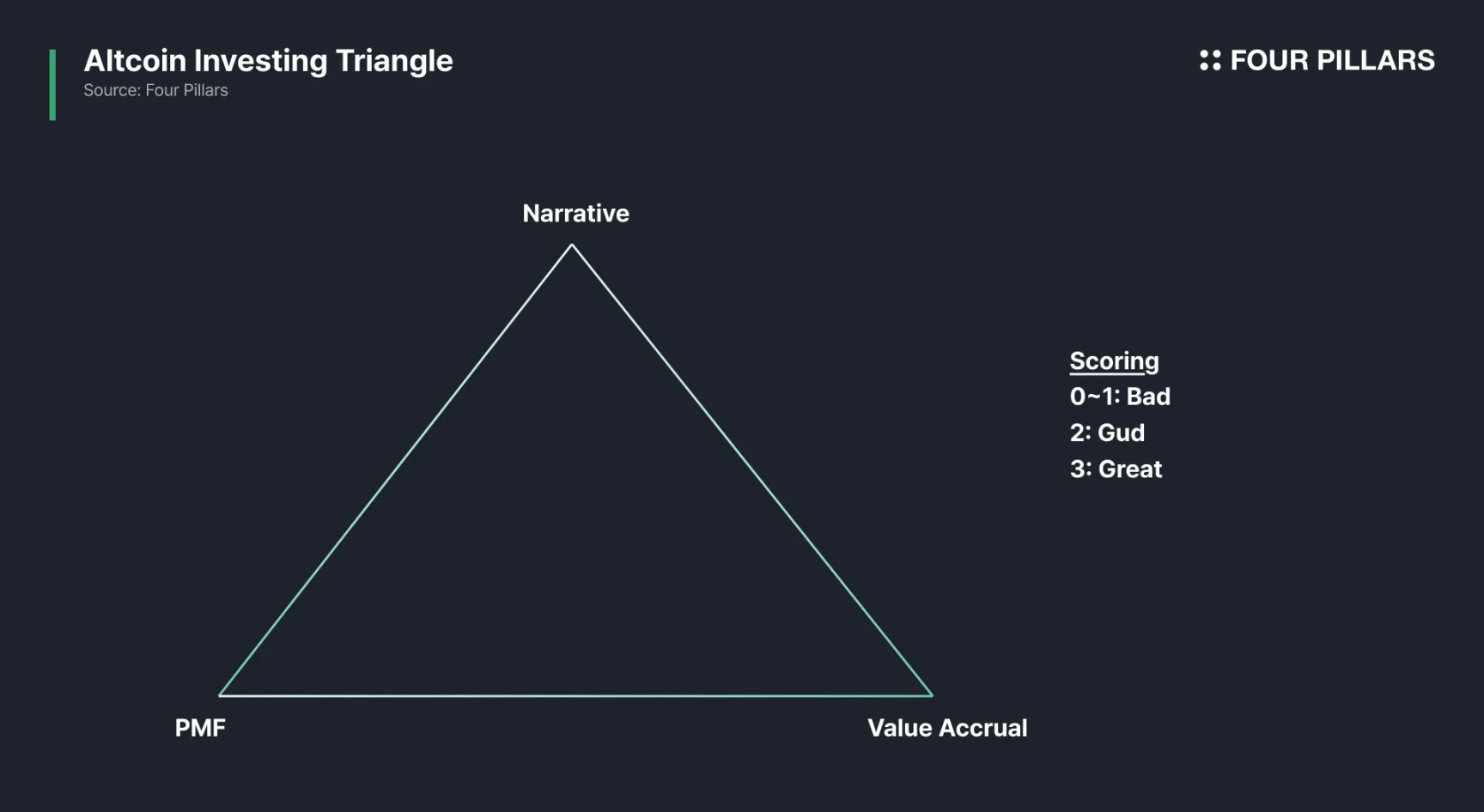

In an era where indicators can be manipulated, how can we see through the narrative fog surrounding token economics?

深潮·2025/09/02 07:03

Paraguay Launches Tokenized Innovation Hub on Polkadot

Coinspaidmedia·2025/09/02 05:40

The underestimated Malaysian Chinese: the invisible infrastructure builders of the crypto world

The foundational infrastructures and emerging narratives in the crypto industry, such as CoinGecko, Etherscan, and Virtuals Protocol, all originate from Malaysian Chinese teams.

BlockBeats·2025/09/02 05:13

Interpretation of AAVE Horizon: Trillions Market Awaiting Unlock, the Key Piece for RWA On-Chain?

What does it mean when U.S. Treasury bonds and stock funds can both be used as collateral in DeFi?

BlockBeats·2025/09/02 05:12

Flash

- 07:58European stocks extend losses, with Germany's DAX index down 1%ChainCatcher news, according to Golden Ten Data, European stocks have extended their losses. The German DAX index fell by 1% during the day, the UK FTSE 100 index dropped by 0.59%, and the Euro Stoxx 50 index declined by 0.69%.

- 07:58CryptoQuant Analyst: Bitcoin's Current Pullback Is Relatively Mild, More Likely a Correction Phase Rather Than a Full Sell-offChainCatcher news, according to CryptoQuant analyst Axel Adler Jr, who posted on Twitter: "In this round of the Bitcoin bull market cycle, most local peak pullbacks have concentrated in the 10% to 18% range, while deeper corrections typically extend to 20% to 30%. At the 12.8% range, we are closer to mild corrections, which aligns with a recovery/consolidation phase rather than a full-scale sell-off."

- 07:47Mastercard Europe executive: The possibility of developing its own blockchain in the future is not ruled outAccording to Jinse Finance, TheBigWhale reported that Christian Rau, Mastercard's Head of Crypto for Europe, stated in an interview that the company views crypto assets as a potential payment technology rather than a disruptive innovation. Mastercard has already deployed on-chain and off-chain crypto services and crypto payment card businesses, and is collaborating with institutions such as MetaMask, Bitget, and Moonpay to promote the application of crypto payments on the merchant side. Rau pointed out that although stablecoin transaction volumes have surpassed those of Mastercard, the company regards them as settlement tools rather than threats. Mastercard processes about 5,000 transactions per second, and its value lies not only in transaction speed but also in its supporting services such as anti-fraud, compliance, and recourse systems. The report states that although Mastercard does not have its own public blockchain project, it does not rule out this option: "We prefer interoperability with existing solutions. But if none can meet our needs, we will also consider it."