News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 17)|Grayscale XRP Spot ETF Ruling Imminent; SEC to Rule on 16 Major Crypto ETFs;2Massive $536M Outflow Hits Spot Bitcoin ETFs3Research Report|In-Depth Analysis and Market Cap of Meteora(MET)

Shiba Inu Eyes a Massive Rebound as Bulls Eye a 3X Rally

Cryptonewsland·2025/10/19 12:09

Bitcoin Plummets Again, But Here’s Why It Might Be a Bullish Signal

Cryptonewsland·2025/10/19 12:09

HYPE Struggles at $43 — Is a Breakout or Breakdown Coming Next?

Cryptonewsland·2025/10/19 12:09

Bullish XRP Trader Shares Deep Insights Explaining How $8, $20, and $27 Bull Targets Can Be Hit

Cryptonewsland·2025/10/19 12:09

3 Cryptos Ready To Skyrocket — Don’t Miss These Buying Opportunities

Cryptonewsland·2025/10/19 12:09

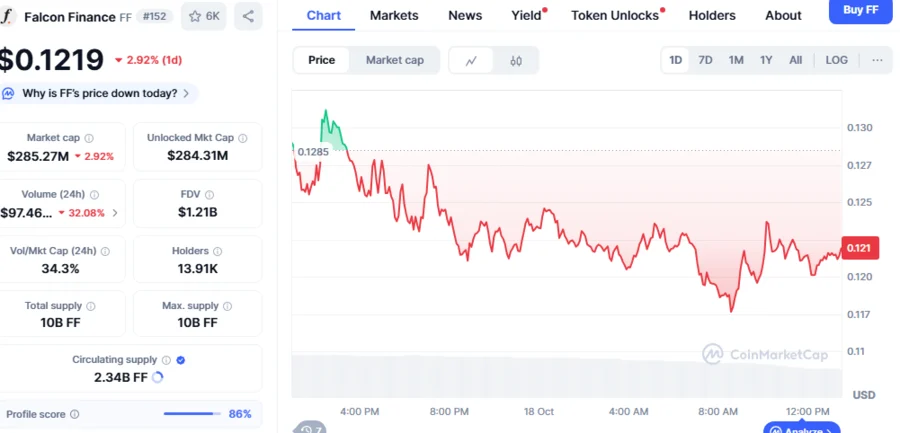

Whales Turn to FF Token Accumulation Amid Falcon Finance’s 37.9% Price Slump

CryptoNewsNet·2025/10/19 11:45

Japan’s FSA weighs allowing banks to hold Bitcoin, other cryptos: Report

CryptoNewsNet·2025/10/19 11:45

XRP, SOL Break Ahead with Bullish Reset in Sentiment as Bitcoin and Ether Stay Stuck in the Gloom

CryptoNewsNet·2025/10/19 11:45

Ripple (XRP) Chief Legal Officer Responds to Criticisms Directed at the Industry

CryptoNewsNet·2025/10/19 11:45

Are Bitcoin Miners Now Abandoning BTC to Work on Artificial Intelligence? Industry Members Respond

CryptoNewsNet·2025/10/19 11:45

Flash

- 15:59NYDIG: Stablecoins such as USDT are merely market trading tools and are not truly pegged to the US dollar.Jinse Finance reported that Greg Cipolaro, Global Head of Research at NYDIG, stated that stablecoins such as USDC, USDT, and USDe are not truly pegged to the US dollar, but rather fluctuate based on market supply and demand. Essentially, they can only be considered as market trading instruments. The so-called "stability" of stablecoins is actually determined by arbitrage and market dynamics. For example, when the price falls below $1, traders buy in; when it rises above $1, traders sell. Users often misunderstand the real risks associated with these assets.

- 14:49A new address is currently facing an unrealized loss of approximately $1.44 million from shorting ETH and ENA.According to Jinse Finance, OnchainLens monitoring shows that a newly created wallet address has withdrawn 4 million USDC from a certain exchange in the past two days and opened short positions on ETH (15x leverage) and ENA (10x leverage), currently with an unrealized loss of about 1.44 million USD.

- 14:30Analysis: Some market indicators suggest ETH may continue its rebound toward $4,500ChainCatcher news, according to Cointelegraph, some market indicators suggest that Ethereum may continue its rebound momentum and reach $4,500 by the end of October. Currently, ETH appears to be forming a "bullish flag," a pattern that typically signals a brief consolidation before continuing an upward trend. In addition, the recent ETH price has mostly remained above the "Weekly Bull Market Support Band," indicating a possible breakout above the channel's upper limit, which is in the $4,450-$4,500 range. If a breakout occurs, ETH could reach $5,200 in November. However, if ETH falls below the lower boundary of the "bullish flag pattern" at $3,550, it may face further pullback.