News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 11)|The Federal Reserve announced a 25 bps cut to the benchmark rate; Bitmine purchased 33,504 ETH; CBOE has approved the listing and registration of the 21Shares XRP ETF2Conflicted Fed cuts rates but Bitcoin’s ‘fragile range’ pins BTC under $100K3Full text of the Federal Reserve decision: 25 basis point rate cut, purchase of $4 billion in Treasury bills within 30 days

Trump Takes Control of the Federal Reserve: The Impact on Bitcoin in the Coming Months

The U.S. financial system is undergoing its most significant transformation in a century.

Chaincatcher·2025/12/11 16:50

Castle Island Ventures partner: I don’t regret spending eight years in the cryptocurrency industry

Move forward with pragmatic optimism.

Chaincatcher·2025/12/11 16:50

Undercurrents Surge: Crypto Whales Spark Another Wave of Accumulation

AICoin·2025/12/11 16:41

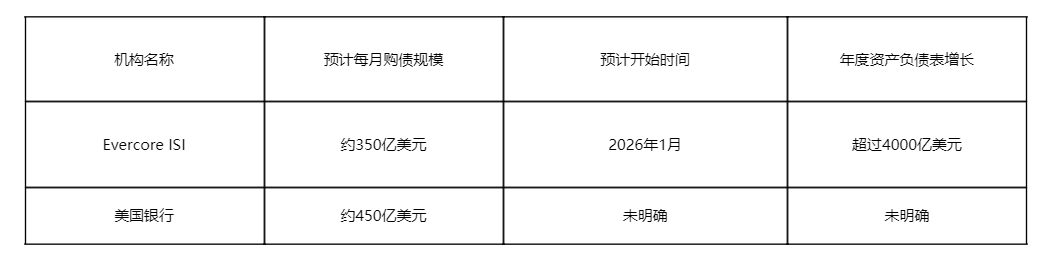

Fed Decision Preview: Balance Sheet Expansion Signals Are More Important Than Rate Cuts

AICoin·2025/12/11 16:41

The Federal Reserve cuts interest rates as expected, what happens next?

AICoin·2025/12/11 16:41

Evolutionary Logic and Ecological Value of the DeFi 2.0 Era Analyzed through IXO Protocol

Is it possible for investment to be risk-free? This is difficult to achieve in both traditional DEX and CEX platforms...

ThePrimedia·2025/12/11 16:23

Bitcoin due 2026 bottom as exchange volumes grind lower: Analysis

Cointelegraph·2025/12/11 14:12

Flash

- 16:56Data: 90,300 SOL transferred from an anonymous address, routed through intermediaries and flowed into WintermuteAccording to ChainCatcher, Arkham data shows that at 00:36, 90,300 SOL (worth approximately $11.78 million) were transferred from an anonymous address (starting with HD1cEB...) to an exchange. Subsequently, the address transferred 18,400 SOL to Wintermute.

- 16:39JPMorgan issues Galaxy short-term bonds on the Solana networkChainCatcher news, according to Bloomberg, JPMorgan arranged, created, distributed, and settled a short-term bond for Galaxy Digital Holdings LP on the Solana blockchain, as part of efforts to use cryptocurrency underlying technology to improve financial market efficiency. This $50 million US commercial paper was purchased by an exchange and asset management company Franklin Templeton, with payment made in USDC stablecoin issued by Circle Internet Group Inc., according to a statement from the relevant companies on Thursday. The redemption payment at maturity will also be made in USDC.

- 16:39Data: In the past 24 hours, total liquidations across the network reached $532 million, with long positions liquidated for $403 million and short positions for $128 million.According to ChainCatcher, citing data from Coinglass, liquidations across the entire network in the past 24 hours reached $532 million, with long positions liquidated for $403 million and short positions for $128 million. Among them, bitcoin long positions were liquidated for $139 million, and bitcoin short positions for $37.53 million. Ethereum long positions were liquidated for $129 million, and ethereum short positions for $52.25 million. In addition, over the past 24 hours, a total of 153,680 people worldwide were liquidated, with the largest single liquidation occurring on Hyperliquid - BTC-USD, valued at $23.185 million.

News

![[Bitpush Daily News Selection] The Federal Reserve cut interest rates by 25 basis points as expected; the Federal Reserve will purchase $40 billions in Treasury securities within 30 days; Gemini received CFTC approval to enter the prediction market; State Street Bank and Galaxy will launch the tokenized liquidity fund SWEEP on Solana in 2026.](https://img.bgstatic.com/multiLang/image/social/87a413b57fb2c702755e8bc5b4385a781765441081405.png)