News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 16)|SEC to Introduce Innovative Exemption Mechanism by End of 2025; Japan Plans Legislation to Ban Crypto Insider Trading; Aptos Partners with Reliance Jio to Launch Blockc2Chainlink holds 63% oracle market share as LINK price tests resistance3Top 3 Altcoins for November Gains: Experts Highlight ETH, ADA, and LINK

Algorand (ALGO) to See a Slight Dip Before a Rebound? This Bullish Fractal Setup Says Yes!

CoinsProbe·2025/10/17 06:27

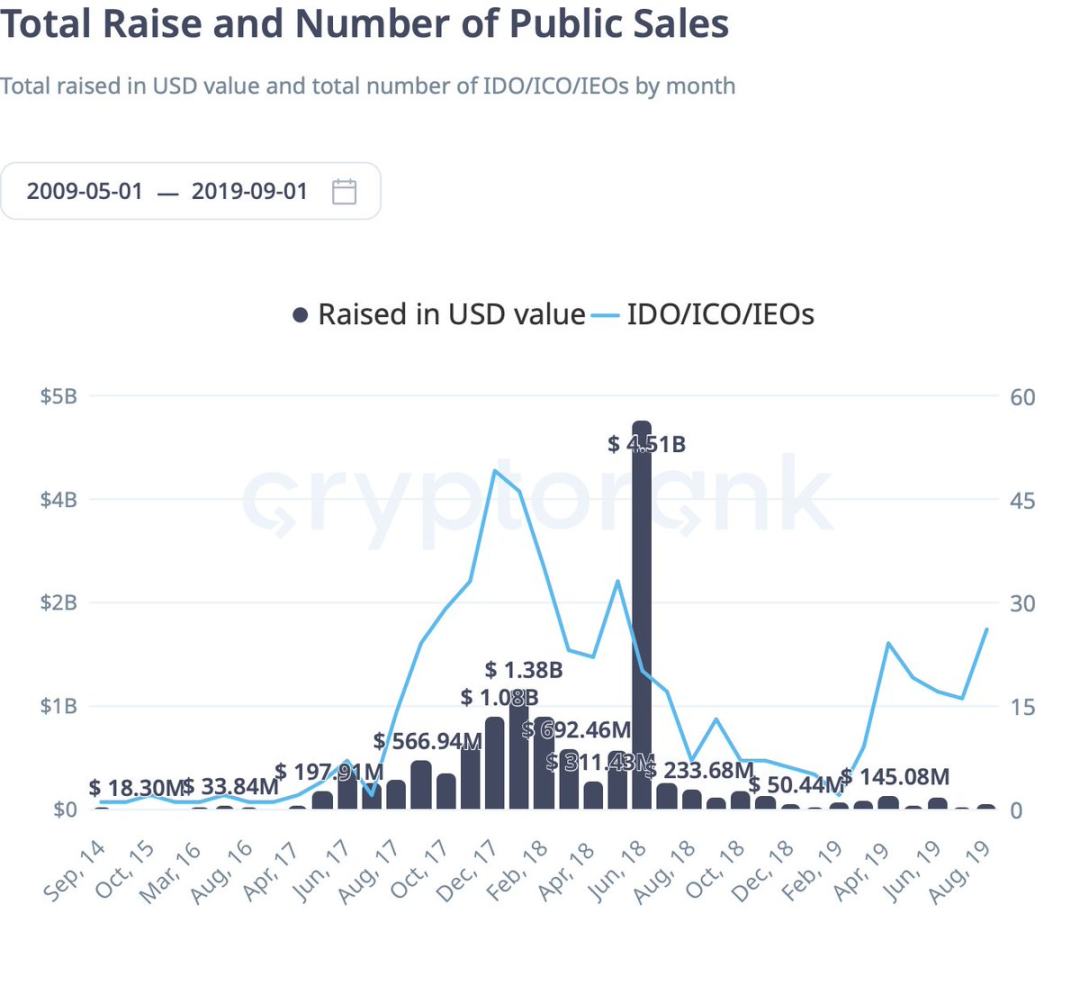

ICO Revival: Echo, Legion and Others Turn Speculation Frenzy into Structured Investment

In 2025, ICOs accounted for approximately one-fifth of all token sale trading volume.

深潮·2025/10/17 05:57

MegaETH Valuation Game: A Good Entry Opportunity or Approaching Risk?

The L2 project MegaETH, backed by Vitalik, is about to launch its public sale.

Chaincatcher·2025/10/17 04:52

The Manipulation Logic and Survival Strategies Behind the "Largest Liquidation in History"

BTC_Chopsticks·2025/10/17 04:43

This is not a bull market signal, but one of the most dangerous turning points in history.

BTC_Chopsticks·2025/10/17 04:42

BitMine Adds $417 Million in Ethereum Amid Market Dip

Quick Take Summary is AI generated, newsroom reviewed. BitMine purchased 104,336 ETH worth $417 million during a 20% price dip. Rising Ethereum whale activity signals renewed institutional accumulation. On-chain data confirms large holders are steadily increasing their positions. The move highlights confidence in Ethereum’s long-term strength despite short-term volatility.References 🔥 TODAY: BitMine bought 104,336 $ETH worth $417M as prices fell 20% from August highs, per onchain data.

coinfomania·2025/10/17 04:06

Ether retail longs metric hits 94%, but optimism could be a classic bull trap

Cointelegraph·2025/10/17 02:33

Bitcoin options markets highlight mounting fears as traders brace for more pain

Cointelegraph·2025/10/17 02:33

Flash

- 06:15Institution: The decline in US Treasury yields may signal a major shift in market sentimentJinse Finance reported that Justin Low, an analyst at the US financial website investinglive, stated that all perspectives on gold have long been exhausted. There are no signs of a pullback in this round of the rally, and since the beginning of this week, gold prices have soared by more than $300, making the market exceptionally wild. Gold is expected to achieve a full five consecutive trading days of gains throughout the week. During the Asian session, gold prices fluctuated again, once falling back to $4,280. However, buying quickly surged in, pushing gold prices back to around $4,370. Trade tensions remain the focus of ongoing developments this week, but new trends are also emerging in the bond market. Earlier this week, the analyst warned that the market was at a critical turning point, and as trading enters the final day of the week, various signs are beginning to emerge. The yield on the 10-year US Treasury is attempting to break strongly below the 4% mark, which may signal a major shift in market sentiment. Therefore, as we enter the mid-to-late October trading period, it is crucial to be alert to fluctuations in other related assets in the market. (Golden Ten Data)

- 06:15Andrew Kang-related address shorted 22,271 ETH with 25x leverage, worth approximately $86.74 million.According to ChainCatcher, based on MLM monitoring, Mechanism Capital partner Andrew Kang's associated address is currently shorting 22,271 ETH with 25x leverage, equivalent to approximately $86.74 million, with a current unrealized profit of $760,000. In addition, this address holds a SOL short position worth $5.71 million and an ENA long position worth $590,000.

- 06:01A certain whale has lowered their ETH limit buy orders to $3,660–$3,710, which is $100 lower than the previous order price.According to ChainCatcher, on-chain analyst @ai_9684xtpa has monitored that the whale who previously placed a limit buy order has adjusted the price range during the recent drop. The latest ETH bottom-fishing expectation is set at "$3,660-$3,710," with a plan to purchase $11 million at this level, which is $100 lower than the original order price.