News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

Revealed: Bitmain’s Massive $229.3 Million Ethereum Purchase Signals Bullish Confidence

Bitcoinworld·2025/12/19 02:42

Revolutionary aPriori Chainlink Partnership Unlocks Seamless Cross-Chain Trading

Bitcoinworld·2025/12/19 02:27

Revolutionary SportsFi Platform GolfN Drives Global Expansion with Major Brand Partnerships

Bitcoinworld·2025/12/19 02:15

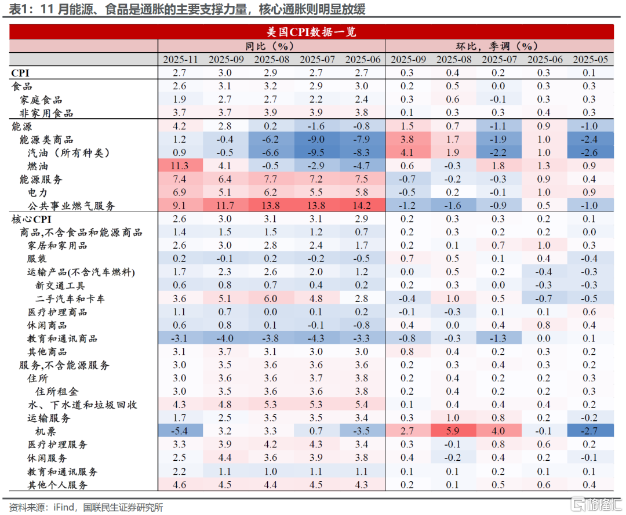

US CPI Surprises, Is There a Turning Point for the Doves?

AIcoin·2025/12/19 02:06

Game-Changing Appointment: Mike Selig Takes Helm as New CFTC Chairman

Bitcoinworld·2025/12/19 01:57

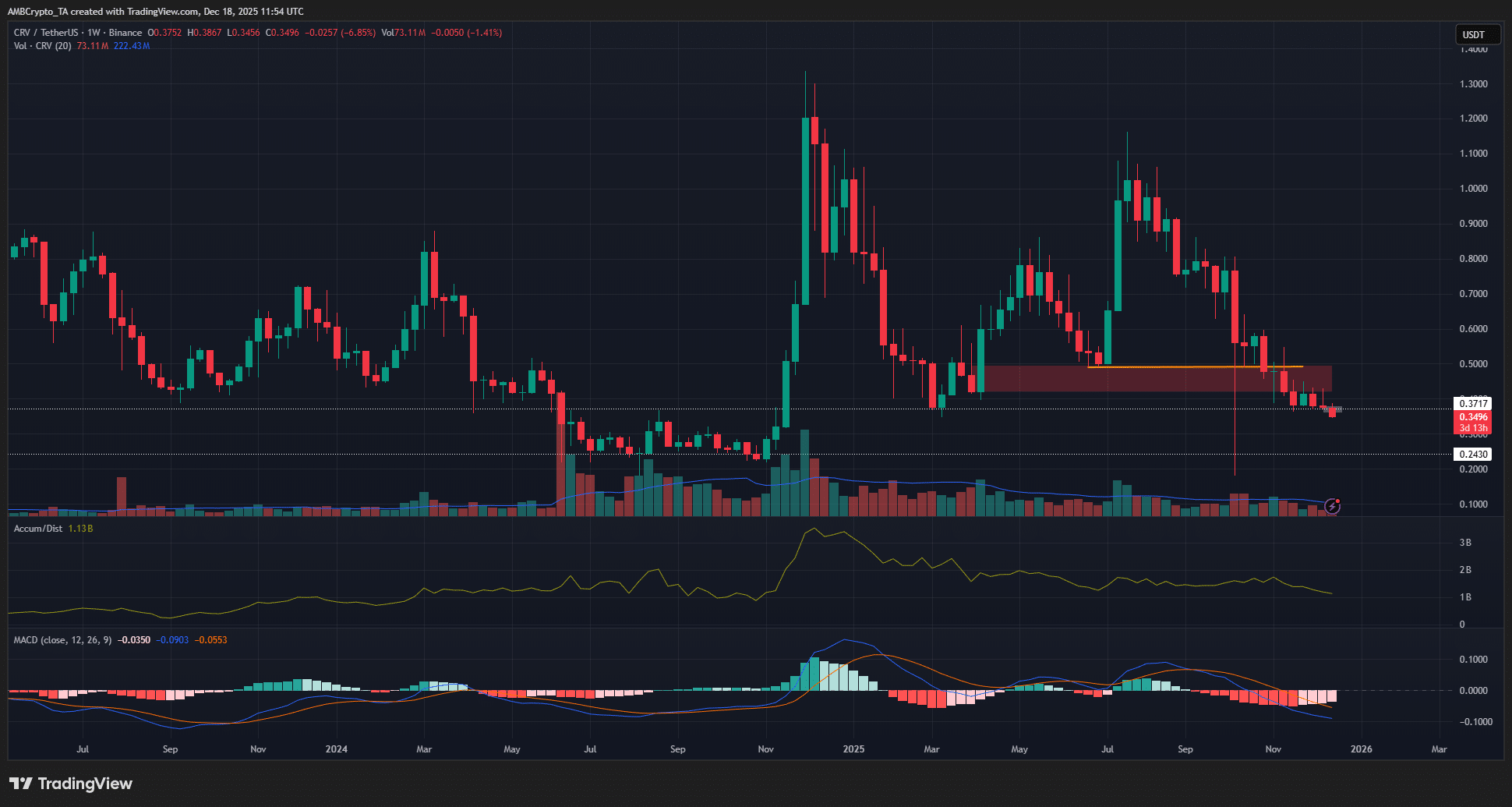

Dissecting Curve DAO’s price action as CRV eyes another support test

AMBCrypto·2025/12/19 01:03

Damaging Impact: Cardano Founder Reveals How Trump’s Crypto Moves Hurt the Market

Bitcoinworld·2025/12/19 01:00

Flash

02:45

Cryptocurrency Fear and Greed Index Lingering at Low Levels, Market Continues to Remain in "Extreme Fear" StateBlockBeats News, December 19, according to Alternative Data, today's cryptocurrency Fear and Greed Index is 16 (yesterday was 17), indicating that the market continues to be in a state of "extreme fear."

Note: The Fear Index threshold is 0-100 and includes the following indicators: Volatility (25%) + Market Volume (25%) + Social Media Hype (15%) + Market Surveys (15%) + Bitcoin's Dominance in the Market (10%) + Google Trends Analysis (10%).

02:38

Visa's Stablecoin Settlement Pilot Project Reaches $3.5 Billion in Annualized Settlement VolumeBlockBeats News, December 19, Visa's Head of Product and Strategy, Jack Forestell, announced that Visa's stablecoin settlement pilot project has reached an annualized settlement volume of $3.5 billion.

Through a partnership with Circle, Visa's U.S. card-issuing and acquiring bank partners can achieve 7-day-a-week settlement.

02:37

Terraform Labs bankruptcy administrator files $4 billion claim against Jump, alleging responsibility for Terraform’s collapse | PANewsPANews, December 19—According to the Wall Street Journal, the bankruptcy administrator responsible for liquidating the remaining assets of Do Kwon's Terraform Labs has filed a lawsuit against Jump Trading, accusing the high-frequency trading giant of illegal profits and contributing to the collapse of the "crypto empire." The plan administrator appointed by the bankruptcy court, Todd Snyder, is seeking $4 billion in claims from Jump, company co-founder William DiSomma, and Kanav Kariya, who rose from intern to president of Jump's crypto trading business.

News