News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

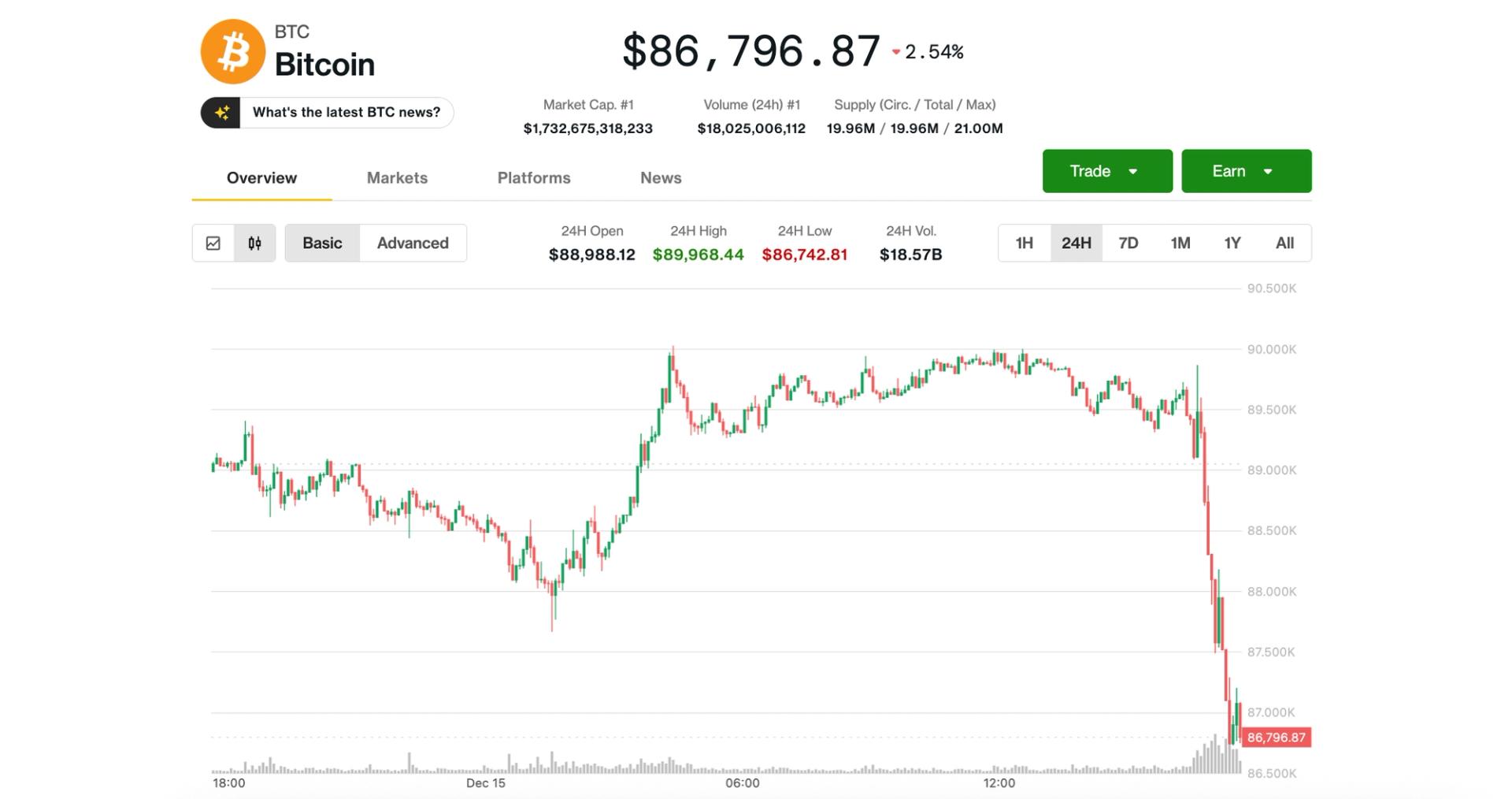

The recent decline in bitcoin prices is primarily driven by expectations of a rate hike by the Bank of Japan, uncertainty regarding the US Federal Reserve's rate cut trajectory, and systemic de-risking by market participants. Japan's potential rate hike may trigger the unwinding of global arbitrage trades, leading to a sell-off in risk assets. At the same time, increased uncertainty over US rate cuts has intensified market volatility. In addition, selling by long-term holders, miners, and market makers has further amplified the price drop. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

The crypto industry is replacing Wall Street's privileged status within the American right-wing camp.

The market is transitioning from an emotion-driven cycle of speculation to a phase of structural differentiation driven by regulatory channels, long-term capital, and fundamental-based pricing.

The market is down again, but this may not be a good buying opportunity this time.

SCOR announced today a major strategic partnership with creative director, cultural icon, and CLOT founder Edison Chen.

- 09:13Grayscale transfers 11,848 ETH to an exchange againAfter transferring 957.354 ETH and approximately 103 BTC to an exchange address, Grayscale has once again transferred a total of 11,848 ETH, worth $37.16 million, to an exchange address through four transactions in the past two hours.

- 09:11Federal Reserve's Williams: Slowing employment and easing inflation risks support Fed rate cutsFederal Reserve's Williams: Slowing Employment and Easing Inflation Risks Support Fed Rate Cut 2025-12-15 16:02 BlockBeats news, on December 16, Federal Reserve's Williams stated that the cooling labor market and easing inflation risks provided the basis for the Fed's rate cut decision last week. This is Williams' first public comment on last week's rate cut decision. He said he is increasingly confident that price increases will continue to slow. Williams noted that inflation is "temporarily staying" above the Fed's target, but he believes that as the impact of tariffs is absorbed more broadly by the economy next year, inflation could continue to decline. Meanwhile, he stated that although employment conditions have not deteriorated sharply, they are gradually cooling, as reflected in official data as well as consumer and business surveys. Williams said that overall, these changes in pressure on the Fed's two main economic goals supported last week's rate cut decision. (Golden Ten Data) Report Correction/Report This platform is now fully integrated with the Farcaster protocol. If you already have a Farcaster account, you can log in to comment

- 09:10CNBC: Hassett's Appointment as Federal Reserve Chairman Was Interfered With by Trump's Inner CircleBlockBeats News, December 15, according to CNBC citing sources, Kevin Hassett, once considered a "quasi-candidate" for Federal Reserve Chair by the market, has recently faced doubts from senior figures who can directly influence former President Trump’s decisions. The point of contention is: Hassett was initially seen as the strongest candidate to succeed current Chair Powell due to his close relationship with Trump, but now concerns are being raised for the same reason—being "too close to the president." This pressure may explain why the candidate interviews were rescheduled after being canceled in early December (at least for Warsh, the interview was completed last week). Trump previously told reporters that he had decided on a candidate for Federal Reserve Chair, but in an interview with The Wall Street Journal on Friday, he stated that former Federal Reserve Governor Kevin Warsh and Hassett had both become the final candidates, which surprised the market. On the Kalshi prediction market, Hassett’s probability of being selected dropped accordingly. "Both Kevins are excellent," Trump said. As of Monday, Hassett still led on the Kalshi platform with a 51% probability, but this was a sharp decline from over 80% earlier this month; Warsh’s probability rose from about 11% in early December to 44%. The current resistance is more about boosting Warsh rather than criticizing Hassett. JPMorgan CEO Jamie Dimon praised both candidates at an event on Thursday, but some of his remarks led the audience to believe he favored Warsh, the former Federal Reserve Governor.