News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 19)|Fed Holds Rates at 4.25%-4.50%; ~$23B Bitcoin Options Expire Next Friday, Volatility May Intensify2Bitget US Stock Morning Brief | CPI Cools Ahead of Expectations; AI Giants Join Genesis Initiative; NYSE Holiday Trading Unchanged (December 19, 2025)3Senate confirms CFTC Chair pick Michael Selig as agency takes larger role regulating crypto

Stunning Bitcoin Price Prediction: BOJ Policy Could Catapult BTC to $1 Million, Says Arthur Hayes

Bitcoinworld·2025/12/19 04:55

Spot Ethereum ETFs Face Alarming Sixth Day of Net Outflows: What’s Driving the Exodus?

Bitcoinworld·2025/12/19 04:45

ECB Says Digital Euro Is Ready as Decision Shifts to EU Lawmakers

Decrypt·2025/12/19 04:20

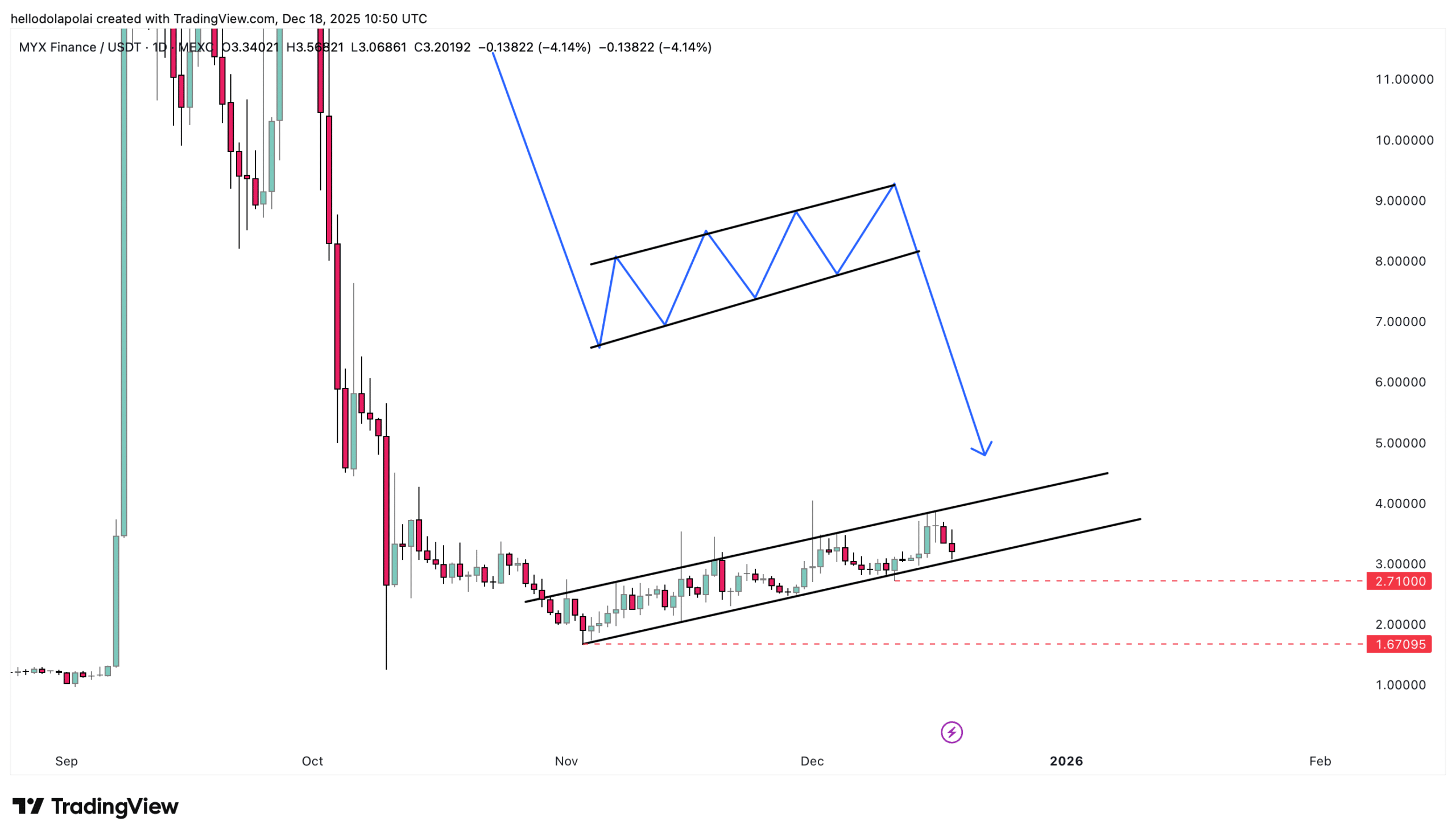

MYX drops 11% as liquidity dries up – Can bulls defend THIS support?

AMBCrypto·2025/12/19 04:03

Take Down OpenAI? The Ambition of the Open-Source AI Platform Sentient Goes Beyond That

Odaily星球日报·2025/12/19 03:44

Historic Shift: Bank of Japan Raises Key Interest Rate to 30-Year High

Bitcoinworld·2025/12/19 03:42

'We are closer than ever': US crypto czar David Sacks says Clarity Act markup confirmed for January

The Block·2025/12/19 03:36

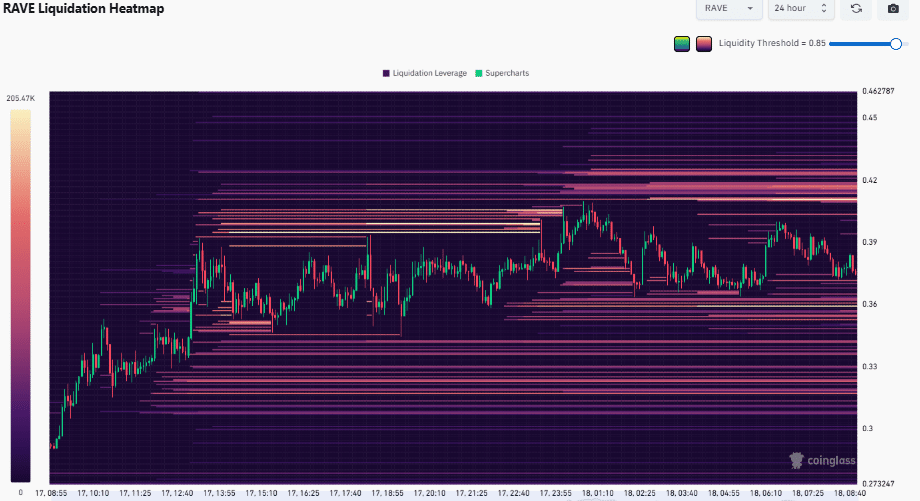

RAVE rallies 29%, but is the post-launch correction already over?

AMBCrypto·2025/12/19 03:03

Stability World AI and Cache Wallet Collaborate to Redefine Asset Recovery and Digital Ownership

BlockchainReporter·2025/12/19 03:00

Flash

04:51

Grayscale: By 2025, the stablecoin supply will reach $300 billion, with an average monthly trading volume of $1.1 trillion, benefiting multiple token assetsBlockBeats News, December 19th, Grayscale posted on X platform, stating that stablecoins will experience explosive growth by 2025, with a total supply reaching $300 billion and average monthly transaction volume reaching $1.1 trillion. With the passage of the GENIUS Act (Stablecoin Genius Act), the increasing adoption of stablecoins, blockchain projects such as ETH, TRX, BNB, and SOL will benefit from the growing transaction flow, and infrastructure projects like Chainlink (LINK) and emerging networks like XPL will also benefit.

04:46

Grayscale: Stablecoin supply to reach $300 billions and average monthly trading volume to hit $1.1 trillions in 2025, with multiple token assets set to benefitAccording to Odaily, Grayscale posted on X stating that stablecoins are expected to experience explosive growth in 2025, with supply reaching $30 billion and average monthly trading volume hitting $1.1 trillion. With the passage of the GENIUS Act (Stablecoin Genius Act) and increased adoption of stablecoins, blockchain projects such as ETH, TRX, BNB, and SOL will benefit from the growing transaction flow. Infrastructure like Chainlink (LINK) and emerging networks such as XPL will also benefit from this trend.

04:38

Stacks officially launches USDCx, bringing native institutional-grade USD liquidity to Bitcoin L2ChainCatcher reported that Stacks has officially launched USDCx. This is a stablecoin based on Circle's new xReserve infrastructure and backed by USDC. The launch of USDCx establishes a native, institution-grade liquidity USD channel for the Bitcoin Layer 2 ecosystem, enabling funds to be settled directly on the Bitcoin network.

News