News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1 Bitget Daily Digest (Dec. 18)|U.S. SEC issues a Statement on the Custody of Crypto Asset Securities by Broker-Dealers; LayerZero (ZRO) to unlock ~25.71 million tokens on Dec. 202Bitget US Stock Morning Brief | S&P 500 Four-Day Decline; Oracle AI Financing Stalls; Energy & Precious Metals Rally; Micron Crushes Guidance, Surges After Hours (December 18, 2025)3SEC says broker-dealers need to maintain crypto private keys to comply with customer protection rules

XRP and HBAR Are Now Institution-Safe Assets? Here’s the Latest

TimesTabloid·2025/12/18 11:51

XRP Price: 850% Upside or 50% Crash? Experts Share Mixed Opinions

Coinspeaker·2025/12/18 11:51

Samson Mow’s Radical Bitcoin Bet: Ditching Everything for BTC

Bitcoinworld·2025/12/18 11:27

Institutions Increase Ethereum Accumulation; Supply on Exchanges Stays Substantial

Bitcoininfonews·2025/12/18 11:24

California Governor Criticizes Trump’s Crypto Pardons

Bitcoininfonews·2025/12/18 11:24

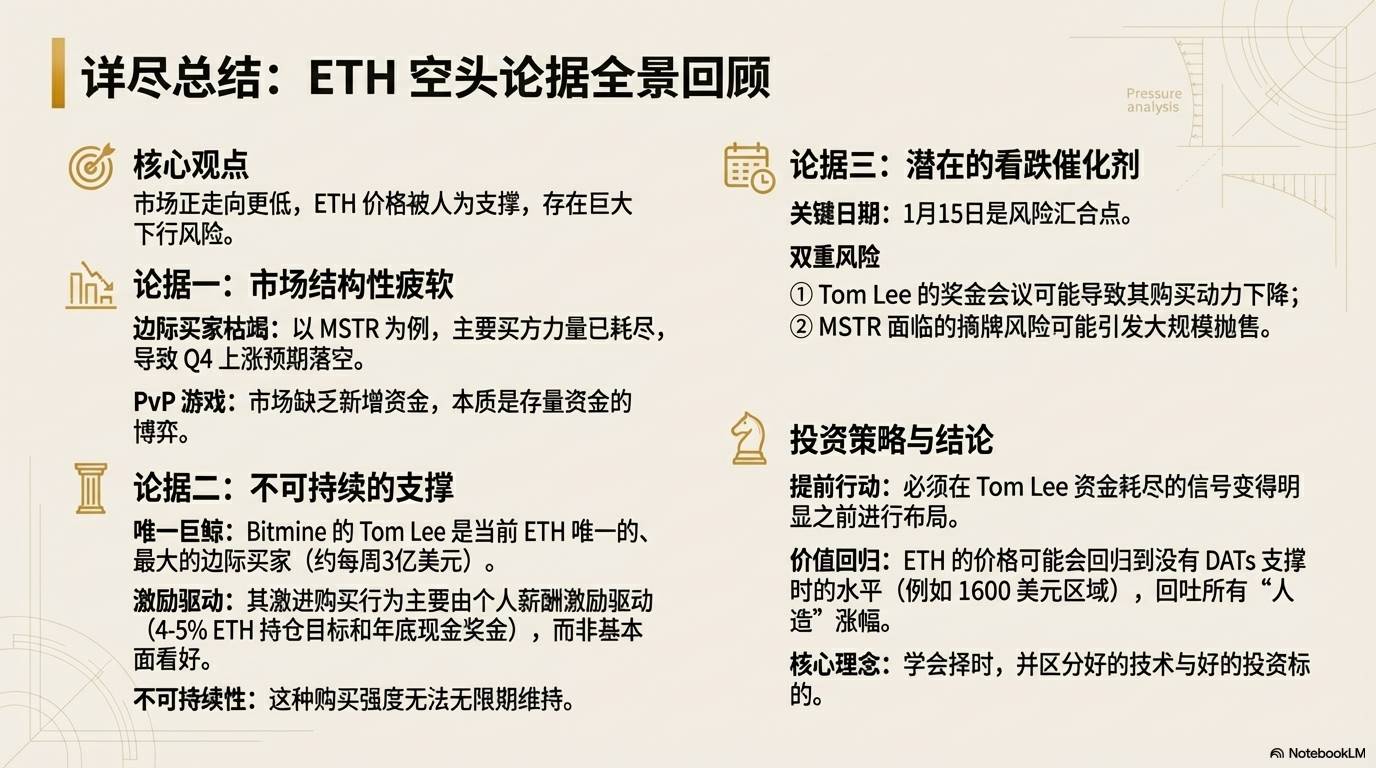

After making a profit of $580,000, I went all in again with $1 million to short ETH

TechFlow深潮·2025/12/18 11:22

Cardano Price Prediction as Senate Crypto Talks Stall and DeepSnitch AI Presale Builds

BlockchainReporter·2025/12/18 11:15

When AI Makes Candlestick Charts Speak

AIcoin·2025/12/18 11:03

Flash

11:53

Trump Media & Technology Group's pre-market gains expand to 37.5% | PANewsPANews, December 18th – According to Golden Ten Data, a certain exchange continued its upward momentum, with pre-market gains once expanding to 37.5%. Market sources reported: The exchange will merge with TAE TECHNOLOGIES in an all-stock transaction. The deal is expected to be completed by mid-2026. The exchange stated: After the merger, the company is expected to select a site and begin construction of its first utility-scale nuclear fusion power plant in 2026. Fusion energy will pave the way for the United States' dominance in artificial intelligence and energy security. The transaction values each TAE share at $53.89. Up to $200 million in cash will be provided at signing. Upon completion, the company will become the holding company for Truth Social, Truth+, Truth.FI, TAE, TAE Power Solutions, and TAE Life Sciences.

11:52

Analyst: Bitcoin options show polarized long and short positions, with capital flows indicating a cautious sentimentBlockBeats News, December 18, according to The Block, Derive founder Nick Forster stated that traders have clearly shifted toward defensive structural positioning, with the 30-day implied volatility of bitcoin rising to nearly 45%, while the skew remains around -5%; longer-term skew is also anchored at this level for the first and second quarters of next year. Around the upcoming expiry date, market positions show a clear polarization. At the $100,000 and $120,000 strike prices, call option positions are continuously accumulating, indicating that some traders are still betting on a strong rebound in bitcoin. However, overall capital flows indicate a stronger sense of caution. Forster pointed out that bears are accumulating "a considerable amount of put option exposure" near the $85,000 strike price to guard against bitcoin falling below this key level in the short term. He added that the implied probability from options still reflects a challenging market environment: the market only gives bitcoin about a 30% chance of reaching $100,000, while the probability of reclaiming its all-time high is only about 10%.

11:47

Analyst: Bitcoin Options Long-Short Setup Diverges, Funding Flows Indicate Cautious SentimentBlockBeats News, December 18th, according to The Block, Derive founder Nick Forster stated that traders have significantly shifted towards a defensive structural setup. The 30-day Bitcoin implied volatility has risen to nearly 45%, while the skew remains at around -5%; the longer-term skew is also anchored at this level in the first and second quarters of next year.

Around the upcoming expiry date, the market positions show a clear polarization. At $100,000 and $120,000 strike prices, the open interest for call options continues to accumulate, indicating that some traders are still betting on a possible strong rebound in Bitcoin.

However, the overall fund flows indicate a stronger sense of caution. Forster pointed out that shorts are accumulating a "significant scale of put option exposure" near the $85,000 strike price to hedge in case Bitcoin drops below this key level in the short term. He added that the option's implied probability still reflects a challenging market environment: the market only gives Bitcoin about a 30% probability of touching $100,000 and only about a 10% probability of reclaiming its all-time high.

News