News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

For bystanders, DeFi is a novel social experiment; for participants, a DeFi hack is an expensive lesson.

A meme, a mini app, and a few clicks—just like that, the Farcaster community has a brand new shared story.

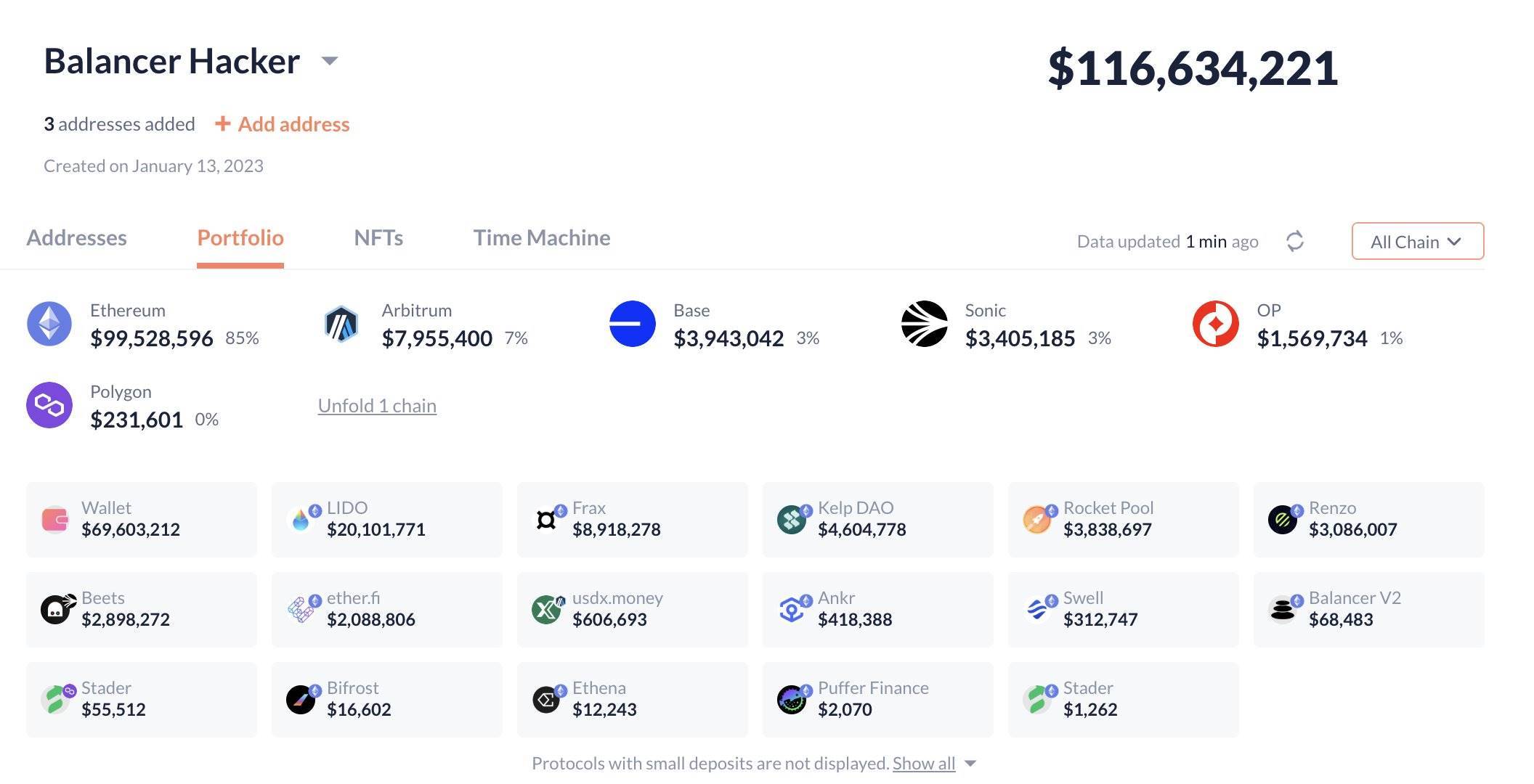

DeFi protocol Balancer suffers a major exploit with $70.9M in crypto drained. Team yet to respond.Funds Moved to New WalletWhat’s Next for Balancer and DeFi Security?

BullZilla and Dogecoin battle for investor attention among the best meme coin presales in 2025 as BullZilla’s presale explodes and Dogecoin eyes a recovery from recent declines.Dogecoin Price Prediction: A Chance for a Strong ComebackBullZilla: Exploding Ahead in the Best Meme Coin Presales in 2025Conclusion

Crypto markets dip as whales sell $2B in BTC, leading to $414M in liquidations amid rising geopolitical risks.Liquidations Top $414M as Sentiment Turns FearfulMarket Cap Falls Amid Uncertainty

Zerohash gains MiCA license in the EU, paving the way for more institutional finance firms to explore crypto.Could TradFi Finally Dive In?Bridging the Gap Between Two Worlds

Learn how BlockDAG’s $435M+ presale, Antony Turner’s leadership, ZCash price setup, & PENGU price analysis define the top crypto gainers.Antony Turner’s Leadership & Strategy Build Global ConfidenceZCash Price Setup: Privacy-Focused Asset Regains StrengthPENGU Price Analysis: Meme Energy Meets Institutional AttentionKey Insights

- 15:55Data: The "100% win rate whale" is currently facing a loss of over 20 million USD on long positionsChainCatcher News, according to on-chain data, as the market declines, the "10.11 to present 100% win rate whale" is currently facing unrealized losses of over $20 million on long positions. Currently, this whale holds 10x leveraged SOL, 15x leveraged ETH, and 5x leveraged HYPE long positions, with a total position value of approximately $168 million.

- 15:32Citi: Global AI industry revenue is expected to reach $97.5 billion by 2030Jinse Finance reported that Citigroup predicts that by 2030, global artificial intelligence industry revenue will reach $97.5 billion, compared to $4.3 billion in 2025, representing a compound annual growth rate as high as 86%. This growth reflects the accelerated adoption and commercialization of AI technology by enterprises, while hyperscale cloud service providers are increasing infrastructure investments to meet surging market demand. Last week, the four major U.S. tech giants—Alphabet (Google's parent company), Meta (Facebook's parent company), Microsoft, and Amazon—announced plans to significantly increase annual capital expenditures, ramping up investments in semiconductor infrastructure and data center capacity to support the rapid growth in AI demand. Citigroup estimates that the total capital expenditure of major U.S. cloud computing providers will reach $4.4 trillion between 2026 and 2030, while total global investment (including sovereign funds and other institutions) is expected to reach $7.75 trillion.

- 15:26Tom Lee maintains his year-end prediction of Bitcoin at $150,000-$200,000 and Ethereum at $7,000.ChainCatcher reported that BitMine Chairman Tom Lee stated in an interview with CNBC that Ethereum's current fundamentals are performing well, with stablecoin trading volume and application layer revenue both reaching all-time highs, and a price breakout is expected to follow. Tom Lee reiterated his previous year-end price prediction, expecting bitcoin to reach the $150,000 - $200,000 range, with a target price of $7,000 for ethereum.