News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Nov 11)|Uniswap Proposal Activates Protocol Fee Switch & UNI Burn; Monad Announces Tokenomics, 3% Airdropped to Community; Strive Increases BTC Holdings to 7,5252Zcash may see ‘violent end’ as ZEC price rallies 1500% in just two months3Bitcoin ‘double bottom’ eyes $110K, but CME gap may postpone rally

Bitcoin (BTC) Climbs on Economic Optimism: Here Are 5 Things to Know This Week

CryptoNewsFlash·2025/11/11 08:51

Stablecoins Can’t Kill XRP — Here’s What Most Critics Miss

CryptoNewsFlash·2025/11/11 08:51

IOTA Integrates Stablecoins to Drive Real Transactions and Ecosystem Adoption

CryptoNewsFlash·2025/11/11 08:51

Morning Brief | The US Senate has passed a procedural vote on the "end government shutdown plan"; About 4.64 million bitcoins have been moved out of dormant wallets this year; Monad token public sale will start on November 17

Overview of major market events on November 10.

Chaincatcher·2025/11/11 07:54

【Calm Order King】Trader achieves 20 consecutive wins: Who can stay calm after watching this?

AICoin·2025/11/11 07:50

ERC-8021: Ethereum’s ‘copy Hyperliquid’ moment, a new way for developers to make a fortune?

Bitpush·2025/11/11 07:36

Morgan Stanley: The End of Fed QT ≠ Restart of QE, Treasury's Issuance Strategy Is the Key

Morgan Stanley believes that the end of the Federal Reserve's quantitative tightening does not mean a restart of quantitative easing.

ForesightNews·2025/11/11 07:01

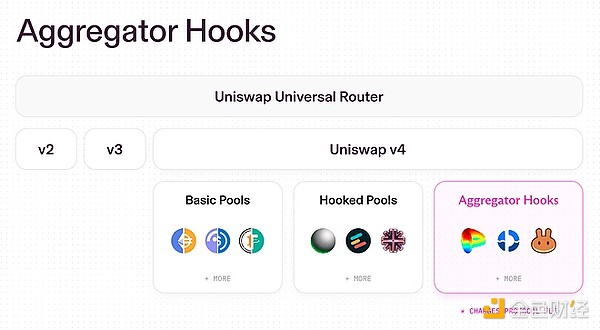

UNI surges nearly 50%: Details of the Uniswap joint governance proposal

金色财经·2025/11/11 06:56

Burning is Uniswap's final trump card

Hayden’s new proposal may not necessarily be able to save Uniswap.

BlockBeats·2025/11/11 06:33

The surge of ZEC has fueled NEAR

Focus on creating a good product, regardless of its application scenarios.

ForesightNews 速递·2025/11/11 06:11

Flash

- 08:43CryptoQuant CEO: Treasury companies and ETF inflows have ended the bear marketBlockBeats News, November 11, CryptoQuant founder Ki Young Ju tweeted, "Since the bitcoin price dropped to $100,000, whales have cashed out billions of dollars. At the beginning of the year, I said the bull market cycle was over, but inflows from MSTR and ETF ended the bear market. If these inflows stop, sellers will dominate again. Currently, selling pressure remains high, but if you believe the macroeconomic outlook is strong, now is a good time to buy."

- 08:43Current mainstream CEX and DEX funding rates indicate the market has returned to a fully bearish outlookBlockBeats News, November 11, according to Coinglass data, the current funding rates on major CEXs and DEXs show that after the recent market rebound, participants remain bearish on altcoins and have resumed a bearish outlook on BTC and ETH. The specific funding rates are shown in the chart below. BlockBeats Note: Funding rates are fees set by cryptocurrency trading platforms to maintain the balance between contract prices and the underlying asset prices, typically applied to perpetual contracts. It is a capital exchange mechanism between long and short traders. The trading platform does not charge this fee; it is used to adjust the cost or return of holding contracts, keeping contract prices close to the underlying asset prices. When the funding rate is 0.01%, it represents the benchmark rate. When the funding rate is greater than 0.01%, it indicates a generally bullish market sentiment. When the funding rate is less than 0.005%, it indicates a generally bearish market sentiment.

- 08:43Trump: An unfavorable ruling could result in tariff refunds exceeding $3 trillions, potentially causing devastating consequences for the future of the United States.BlockBeats News, November 11, US President Trump stated that the US Supreme Court was provided with incorrect data. If an unfavorable ruling is made on the tariff issue, the resulting "tariff refunds," including invested, pending investment, and repatriated funds, will exceed 3 trillions USD. Such a scale of blow is simply irreparable and would constitute a true, insurmountable national security event, causing devastating effects on the future of the United States—even potentially making it difficult for the nation to sustain itself. (Golden Ten Data)