News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(October 17)|Grayscale XRP Spot ETF Ruling Imminent; SEC to Rule on 16 Major Crypto ETFs;2Massive $536M Outflow Hits Spot Bitcoin ETFs3Research Report|In-Depth Analysis and Market Cap of Meteora(MET)

Shiba Inu Eyes a Massive Rebound as Bulls Eye a 3X Rally

Cryptonewsland·2025/10/19 12:09

Bitcoin Plummets Again, But Here’s Why It Might Be a Bullish Signal

Cryptonewsland·2025/10/19 12:09

HYPE Struggles at $43 — Is a Breakout or Breakdown Coming Next?

Cryptonewsland·2025/10/19 12:09

Bullish XRP Trader Shares Deep Insights Explaining How $8, $20, and $27 Bull Targets Can Be Hit

Cryptonewsland·2025/10/19 12:09

3 Cryptos Ready To Skyrocket — Don’t Miss These Buying Opportunities

Cryptonewsland·2025/10/19 12:09

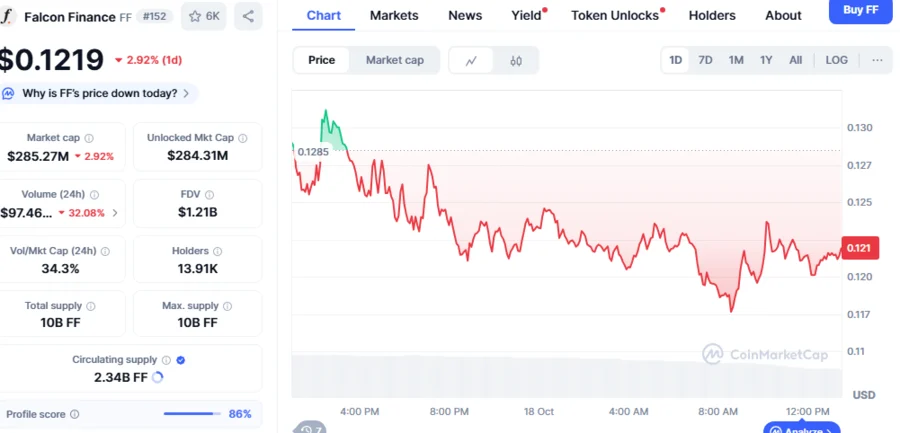

Whales Turn to FF Token Accumulation Amid Falcon Finance’s 37.9% Price Slump

CryptoNewsNet·2025/10/19 11:45

Japan’s FSA weighs allowing banks to hold Bitcoin, other cryptos: Report

CryptoNewsNet·2025/10/19 11:45

XRP, SOL Break Ahead with Bullish Reset in Sentiment as Bitcoin and Ether Stay Stuck in the Gloom

CryptoNewsNet·2025/10/19 11:45

Ripple (XRP) Chief Legal Officer Responds to Criticisms Directed at the Industry

CryptoNewsNet·2025/10/19 11:45

Are Bitcoin Miners Now Abandoning BTC to Work on Artificial Intelligence? Industry Members Respond

CryptoNewsNet·2025/10/19 11:45

Flash

- 14:30Analysis: Some market indicators suggest ETH may continue its rebound toward $4,500ChainCatcher news, according to Cointelegraph, some market indicators suggest that Ethereum may continue its rebound momentum and reach $4,500 by the end of October. Currently, ETH appears to be forming a "bullish flag," a pattern that typically signals a brief consolidation before continuing an upward trend. In addition, the recent ETH price has mostly remained above the "Weekly Bull Market Support Band," indicating a possible breakout above the channel's upper limit, which is in the $4,450-$4,500 range. If a breakout occurs, ETH could reach $5,200 in November. However, if ETH falls below the lower boundary of the "bullish flag pattern" at $3,550, it may face further pullback.

- 14:04Data: 200 million TRX transferred from an unknown wallet to a certain exchangeAccording to ChainCatcher, Whale Alert monitoring shows that 200 million TRX (approximately $63,517,911) were transferred from an unknown wallet to an exchange.

- 13:17Data: The "220 million USD long position whale" has increased holdings to 250 million USDAccording to ChainCatcher, on-chain analyst @ai_9684xtpa has monitored that the mysterious whale who went long on BTC and ETH with $220 million has increased their position to $250 million. This latest increase is mainly in BTC, with the ETH position remaining unchanged. With continued efforts, the overall unrealized loss has also narrowed to $3.12 million. BTC 15x long position: holding 1,610.93 BTC ($173 million), entry price $108,043.9; ETH 3x long position: holding 19,894.21 ETH ($77.42 million), entry price $4,037.43.