News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

c402.market's mechanism design is more inclined to incentivize token creators, rather than just benefiting minters and traders.

A one-person media company, ushering in the era of everyone as a Founder.

The platform serves as a foundation, enabling thousands of applications to be built and profit.

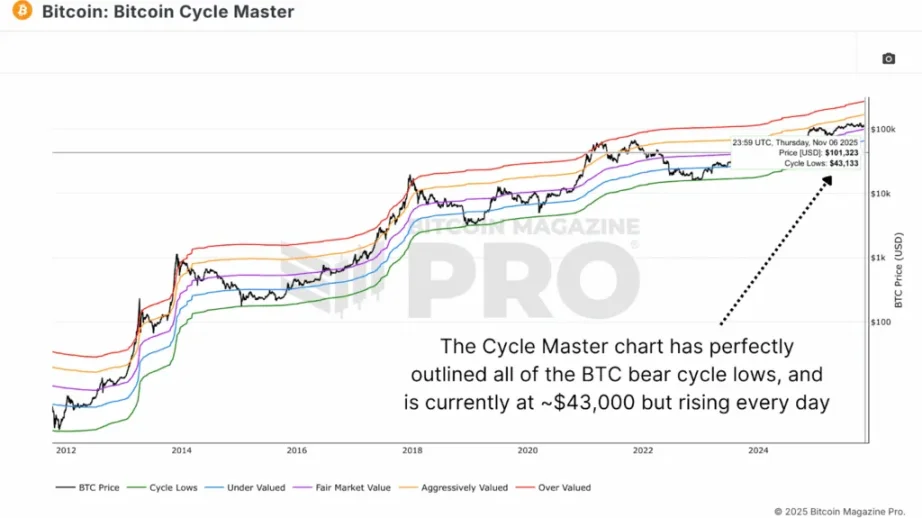

If the price falls back to the $55,000-$70,000 range, it would be a normal cyclical movement rather than a signal of systemic collapse.

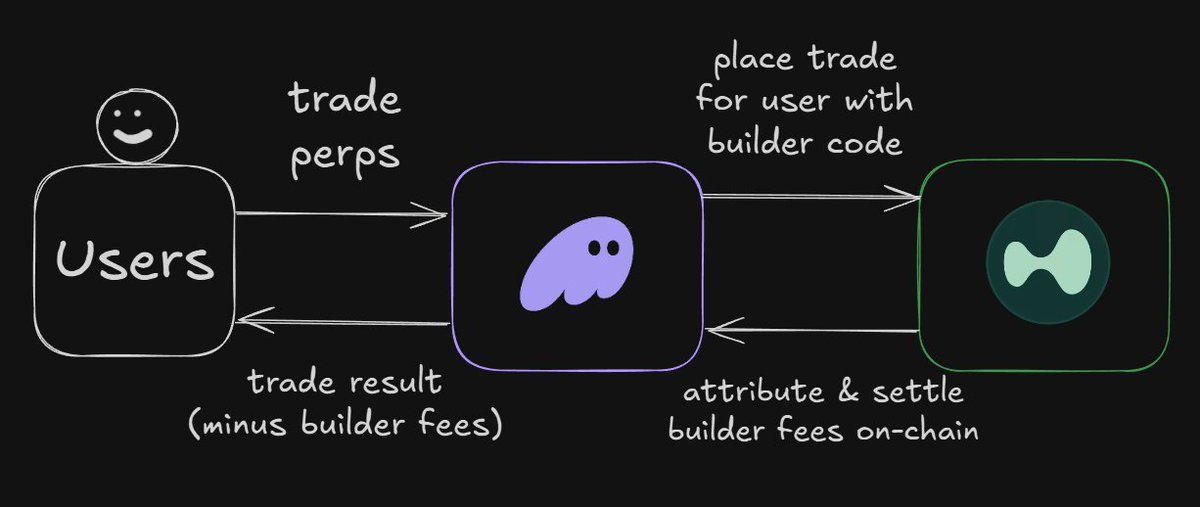

In Brief DYDX launches zero fee initiative to boost on-chain trading platform usage. The move aims to increase user participation and improve DYDX's market dynamics. DYDX faces challenges with declining TVL and user interest amidst market uncertainties.

- 20:34The whale who previously borrowed coins to short 66,000 ETH has accumulated an additional 23,501 ETH, possibly planning to use leveraged loans to buy more ETH.According to ChainCatcher, monitored by lookonchain, the whale who previously lent out 66,000 ETH and sold them, then bought back 257,543 ETH during the market downturn, has just purchased another 23,501 ETH (approximately $82.63 million). He also lent out another 40 million USDT and transferred it to an exchange, most likely preparing to buy more ETH.

- 20:33Analyst: US government shutdown may prompt the Federal Reserve to cut rates in DecemberAccording to ChainCatcher, citing Golden Ten Data, Peter Cardillo from Spartan Capital Securities stated that gold futures are rising because the anticipated end of the U.S. government shutdown will allow government data to return to its normal release schedule. This could make it possible for the Federal Reserve to cut interest rates further in December. He added that the unreleased macroeconomic data flow may indicate that inflation remains stubborn and that labor market conditions are weaker than what the ADP report suggests. These two factors could prompt the Federal Reserve to cut rates in December, despite their repeated cautious statements.

- 20:08Short-selling firm Kynikos closes out Strategy hedge tradeJinse Finance reported that Jim Chanos, President and Founder of the short-selling firm Kynikos Associates, announced that he has closed his hedged trade between Strategy stocks and bitcoin. This trade was established in May, betting on the narrowing premium between MSTR's stock price and the value of its bitcoin holdings. Data shows that MSTR's price-to-book ratio has dropped from a yearly high of 1.8 times to the current 1.1 times, with the premium space shrinking by more than 50%. Chanos has repeatedly warned that companies holding bitcoin face SPAC-like speculative risks, arguing that their valuation premiums lack fundamental support. Chanos believes that the "copycat" trades of other bitcoin treasury companies are based on financial engineering, cheap capital, and market frenzy, rather than on business fundamentals.