News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Non-Farm Data Eases Employment Concerns; Iran Geopolitical Risks Fuel Commodities; Trump's Interest Rate Cap Policy Sparks Controversy (January 12, 2026)2Bitget Daily Digest (Jan.12)|Spot Gold Breaks Above $4,600; $271M TRUMP Unlock Scheduled This Week; Strategy May Disclose Additional BTC Purchases3Bitcoin Price Prediction: Expert Reveals December 2025 Bottom Signals Powerful Short-Term Rebound

Vitalik Buterin Clears Air on Controversial Role of Ethereum

UToday·2026/01/06 11:51

Bitcoin’s 2026 Outlook Points to Consolidation, While Interest Builds Around Remittix’s Feb PayFi Launch

BlockchainReporter·2026/01/06 11:45

Morgan Stanley Bitcoin Trust Filing Signals Monumental Shift in Institutional Cryptocurrency Adoption

Bitcoinworld·2026/01/06 11:36

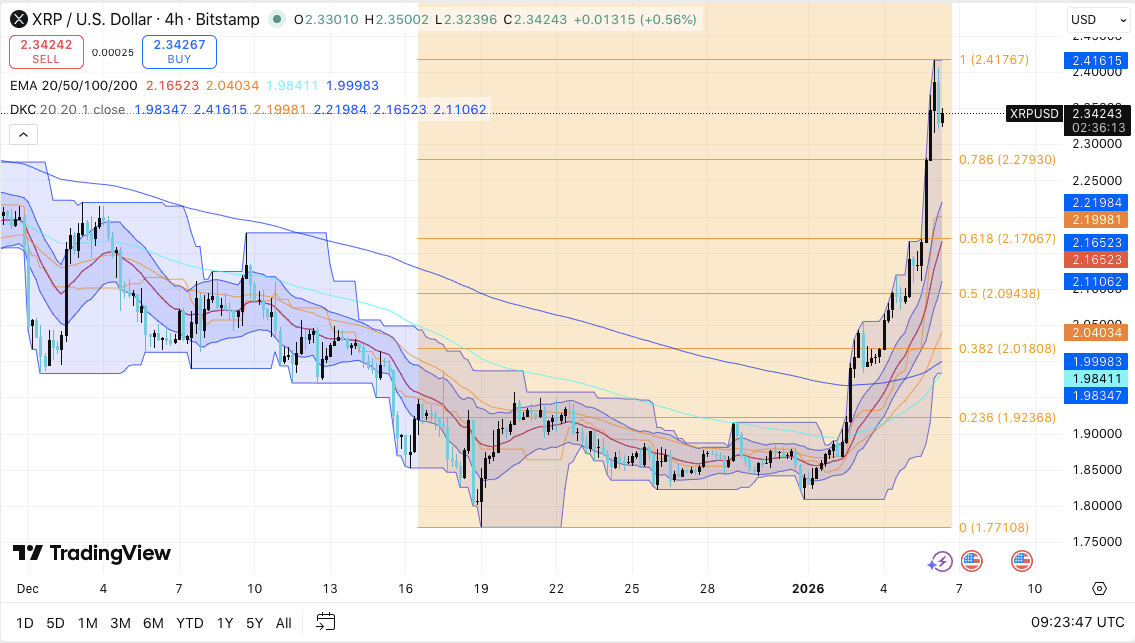

XRP Price Prediction: Bullish Structure Holds as Traders Weigh Momentum Signals

CoinEdition·2026/01/06 11:33

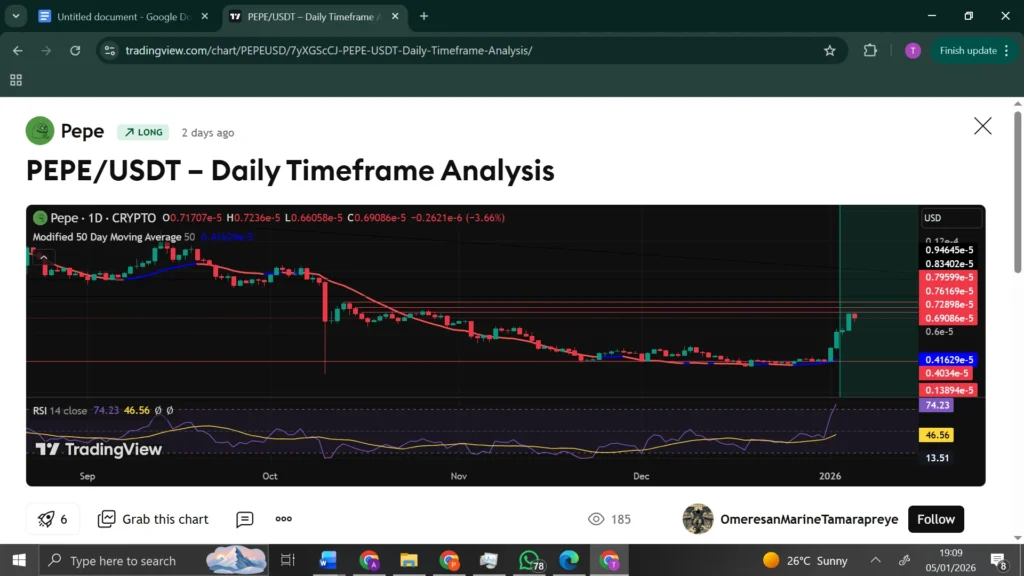

As Ethereum Slowly Grinds Higher, ETH Tokens Pepe and Remittix Are Skyrocketing

BlockchainReporter·2026/01/06 11:30

Spot XRP ETFs Outperform, XRP Jumps 12% as Price Breaks $2.40

CoinEdition·2026/01/06 11:30

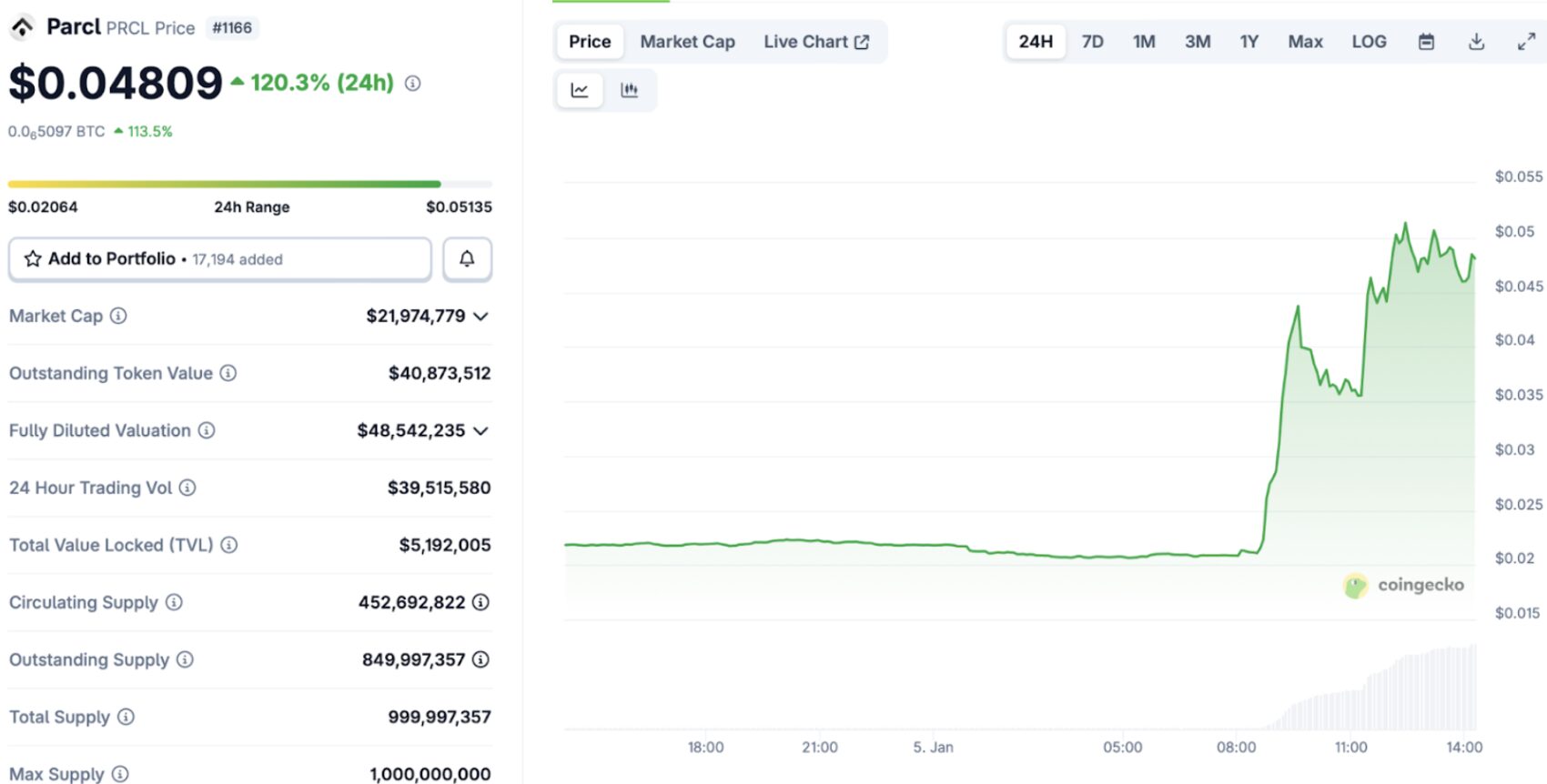

Polymarket Taps Parcl Data, Launches Housing Markets, Expands Real Estate Betting

DeFi Planet·2026/01/06 11:30

USD pulls back as risk-on mood boosts GBP – OCBC

101 finance·2026/01/06 11:27

Record Capital Flow into Spot Bitcoin ETFs Shapes Market Outlook

Cointurk·2026/01/06 11:12

Flash

16:24

Spot Gold and Silver Continue to Rise, Hitting New HighsBlockBeats News, January 13th, according to Bitget market data, spot gold reached up to $4630 per ounce, hitting a new all-time high, with a 2.67% increase during the day.

Spot silver surged $6.00 intraday, breaking through $86 per ounce, hitting a new all-time high, with a 7.59% increase during the day.

16:23

Jump Trading, the official WLFI Foundation transferred 500 million WLFI, worth approximately $83.12 millionBlockBeats News, January 13th, according to Onchain lens monitoring, World Liberty Finance transferred 5 billion WLFI to Jump Trading 5 minutes ago, worth approximately $83.12 million.

16:21

Eigen Foundation: The EIGEN token will be internally transferred in the next few days and will not be used for saleBlockBeats News, January 13, Eigen Foundation posted an "EIGEN Transparency Update" on social media, stating that in the coming days, the Eigen Foundation will execute the EIGEN token transfer as planned, as part of its standard fund management and security operations procedures. Regular internal transfers are used to support secure custody and ongoing ecosystem operations best practices. All transfers will only occur between accounts controlled by the Eigen Foundation. The EIGEN token release schedule and governance rules remain unchanged, and the associated tokens will not be used for sale.

News