News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Non-Farm Data Eases Employment Concerns; Iran Geopolitical Risks Fuel Commodities; Trump's Interest Rate Cap Policy Sparks Controversy (January 12, 2026)2Bitget Daily Digest (Jan.12)|Spot Gold Breaks Above $4,600; $271M TRUMP Unlock Scheduled This Week; Strategy May Disclose Additional BTC Purchases3Bitcoin Price Prediction: Expert Reveals December 2025 Bottom Signals Powerful Short-Term Rebound

Metaplanet Stock Jumps 8% as Crypto Rebound Lifts Sentiment

Coinspeaker·2026/01/06 10:24

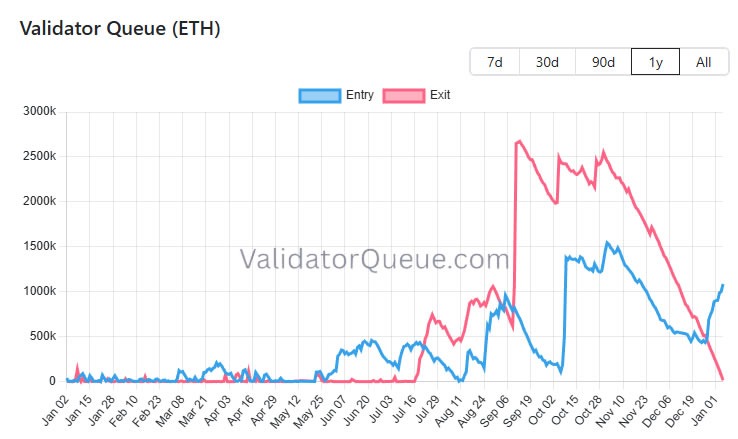

Ethereum Staking Demand Spikes with Tom Lee’s BitMine Leading

Coinspeaker·2026/01/06 10:21

USD: Venezuela situation stabilizes – ING

101 finance·2026/01/06 10:18

Bitcoin Holds Key Levels as Crypto Investors Search for the Best Crypto to Buy Right Now

BlockchainReporter·2026/01/06 10:12

Ethereum Rockets to Record Highs, Leaving Bitcoin in Its Wake

Cointurk·2026/01/06 10:12

Factbox-Governments and regulatory bodies intensify oversight of DeepSeek

101 finance·2026/01/06 10:06

AUD/USD: Likely to trade in a higher range of 0.6685/0.6730 – UOB Group

101 finance·2026/01/06 10:00

Gold and Silver surge amid geopolitical uncertainties – ING

101 finance·2026/01/06 10:00

NZD/USD: Likely to trade in a range between 0.5760 and 0.5800 – UOB Group

101 finance·2026/01/06 10:00

Flash

05:03

Data: 8.36 million SNX transferred out from Synthetix, worth approximately $4 millionAccording to ChainCatcher, Arkham data shows that at 12:58 (UTC+8), 8.36 million SNX (worth approximately $4 million) were transferred from Synthetix to an anonymous address (starting with 0x0848...).

05:02

A suspected entity has recently accumulated LINK tokens worth $5.48 million through two new wallets.PANews reported on January 12 that, according to monitoring by Onchain Lens, newly created wallets are accumulating LINK tokens, and these wallets are likely associated with the same entity. Wallet "0x10D" withdrew 202,607 LINK, worth $2.7 million. Wallet "0xb59" withdrew 207,328 LINK, worth $2.78 million.

05:02

Two new addresses have recently accumulated $5.48 million worth of LINK.BlockBeats News, January 12, according to Onchain Lens monitoring, two newly created addresses recently accumulated $5.48 million worth of LINK, possibly belonging to a single entity.

Wallet '0x10D' withdrew 202,607 LINK worth $2.7 million from an exchange.

Wallet '0xb59' withdrew 207,328 LINK worth $2.78 million from an exchange.

News