News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Non-Farm Data Eases Employment Concerns; Iran Geopolitical Risks Fuel Commodities; Trump's Interest Rate Cap Policy Sparks Controversy (January 12, 2026)2Bitget Daily Digest (Jan.12)|Spot Gold Breaks Above $4,600; $271M TRUMP Unlock Scheduled This Week; Strategy May Disclose Additional BTC Purchases3Bitcoin Price Prediction: Expert Reveals December 2025 Bottom Signals Powerful Short-Term Rebound

Bosch Plans $2.9 Billion Investment in Artificial Intelligence Over the Coming Years

101 finance·2026/01/06 13:18

Shiba Inu Price Briefly Surges Past Psychological Barrier

Cointurk·2026/01/06 13:12

NZD/USD retreats under 0.5800 as market sentiment grows wary

101 finance·2026/01/06 13:09

Next issues alert regarding the UK's rising unemployment problem

101 finance·2026/01/06 13:06

Pi Price Prediction 2026: 17.5M Users Battle 28-Node Crisis And 90% Foundation Control

CoinEdition·2026/01/06 13:06

Ledger Payment Partner Exposes Customer Data, Heightens Phishing Risks

DeFi Planet·2026/01/06 13:06

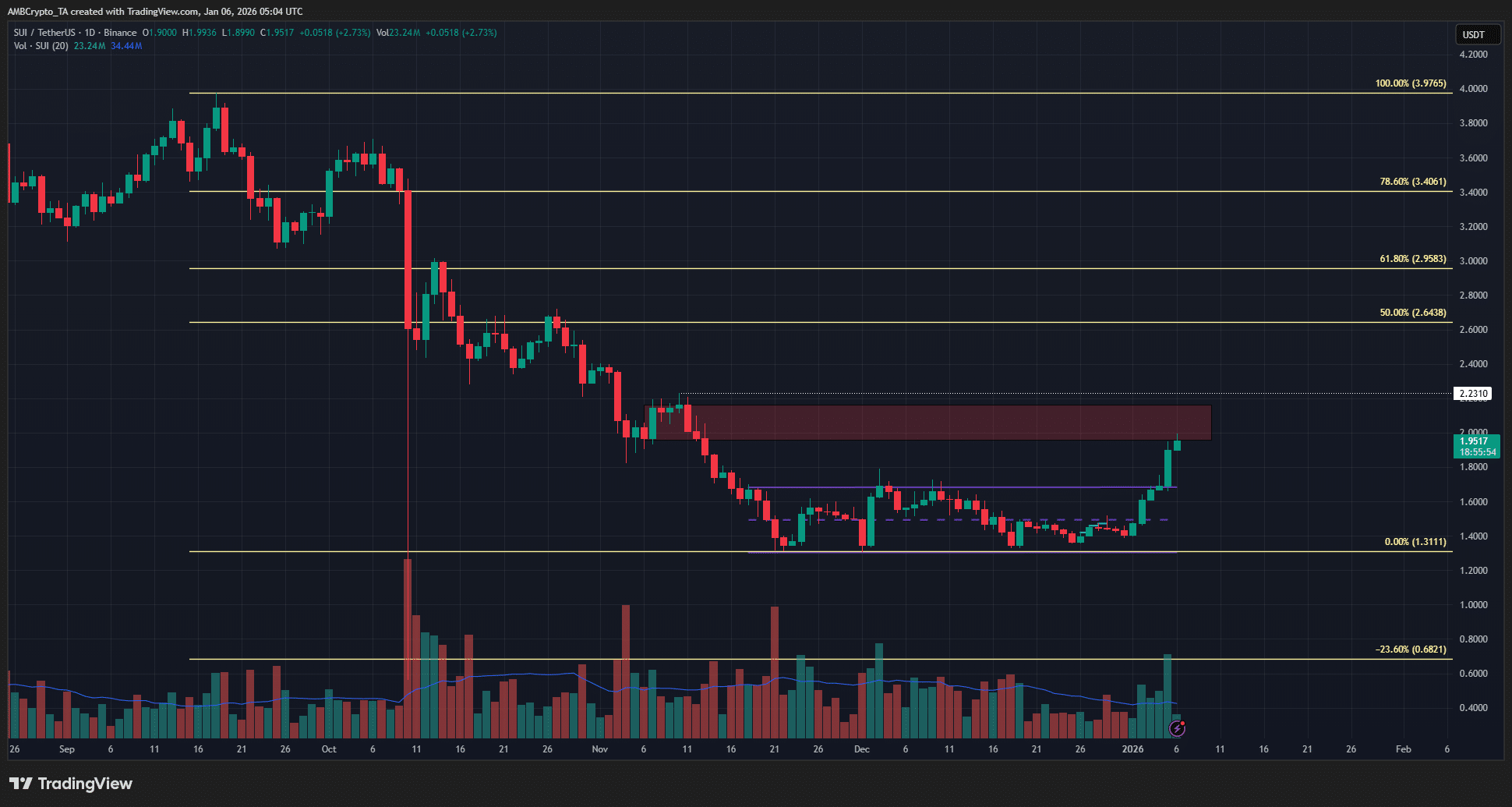

SUI breaks out, but a $1.70 pullback could be next – Here’s why

AMBCrypto·2026/01/06 13:03

Trump’s income from trade tariffs is already dropping, and Wall Street seems quite pleased with this development

101 finance·2026/01/06 13:00

The CEO is working to bring back some of the qualities that once set GE apart

101 finance·2026/01/06 13:00

Flash

06:49

A trader made over 7x profit in one week by going long on PEPEAccording to Odaily, Lookonchain monitoring shows that a trader (0x419f) leveraged long PEPE and turned $58,700 into $489,900 within a week, achieving a return on investment of 734%. Seven days ago, this trader deposited $58,700 into Hyperliquid and opened a 10x long position on PEPE. As the price of PEPE rose, the trader continuously rolled profits into the position, eventually holding 221.96 million PEPE.

06:49

Aave's Ethereum network ETH deposits surpass 3 million, reaching a new all-time highToken Terminal stated on platform X that the amount of ETH deposited in Aave on the Ethereum mainnet has reached a historic high. According to the image information, the amount of ETH absorbed by Aave has surpassed 3 million and is steadily approaching 4 million.

06:48

James Wynn increases long positions in BTC and PEPE again, with unrealized profits exceeding $340,000PANews, January 4th – According to tracking by Lookonchain, trader James Wynn has once again opened long positions in BTC and kPEPE. His current holdings include: a 40x leveraged long position on 58.94 BTC (approximately $5.4 million) and a 10x leveraged long position on 365 million kPEPE (approximately $2.34 million). His current unrealized profit has exceeded $343,000.

News