News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget UEX Daily | Trump Imposes 25% Tariffs on Iran's Trade Partners; Google Market Cap Breaks $4 Trillion for the First Time; Gold Surpasses $4600 Threshold (Jan,13, 2026)2Bitget Daily Digest (Jan.13)|Market Risk-Off Triggered by Fed Independence Dispute; Meta Plans to Cut Metaverse Investment; Strategy Added 13,627 BTC Last Week

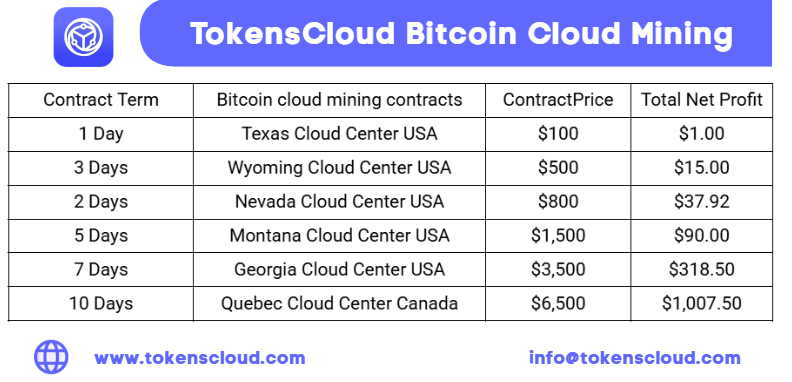

Overview of Bitcoin Cloud Mining Platforms in 2026

Crypto Ninjas·2026/01/08 06:21

Exclusive-Nvidia requires full upfront payment for H200 chips in China, sources say

101 finance·2026/01/08 06:12

GBP/JPY struggles below 211.00 as flight to safety benefits JPY; lacks bearish conviction

101 finance·2026/01/08 05:57

AUD/JPY Price Forecast: Attracts some sellers, initial support level emerges above 102.50

101 finance·2026/01/08 05:57

EUR/JPY stays muted around 183.00 as BoJ's move toward policy normalization gathers momentum

101 finance·2026/01/08 05:39

Why Wall Street Is Paying Attention to XRP? A Brief On Market Sentiments

CoinEdition·2026/01/08 05:24

AI to boost copper demand 50% by 2040, but more mines needed to ensure supply, S&P says

101 finance·2026/01/08 05:15

USD/INR recovers as investors brush off RBI’s intervention

101 finance·2026/01/08 05:06

Flash

04:44

A trader bought 27.72 million PsyopAnime tokens for $525,000 5 hours ago, becoming the largest holderBlockBeats News, January 13th, according to LookIntoChain monitoring, trader 3cBB2Z spent 3,775 SOL ( $525,000 ) to purchase 27.72 million PsyopAnime 5 hours ago, becoming the largest holder of the token.

Prior to this, the trader made a profit of $7.45 million trading WIF, earned $1.11 million on Pnut, but lost $1.39 million on pippin and $477,000 on arc.

04:41

BSC On-Chain Meme Coin "Life Candle" Experiences 50% Short-Term Surge, Market Cap Currently at $13.3 MillionBlockBeats News, January 13th, according to GMGN monitoring, the BSC chain's Meme coin "Life Candlestick" surged over 50% in 1 hour, with a market value rebounding to $13.3 million and is currently priced at $0.013. Part of the reason for this rise may be due to attention from Mango Labs founder Dov (X:dov_wo).

BlockBeats reminds users that Meme coin trading is extremely volatile, mostly relying on market sentiment and conceptual hype, with no actual value or use case. Investors should be aware of the risks.

04:31

VanEck: Bitcoin's Four-Year Cycle Broken in 2025, Future Trend Still Cautious for the Next 3 to 6 MonthsBlockBeats News, January 13th, VanEck stated in a post that "Entering 2026, the signals of fiscal and monetary policy are becoming increasingly clear, the overall market is more inclined towards risk appetite, and opportunities for investment in artificial intelligence, private credit, gold, and crypto assets are emerging as more attractive after the adjustment."

"The market operating environment in 2026 presents a scene that investors have not seen in many years: a clear market outlook. Clear expectations regarding fiscal policy, the direction of monetary policy, and core investment themes have provided support for the market to adopt a more constructive, risk-biased strategy, although a high level of discernment still needs to be maintained in asset selection."

"In the crypto market, the traditional four-year cycle of Bitcoin was broken in 2025, making short-term signals more complex. This deviation makes the trend in the next 3–6 months more inclined to cautious judgment. However, this view is not an internal consensus, and there are still differences within the team, with Matthew Sigel and David Schassler holding a relatively more positive view of the short-term performance of the current cycle."

News