News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget US Stock Daily Brief | Trump Plans to Sue Powell; Meta Acquires Manus; Tesla Orders Sharply Decline (December 30, 2025)2Bitget Daily Digest (Dec.30)|Meta acquires Manus for billions of dollars; RWA protocols become the 5th largest DeFi category; Strategy purchases another 1,229 BTC3 Chainlink Is Stuck Around $12 as Selling Pressure Fades: Here’s What Next for LINK Price Rally

Thai Banks Freeze Millions of Accounts in Scam Crackdown, Innocent Customers Caught in Dragnet

DeFi Planet·2025/09/15 17:57

Monero Rallies Despite 18-Block Reorg Breach Linked to Qubic

DeFi Planet·2025/09/15 17:57

XDC Network Partners with Orochi to Bring Zero-Knowledge Verifiable Data to RWA Markets

DeFi Planet·2025/09/15 17:57

Trump Seeks to Oust Fed Governor Ahead of Rate Decision

Cointribune·2025/09/15 17:57

ETH/BTC Ratio Remains Under 0.05 Despite Ethereum’s Resilience

Cointribune·2025/09/15 17:57

io.net (IO) To Rise Higher? Key Breakout and Retest Signaling Potential Upside Move

CoinsProbe·2025/09/15 17:54

Solana (SOL) To Rally Higher? Key Bullish Pattern Formation Suggest Potential Breakout Move

CoinsProbe·2025/09/15 17:54

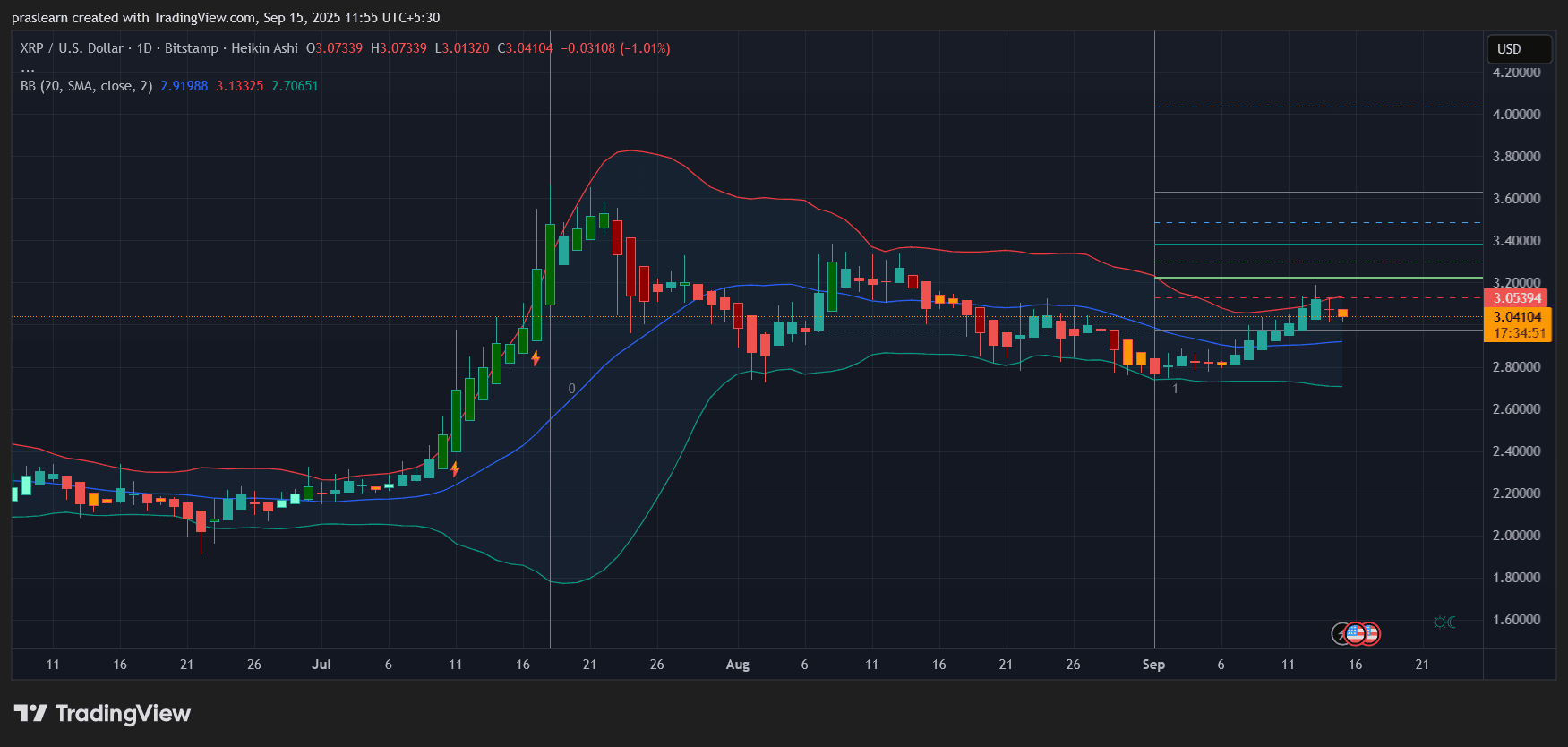

Will XRP Price Really Crash to Zero?

Cryptoticker·2025/09/15 17:45

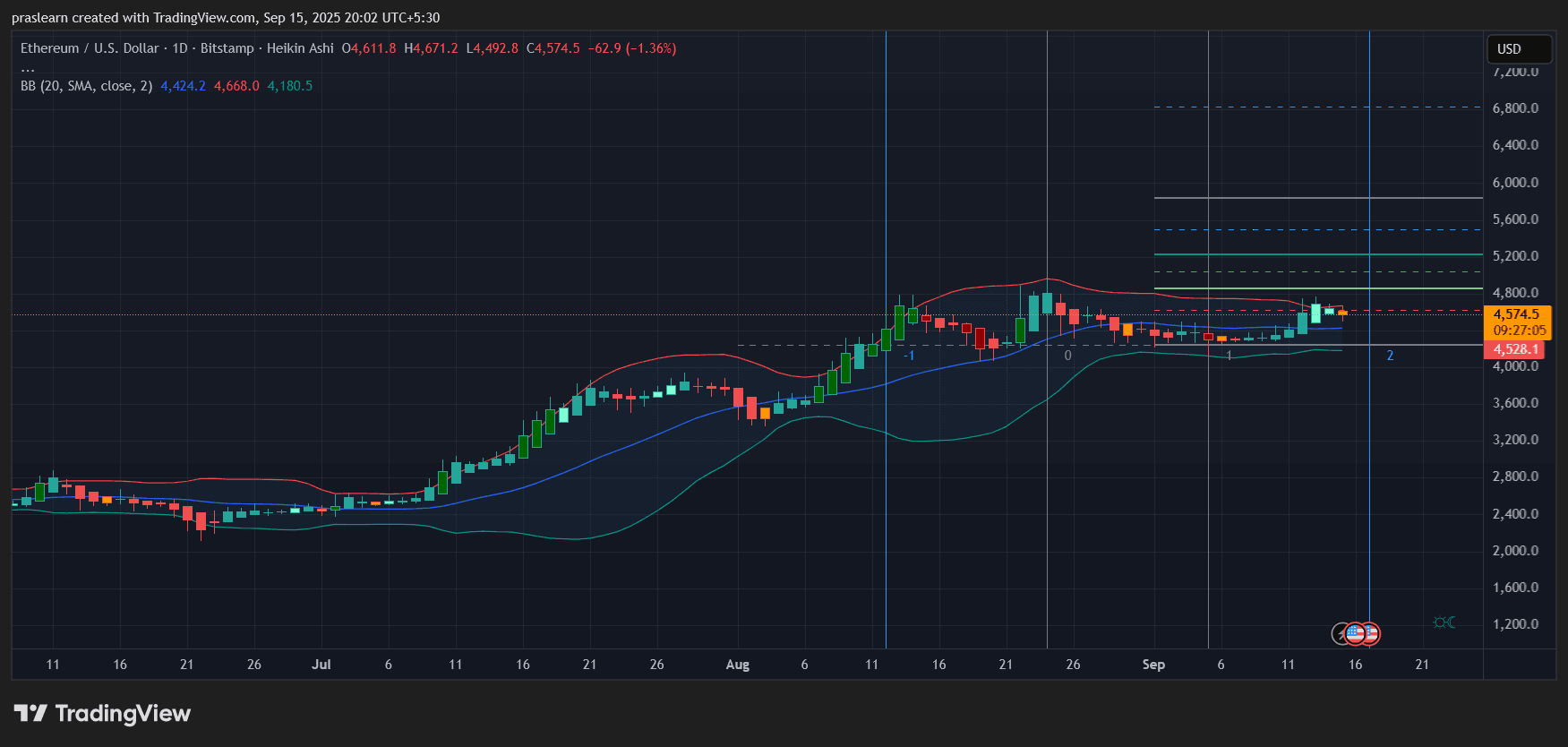

Ethereum Price Ready to Explode After AI Announcement?

Cryptoticker·2025/09/15 17:45

Letter from the Founder of Figure, the First RWA Stock: DeFi Will Eventually Become the Mainstream Method for Asset Financing

IPO is just one step in the long process of bringing blockchain into various aspects of the capital market.

BlockBeats·2025/09/15 16:46

Flash

23:35

As the U.S. court considers a retrial of the MEV case, prosecutors oppose DEF's submission of an amicus brief.PANews, December 31—According to Cointelegraph, as a U.S. court considers a retrial for brothers Anton and James Peraire-Bueno, who are accused of illegally profiting $25 million by exploiting a vulnerability in the Ethereum blockchain, U.S. prosecutor Jay Clayton has submitted a letter to Judge Jessica Clarke opposing the amicus brief filed by the DeFi Education Fund (DEF). Clayton stated: "The brief is disconnected from the trial record and merely repeats legal arguments that have already been rejected by this Court. The brief submitted by DEF is unlikely to assist the Court in its consideration of the specific issues." Last November, after the jury failed to reach a unanimous verdict on the brothers' guilt or innocence, Clarke declared a mistrial. Within a week, the U.S. government requested the court to "promptly schedule a retrial for the brothers in late February or early March 2026." According to a draft of the DEF amicus brief submitted on December 19, the organization supports a motion for acquittal or dismissal, arguing that the case has "broader implications for the industry." DEF stated: "Such prosecutions create uncertainty and fear for software developers, suppress participation in the decentralized finance sector, and drive participants overseas." DEF further added: "The Department of Justice should not bring charges based on a misinterpretation of existing law that goes beyond potential future legislation, as this would create confusion in governance rules and hinder industry development." Many in the crypto industry continue to closely watch the potential impact of this case on MEV-related activities.

23:34

Federal Reserve meeting minutes: Participants generally expect economic growth to accelerate in 2026According to Odaily, the minutes of the Federal Reserve meeting indicated that participants generally expect economic growth to accelerate in 2026, and that in the medium term, economic activity will expand at a pace roughly in line with potential output. Many participants anticipate that adjustments in fiscal policy, regulatory policy, or more favorable financial market conditions will support economic growth. However, participants believe that the uncertainty surrounding their forecasts for real GDP growth remains very high. In addition, some participants pointed out that structural factors such as technological progress and increased productivity (possibly reflecting the growing application of artificial intelligence) could promote economic growth without generating price pressures, but may also restrain employment growth.

23:17

Grayscale submits initial S-1 registration statement to the US SEC for Bittensor ETFChainCatcher reported that, according to market sources, Grayscale has announced that it has submitted an S-1 registration statement to the US SEC, proposing to convert its Bittensor Trust Fund into an ETF. If approved, this fund will become the first TAO ETP in the United States.

News