News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget US Stock Daily Brief | US Stocks Close Lower for Third Straight Day; Fed Rate Cut Divisions Significant; Gold and Silver Prices Rebound (December 31, 2025)2Bitget Daily Digest (Dec.31)|Bitwise Files ETF Applications for AAVE and 11 Other Cryptos; Strategy Seeks Untapped Capital to Increase BTC Holdings3Crypto sentiment turns fearful as Bitcoin consolidates – Panic or patience?

UK Trade Groups Push for Blockchain in US Tech Deal

UK trade bodies urge the government to include blockchain in the UK-US Tech Bridge to avoid falling behind in innovation.Warning Against Falling Behind the USStrengthening Transatlantic Blockchain Ties

Coinomedia·2025/09/12 14:42

Maple Finance Fees Surge 238% to $3M in a Week

Maple Finance sees a 238% rise in fees over 7 days, hitting $3M and ranking 2nd in growth among major crypto protocols.What’s Driving Maple Finance’s Growth?Maple Finance’s Position in DeFi

Coinomedia·2025/09/12 14:42

Crypto Fear & Greed Index Hits 57: Greed Zone

The Crypto Fear & Greed Index rises to 57, signaling market greed. What does this mean for Bitcoin and altcoins?What Does Greed Mean for Crypto Markets?Staying Smart in Greedy Times

Coinomedia·2025/09/12 14:42

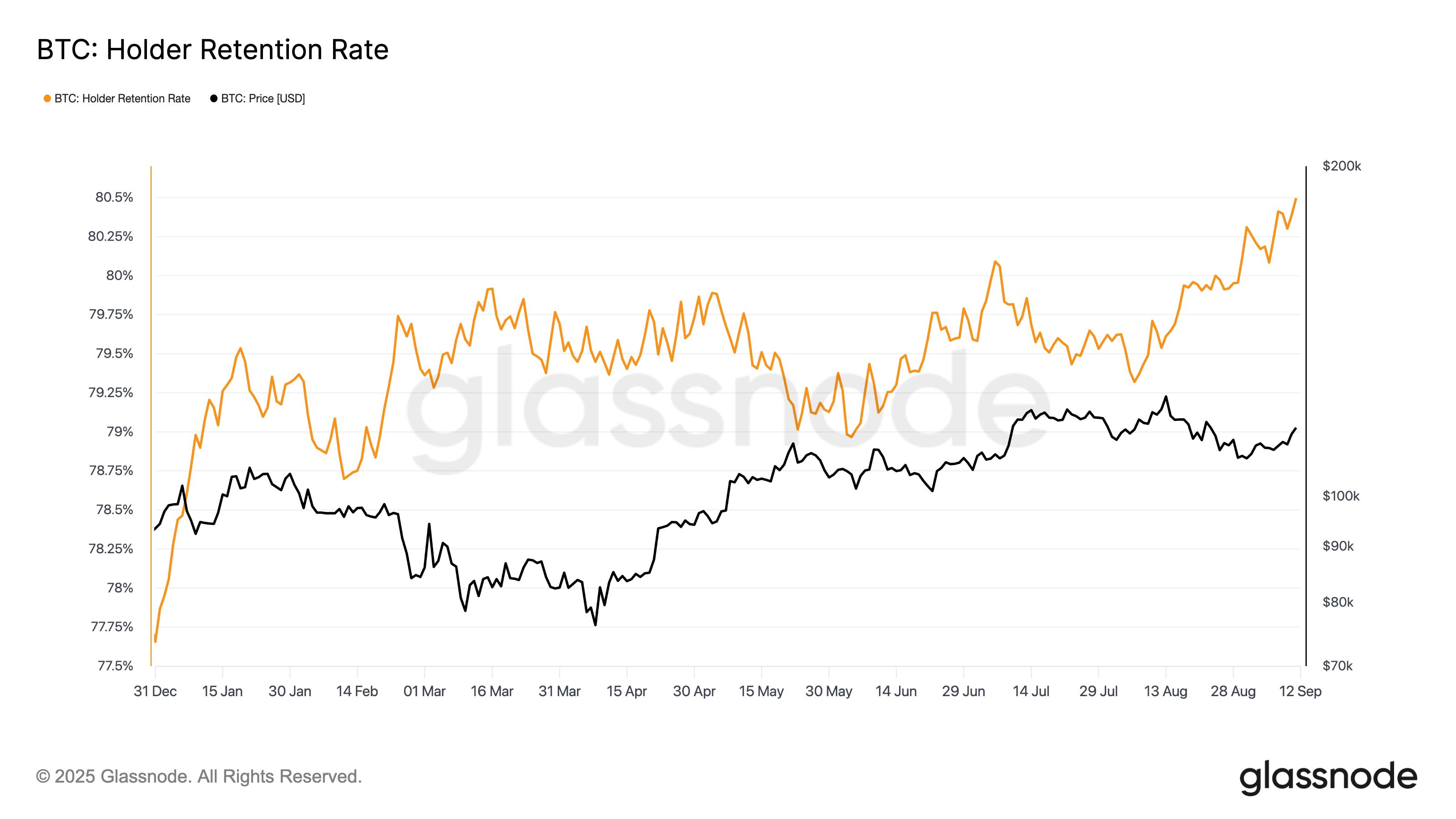

Bitcoin Clears $112,000 Wall, Eyes Return to $120,000 as Hodlers Double Down

CryptoNewsNet·2025/09/12 14:39

Not Just Another Marketplace: How Afrikabal Is Building the ‘SWIFT of Agriculture’ on Lisk

CryptoNewsNet·2025/09/12 14:39

Hedera’s HBAR Climbs 15%, But Diverging Flows Suggest Bulls May Tire Soon

CryptoNewsNet·2025/09/12 14:39

Traders Load Up on Nine-Figure Bullish Bitcoin Bets, Raising Liquidation Risks

CryptoNewsNet·2025/09/12 14:39

US spot Bitcoin ETFs record $552.8M inflows as prices rebound

Coinjournal·2025/09/12 14:36

Nasdaq-listed Safety Shot launches BONK memecoin treasury-focused subsidiary

Coinjournal·2025/09/12 14:36

REX-Osprey Solana ETF crosses $200M milestone as SOL hits seven-month high

CryptoSlate·2025/09/12 14:30

Flash

11:25

Justin Sun has spent $33 million to purchase 13.25 million LIT, accounting for 5.32% of the circulating supply.BlockBeats News, January 1st, according to MLM monitoring, of the approximately $200 million that Justin Sun deposited into the Lighter LLP platform, he has currently withdrawn about $38 million and used around $33 million to purchase 13.25 million LIT tokens. The spot account balance still has about $5.5 million remaining. This LIT holding accounts for approximately 1.33% of the total token supply and 5.32% of the circulating supply.

11:15

After depositing approximately 200 millions USD into Lighter LLP, Justin Sun has used around 33 millions USD to purchase 13.29 million LIT, accounting for about 1.33% of the total supply.PANews reported on January 1 that, according to MLM monitoring, after Justin Sun previously deposited approximately $200 million into Lighter LLP and withdrew about $4.65 million to purchase around 1.66 million LIT, he continued to increase his holdings. As of now, he has withdrawn about $38 million from the $200 million, using approximately $33 million to buy around 13.29 million LIT. These tokens account for about 1.33% of the total LIT token supply and approximately 5.32% of the circulating supply.

10:49

Asset: Global Sovereign Wealth Fund Assets Hit Record High, Increased Investment in Technology SectorBlockBeats News, January 1st, a new report from Global SWF shows that this year, the global sovereign wealth funds' assets under management (AUM) have reached a record high of $15 trillion. This growth is mainly attributed to the major funds' gains in a bull market and their continued focus on the technology sector. Sovereign investors' total investment in AI and digitalization is expected to reach $66 billion by 2025.

In this wave, wealth funds in the Middle East have been particularly active, emerging as leaders in digital transformation: Mubadala Investment Co. in Abu Dhabi is set to invest $12.9 billion in AI and digitalization by 2025, followed by Kuwait Investment Authority and Qatar Investment Authority with $6 billion and $4 billion investments respectively. (Jinse)

News