News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget US Stock Daily Brief | US Stocks Close Lower for Third Straight Day; Fed Rate Cut Divisions Significant; Gold and Silver Prices Rebound (December 31, 2025)2Bitget Daily Digest (Dec.31)|Bitwise Files ETF Applications for AAVE and 11 Other Cryptos; Strategy Seeks Untapped Capital to Increase BTC Holdings3Crypto sentiment turns fearful as Bitcoin consolidates – Panic or patience?

Manipulation Fears Rise As Bots Swarm Social Media

Cointribune·2025/09/12 14:27

XRP Eyes Breakout While Markets Remain Tense

Cointribune·2025/09/12 14:27

Why October 10 Could Be a Game-Changer for Solana

Cointribune·2025/09/12 14:27

Fartcoin (FARTCOIN) To Rise Further? Key Pattern Formation Suggests Potential Upside Move

CoinsProbe·2025/09/12 14:27

Shiba Inu (SHIB) To Rally Higher? Key Harmonic Pattern Signals Potential Upside Move

CoinsProbe·2025/09/12 14:27

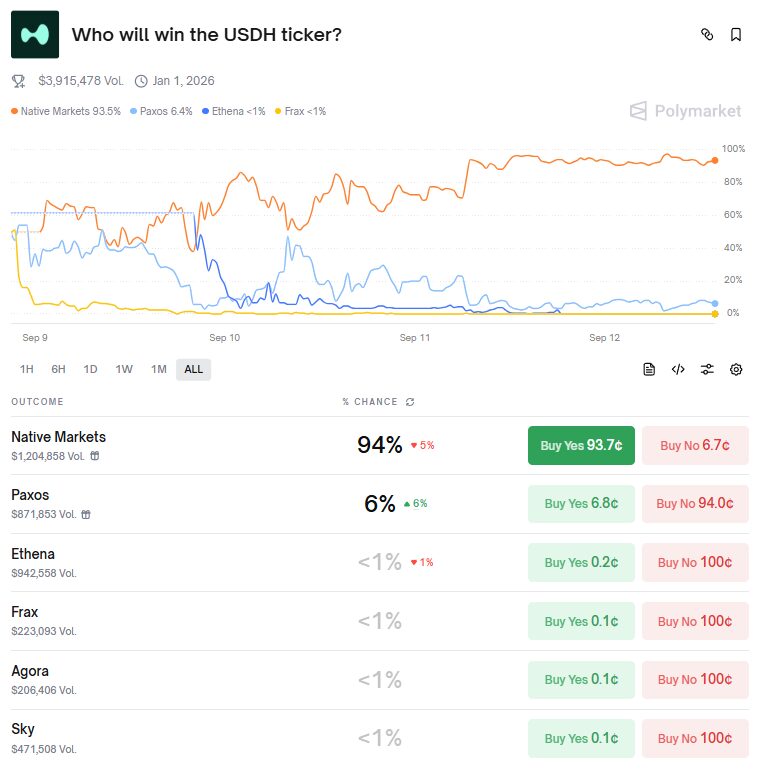

Ethena Labs Withdraws USDH Proposal on Hyperliquid

DailyCoin·2025/09/12 14:22

XRP Price Rebounds Strongly from $2.8 Support – Here's What’s Next

Cryptoticker·2025/09/12 14:18

The Internet is building a native financial system, and the key to success or failure still lies in user experience.

We now have a new monetary operating system, known as the Internet-native financial cloud service, but most people still cannot access it.

ForesightNews 速递·2025/09/12 13:53

Why Perpetual Contracts Must Belong to General-Purpose Blockchains?

Why does Hyperliquid, despite being a relatively successful application chain, still rely on the general-purpose chain HyperEVM?

ForesightNews 速递·2025/09/12 13:53

Finally, a token launch platform that requires mandatory disclosure of selling purposes.

The first step in issuing a token: it is essential to give the token real value.

ForesightNews 速递·2025/09/12 13:53

Flash

11:25

Justin Sun has spent $33 million to purchase 13.25 million LIT, accounting for 5.32% of the circulating supply.BlockBeats News, January 1st, according to MLM monitoring, of the approximately $200 million that Justin Sun deposited into the Lighter LLP platform, he has currently withdrawn about $38 million and used around $33 million to purchase 13.25 million LIT tokens. The spot account balance still has about $5.5 million remaining. This LIT holding accounts for approximately 1.33% of the total token supply and 5.32% of the circulating supply.

11:15

After depositing approximately 200 millions USD into Lighter LLP, Justin Sun has used around 33 millions USD to purchase 13.29 million LIT, accounting for about 1.33% of the total supply.PANews reported on January 1 that, according to MLM monitoring, after Justin Sun previously deposited approximately $200 million into Lighter LLP and withdrew about $4.65 million to purchase around 1.66 million LIT, he continued to increase his holdings. As of now, he has withdrawn about $38 million from the $200 million, using approximately $33 million to buy around 13.29 million LIT. These tokens account for about 1.33% of the total LIT token supply and approximately 5.32% of the circulating supply.

10:49

Asset: Global Sovereign Wealth Fund Assets Hit Record High, Increased Investment in Technology SectorBlockBeats News, January 1st, a new report from Global SWF shows that this year, the global sovereign wealth funds' assets under management (AUM) have reached a record high of $15 trillion. This growth is mainly attributed to the major funds' gains in a bull market and their continued focus on the technology sector. Sovereign investors' total investment in AI and digitalization is expected to reach $66 billion by 2025.

In this wave, wealth funds in the Middle East have been particularly active, emerging as leaders in digital transformation: Mubadala Investment Co. in Abu Dhabi is set to invest $12.9 billion in AI and digitalization by 2025, followed by Kuwait Investment Authority and Qatar Investment Authority with $6 billion and $4 billion investments respectively. (Jinse)

News