News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget US Stock Daily Brief | US Stocks Close Lower for Third Straight Day; Fed Rate Cut Divisions Significant; Gold and Silver Prices Rebound (December 31, 2025)2Bitget Daily Digest (Dec.31)|Bitwise Files ETF Applications for AAVE and 11 Other Cryptos; Strategy Seeks Untapped Capital to Increase BTC Holdings3Crypto sentiment turns fearful as Bitcoin consolidates – Panic or patience?

Staking Crisis: Kiln Security Vulnerability Triggers Withdrawal of 2 Million ETH

Bitpush·2025/09/10 19:42

Polkadot Approaches Breakout as $4.07 Resistance Holds and $3.86 Support Remains Firm

Cryptonewsland·2025/09/10 19:15

Kiln begins expelling Ethereum validators after $40 million attack

Portalcripto·2025/09/10 19:15

BLS Review Wipes Out $60 Billion Cryptocurrency Market

Portalcripto·2025/09/10 19:15

Lukashenko urges Belarusian banks to use cryptocurrencies against sanctions

Portalcripto·2025/09/10 19:15

Ethena Proposes BlackRock-Backed USDH Stablecoin on Hyperliquid

DeFi Planet·2025/09/10 18:54

Employment Data Revision Triggers $60B Crypto Market Cap Loss

DeFi Planet·2025/09/10 18:54

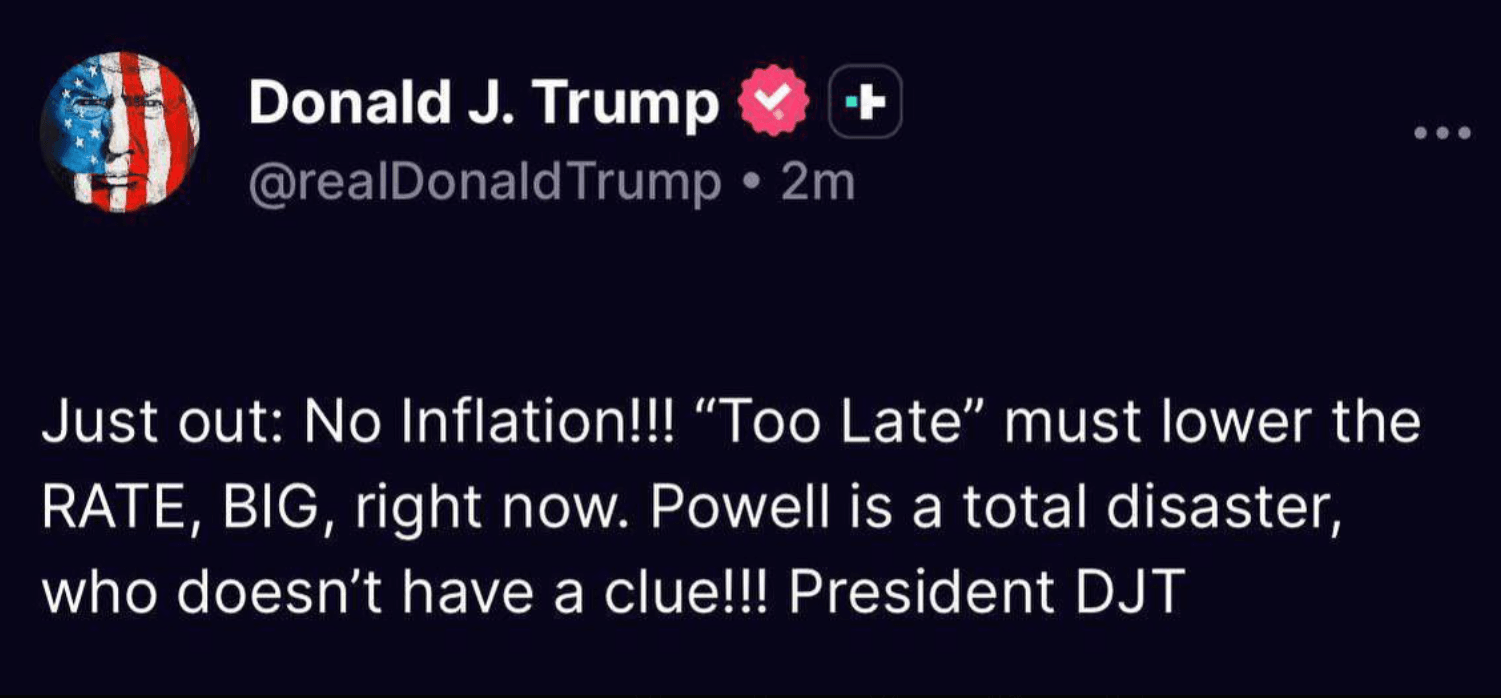

Breaking: Trump Slams Powell, Calls for Immediate Rate Cuts as Crypto Prices Turn Bullish

Cryptoticker·2025/09/10 18:39

US PPI for August falls 0.1%, below estimate of 0.3%

Cryptobriefing·2025/09/10 17:33

BNP Paribas and HSBC join Canton Foundation

Following the addition of Goldman Sachs, HKFMI, and Moody's Ratings in the first quarter of this year, the joining of new members continues this momentum of development.

Chaincatcher·2025/09/10 17:08

Flash

07:28

The President of Gabon announces the formation of a new governmentGolden Ten Data reported on January 2 that on January 1, 2026 local time, Gabonese President Nguema announced the formation of a new government consisting of 31 members. This cabinet reshuffle took place after the legislative and local elections held at the end of 2025. The new government includes 11 women and 20 men, with several new ministers taking up key positions in the ministries of Interior, Foreign Affairs, and Justice. According to the Gabonese constitution, the president also serves as the head of government.

07:25

On the first day of the New Year's holiday, the total number of cross-regional travelers nationwide exceeded 200 millions.Golden Ten Data reported on January 2 that, according to the Ministry of Transport, as of January 1, 2026, the total number of cross-regional personnel movements nationwide reached 208.13 million, a month-on-month increase of 0.2% and a year-on-year increase of 21%. (Xinhua News Agency)

07:17

Economist: UK housing prices to soften by the end of 2025, while overall housing demand remains robust throughout the yearGolden Ten Data reported on January 2 that Nationwide Chief Economist Robert Gardner commented on the UK's December Nationwide House Price Index monthly rate: UK house prices softened by the end of 2025, with the annual increase slowing from 1.8% in November to 0.6%, the lowest level since April 2024. The slowdown in year-on-year growth can be partly explained by a higher base of comparison (the year-on-year increase in house prices in December 2024 was as high as 4.7%). However, after excluding seasonal factors, house prices still saw a month-on-month decline of 0.4% in December. Despite the weak performance at the end of the year, the best word to describe the overall housing market in 2025 remains "resilient." Even though consumer confidence is relatively low, household spending intentions are cautious, and mortgage rates remain about three times the post-pandemic lows, the number of approved mortgage loans is still close to pre-pandemic levels. Overall, the fundamentals have not changed significantly, and housing demand has remained robust.

News