News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.5)|BTC spot sees a single-day net inflow of $120 million; Hyperliquid unlocks ~12.46 million HYPE today; Solana to roll out the “Alpenglow” consensus upgrade targeting sub-second finality2Bitget US Stock Daily | US Stocks Mixed with Tech Rebound; Fed Signals Cautious Rate Path; CES Kicks Off (2026-01-05)3Top crypto VCs share 2026 funding and token sales outlook

Eric Trump removed from ALT5 Sigma board following Nasdaq rule compliance requirements

CryptoSlate·2025/09/09 10:31

Solana Price Hits 7-Month High, Even As SOL Traction Dips To April Lows

Solana is rallying near $219, but with RSI nearing reversal levels and network growth slowing, the token may face a cooling dip before resuming its uptrend.

BeInCrypto·2025/09/09 10:30

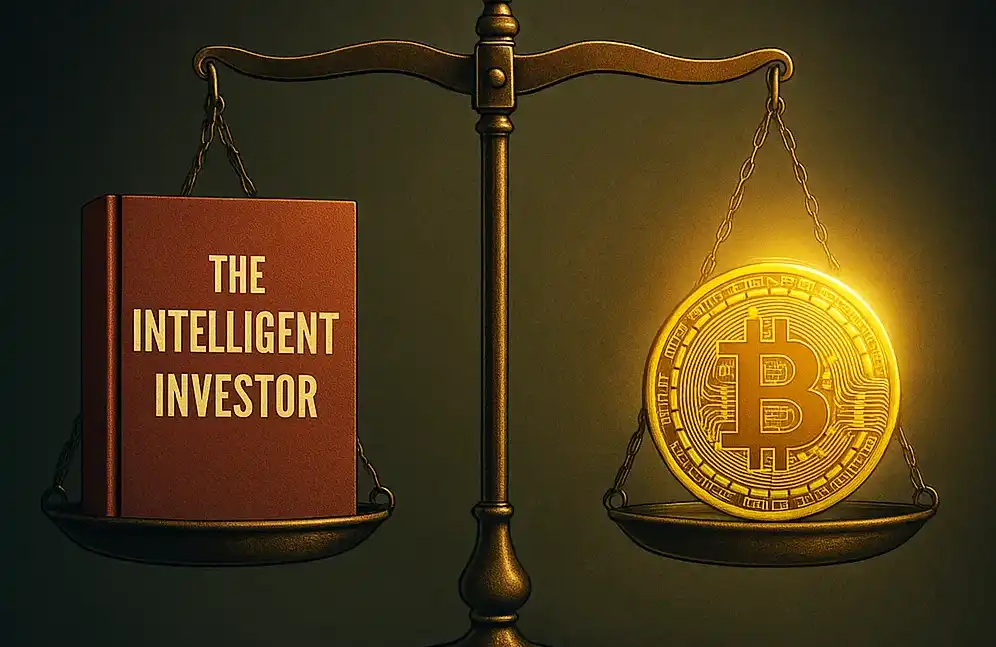

Smart Investing vs Ideological Investing: Who Will Lead the Future Capital Markets?

The Bitcoin Treasury Company embodies a new paradigm of ideological investment, blending financial innovation with ideological alignment.

BlockBeats·2025/09/09 09:53

Ethena enters USDH race supported by BlackRock BUIDL, Anchorage, Securitize

CryptoSlate·2025/09/09 09:47

Ethereum Price Poised for Bullish Breakout Amid Strong Fundamentals

TheCryptoUpdates·2025/09/09 09:15

The Rise of Bitcoin DeFi: Infrastructure Development and Market Boom

We are likely to see bitcoin evolve from "digital gold" into the most important foundational asset in the multi-chain DeFi ecosystem.

深潮·2025/09/09 09:12

Can VIRTUAL Hit $2? Bullish Patterns Signal a Strong Upside Move

Cryptotale·2025/09/09 09:12

US Lawmakers Require Treasury Study on Strategic Bitcoin Reserve Security and Implementation

BTCPEERS·2025/09/09 08:20

Hyperliquid Opens Stablecoin Bidding as Issuers Compete for USDH

Cryptotale·2025/09/09 08:00

Revised US Jobs Report Creates Economic Worries But Optimism For Crypto

US Jobs data raises odds of three interest rate cuts, but while gold soars, crypto faces uncertainty as recession fears weigh on ETF inflows

BeInCrypto·2025/09/09 07:52

Flash

14:58

CME Group's average daily trading volume of crypto derivatives reached $12 billion in 2025, setting a new all-time high.PANews, January 5th – According to CoinDesk, the cryptocurrency derivatives trading volume on CME Group soared to a record high in 2025. Even as the prices of the largest tokens declined, the average daily trading volume still increased by 139% year-on-year, reaching 278,000 contracts. According to data released by the company, this trading volume is equivalent to a daily notional value of approximately $12 billion, marking the strongest annual performance since the launch of cryptocurrency products in 2017. The exchange highlighted the outstanding performance of its Micro Ether futures contracts and Micro Bitcoin futures contracts, with average daily trading volumes of 144,000 and 75,000 contracts, respectively. Standard-sized Ether futures also saw significant growth, with average daily trading volume rising to 19,000 contracts. The cryptocurrency business is only part of CME’s record-breaking annual performance. The exchange stated that overall, including assets such as interest rates, energy, and metals, the average daily trading volume reached 28.1 million contracts, setting a new all-time high.

14:58

Hyperion DeFi appoints Hyunsu Jung as CEO to fully implement its 2026 strategic planForesight News reported that Hyperion DeFi, Inc. (NASDAQ: HYPD) announced that Hyunsu Jung has been appointed as Chief Executive Officer, effective immediately. Jung's appointment marks a significant milestone in advancing the company's strategic priorities for 2026. Since June 2025, he has served as the company's Chief Investment Officer, focusing on developing on-chain business, enhancing operational standards, and expanding institutional relationships. Prior to this, Jung worked at DARMA Capital, where he designed and implemented diversified digital asset strategies. In addition, the company announced on September 29, 2025, that David Knox has been appointed as Chief Financial Officer. Knox brings extensive experience in capital markets and financial services, having held executive roles at PayPal, SoFi, and Cantor Fitzgerald, where he was primarily responsible for strengthening the company's financial infrastructure and building a bridge of trust between Hyperion DeFi, traditional capital markets, and decentralized finance. Furthermore, Robert Rubenstein will join the company on January 12, 2026, as General Counsel. Rubenstein has nearly thirty years of legal and compliance experience, having led legal and business development functions for several multinational companies and managed complex corporate transactions exceeding $20 billions.

14:58

Analysts expect bitcoin to fluctuate within a range in Q1 but with high volatilityOn January 5, SynFutures Chief Operating Officer Wenny Cai stated that the average bitcoin inflow on a certain exchange has risen sharply, indicating that large holders have become active again, which is usually an early signal of a new round of speculative activity. The current market looks more like an adjustment after light positions, with traders testing the upside rather than building large positions. It is expected that bitcoin will remain in a volatile range in the first quarter, with the direction depending on ETF capital inflows and institutional strategies. Caladan Head of Research Derek Lim pointed out that although the Venezuela incident did not directly affect crypto prices, it could trigger market panic. Lim also noted that large holders are re-entering the market, long-term bitcoin holders have turned into net buyers, and the price has established a more solid support base.

News