News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.7)|Walmart’s OnePay app launches BTC and ETH trading services; Polymarket introduces taker fees; Discord confidentially files for IPO2Bitget US Stock Daily | Tariff Ruling Suspense to Be Revealed This Week; Fed Officials' Interest Rate Debate Intensifies; Metals Surge with Gold and Silver Hitting New Highs (26/01/07)3Bitcoin Price Analysis: Critical $94K Resistance Threatens Alarming Drop to $85K Support

Weak Momentum Indicators Keep Pepe $0.00001124 Trading Range-Bound Despite Recent Rally

Cryptonewsland·2025/09/14 19:15

MARA Monthly Chart Shows 20/50 EMA Ribbon Tightening Toward Breakout

Cryptonewsland·2025/09/14 19:15

Profit Opportunity: 5 Tokens Showing Early Signals of a 50% Pump

Cryptonewsland·2025/09/14 19:15

Ethereum (ETH) Drops Today, But Could Reach $5.500 With Adam & Eve Pattern

Portalcripto·2025/09/14 19:15

TRON’s GasFree Wallet Spurs USDT Growth as TRX Price Tests Key Breakout Levels

TRON powers $82.6B in USDT transfers with rising retail demand despite revenue drop. Meanwhile, BullZilla Presale sells 24.7B tokens, securing its spot as the best crypto presale now.TRON Powers $82.6B in USDT TransfersTRON Price Eyes V-Shaped Recovery Despite Revenue SlumpBullZilla Presale Gains Strength With 24.7 Billion Tokens SoldConclusion: TRON Leads Stablecoin Growth, BullZilla Fuels Retail HypeFrequently Asked Questions About TRON, USDT, and BullZilla Presale

Coinomedia·2025/09/14 19:12

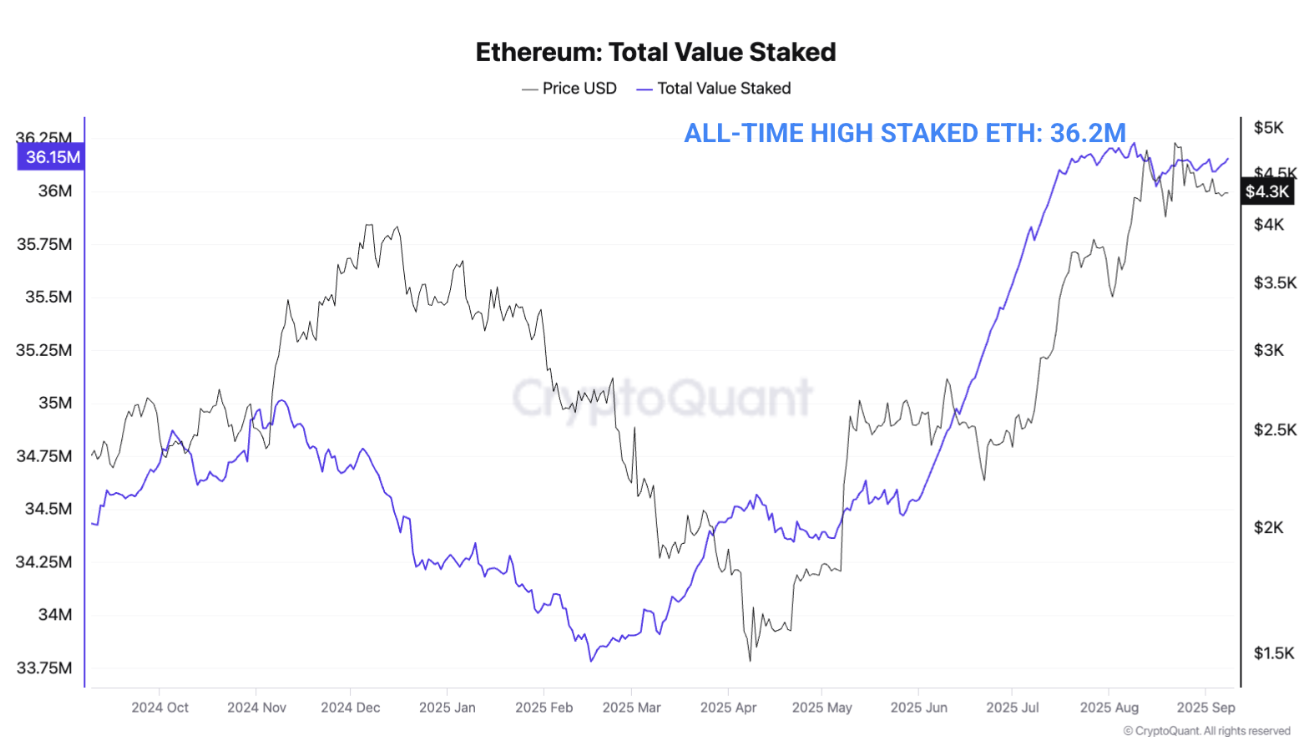

Ethereum Nears $5,000 as ETFs and Staking Reshape Market Demand

CryptoNewsNet·2025/09/14 19:03

Japanese City Iizuka Pilots IOTA-Based Digital IDs for Faster, Safer Evacuations

CryptoNewsNet·2025/09/14 19:03

Here’s Why Real Estate Could Be The Key to Unlocking XRP Next Big Rally

CryptoNewsNet·2025/09/14 19:03

Tron’s Gas Fee Reduction Cuts Daily Revenue by 64% in 10 Days

Cointribune·2025/09/14 18:57

Bittensor (TAO) To Soar Further? Key Harmonic Structure Hints at Potential Upside Move

CoinsProbe·2025/09/14 18:57

Flash

11:45

Negotiations on the US Crypto Market Structure Bill Stall: DeFi Regulation and Stablecoin Yields Emerge as Main Points of DisagreementAccording to Odaily, Tim Scott, Chairman of the U.S. Senate Banking Committee, previously stated that a hearing on the crypto market structure bill would be held on January 15. However, negotiation documents show that there are still four unresolved issues, with the main points of disagreement including: 1. DeFi: There is a demand for decentralized finance (DeFi) to be subject to the same level of oversight as federally regulated financial companies in the U.S., but its basic definition and related issues remain unresolved. 2. Stablecoin Yields: The GENIUS Act stipulates that stablecoin issuers cannot offer interest, but their affiliated companies can provide yields and customer reward programs. The banking industry believes this could threaten their core deposit business, and some Democrats hope to restrict crypto yields. 3. Code of Ethics: There is a requirement to prohibit senior U.S. government officials from obtaining personal benefits from crypto activities. 4. CFTC: The U.S. Commodity Futures Trading Commission (CFTC) will play a leading role in crypto regulation, but the allocation of seats between the two parties within the CFTC needs to be balanced. (CoinDesk)

11:41

dYdX Foundation: Surge Season 9 rewards distribution has been approved by the communityAccording to Odaily, the dYdX Foundation has announced that after a community vote, the distribution of Surge Season 9 rewards has been approved, with a support rate of 85.04%. It is reported that the total DYDX reward pool for Season 9 amounts to $320,784, with all funds coming from a 50% rebate of positive fee payments. In addition, the dYdX Foundation stated that for Season 8 rewards, 1,704,483 DYDX tokens from the community treasury will be distributed to eligible users.

11:30

21Shares will distribute staking rewards to its Ethereum ETF holders, with each share receiving $0.010378.BlockBeats News, January 8th, according to Globenewswire, 21Shares announced that it will distribute income generated through ETH staking to holders of its Ethereum exchange-traded product 21shares Ethereum ETF (TETH) on the Ethereum trading platform. Under this distribution plan, TETH holders will receive $0.010378 per share held, and the distribution will take place on January 9, 2026.

News