News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Pavel Durov marked his arrest anniversary by criticizing French authorities for finding no evidence after one year. The Telegram founder faces ongoing travel restrictions without trial date.

Former BitMEX CEO Arthur Hayes forecasts the crypto bull market will extend until 2028, driven by US government efforts to redirect global dollar flows through stablecoins for enhanced fiscal control.

Jerome Powell’s Jackson Hole tone shift lifted crypto sentiment, with Ethereum outperforming Bitcoin despite ETF outflows. This week, traders await August PCE inflation data and Fed guidance to gauge market direction before September’s FOMC meeting.

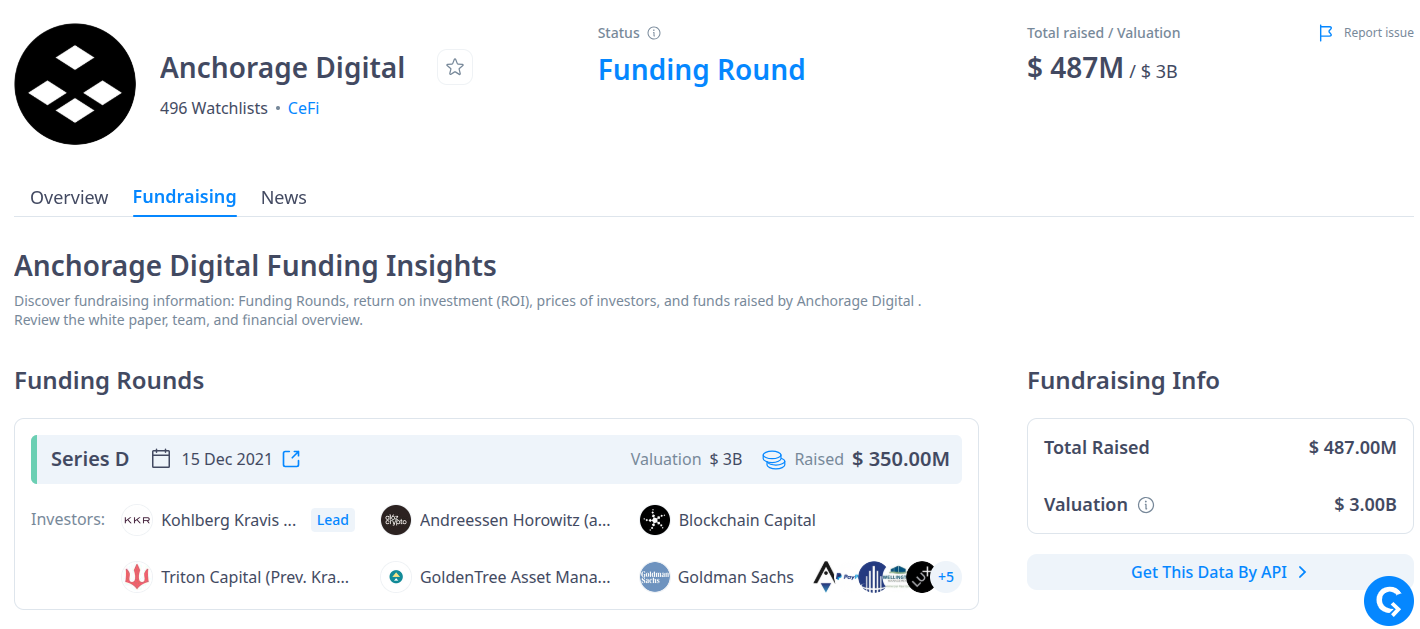

Anchorage Digital, the $3 billion crypto unicorn, is launching a venture investing arm focused on early-stage onchain protocols. Applications are open with demo day planned at Token2049 Singapore in October 2025.

- 08:50The Crypto Fear Index drops to 21, and the market remains in a state of extreme fear.Jinse Finance reported, according to Alternative data, today the Crypto Fear & Greed Index dropped to 21 (compared to 23 yesterday), indicating that the market remains in a state of extreme fear. Note: The Fear & Greed Index ranges from 0-100 and includes the following indicators: volatility (25%) + market trading volume (25%) + social media popularity (15%) + market surveys (15%) + bitcoin's proportion in the entire market (10%) + Google trending keywords analysis (10%).

- 08:47Analysis: Bitcoin options with a notional value of approximately $23.8 billions will expire on December 26, potentially leading to concentrated liquidation and repricing of risk exposure at year-end.According to ChainCatcher, on-chain data analyst Murphy stated that bitcoin options with a notional value of approximately $23.8 billion will expire on December 26, covering quarterly options, annual options, and a large number of structured products. This means that the BTC derivatives market will experience a "concentrated clearing and repricing of risk exposure" at the end of the year. Prices may be structurally constrained before expiry, but uncertainty will increase after expiration. From the data, there is a large accumulation of OI at the two positions closest to the current BTC spot price: $85,000 Put: 14,674 BTC; $100,000 Call: 18,116 BTC. In terms of scale, this is not retail behavior, but rather large-scale long-term capital, most likely ETF hedging, BTC treasury companies, large family offices, and other institutions that hold large amounts of BTC spot for the long term. The Put at the $85,000 strike price is initiated by the buyer, reflecting a strong demand for downside risk hedging at this level. Similarly, the large accumulation of Call OI at the $100,000 strike price does not essentially mean "the market is bullish to this level," but rather that long-term capital is willing to give up upside potential above this price in exchange for current certainty of cash flow and overall risk control. By buying Puts below and selling Calls above, the BTC return distribution is compressed within a manageable range. With OI already highly established, this $85,000–$100,000 options corridor will have a structural impact on BTC prices before December 26, creating "implicit resistance above, passive buffering below, and fluctuations within the middle range."

- 08:32The Moonbirds token BIRB is scheduled to be issued in Q1 2026.BlockBeats News, December 14, Orange Cap Games CEO Spencer stated that Moonbirds will issue the BIRB token on Solana in the first quarter of 2026. Previously, on October 2, Moonbirds announced that it would launch the BIRB token on Solana.