News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Share link:In this post: Santiment has stated that the increase in social media chatter surrounding the Fed and interest rates could pose risks to digital assets. More than 75% of market participants are predicting a rate cut in September after Powell’s speech. Analysts are divided over the short and long-term effects on digital assets if a rate cut happens in September.

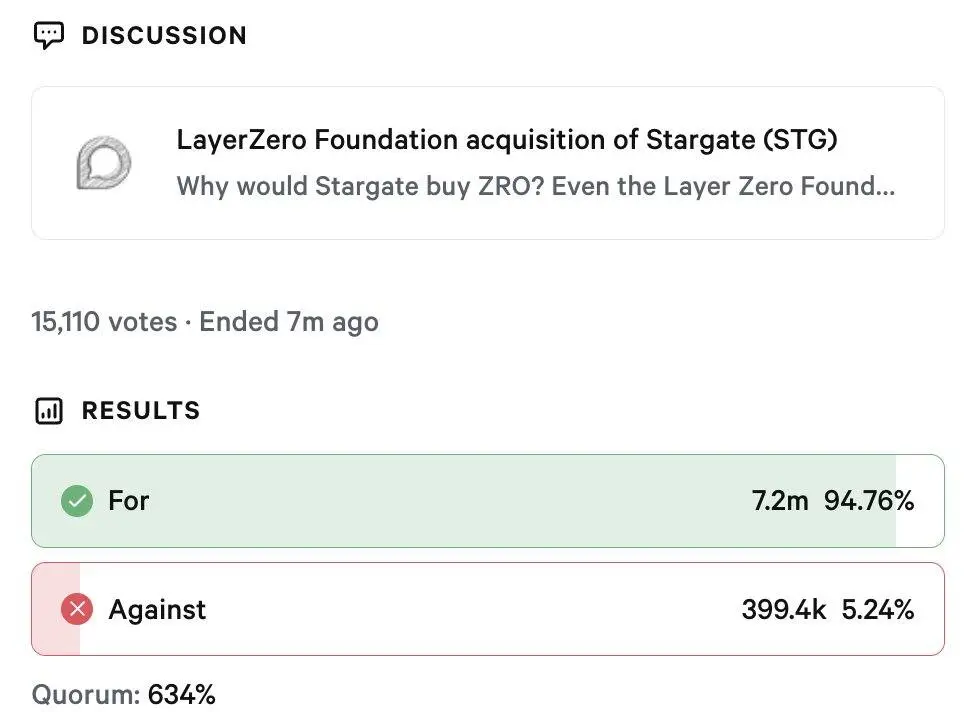

Share link:In this post: LayerZero announced its acquisition of Stargate Finance in a $120 million deal. The deal will bring Stargate under LayerZero’s ecosystem, with ZRO becoming the sole token. ZRO and STG are down today despite the deal, as holders hope for a resurgence.

Share link:In this post: Emerging markets are projected to outperform developed economies due to looser U.S. monetary policy, tighter fiscal control in EMs, and increasing investor flows. Fed rate cut expectations are boosting EM appeal, with funds like iShares Core MSCI EM ETF attracting billions since April. Strong fundamentals support EM assets, including lower inflation surprises, attractive equity valuations, and selective currency strength like the Brazilian real.

- 03:50Ethereum consensus layer client Prysm releases post-mortem analysis report on Fusaka mainnet incidentChainCatcher news, the Ethereum consensus layer client Prysm team has released a post-mortem analysis report on the Fusaka mainnet incident. During the event, almost all Prysm nodes experienced resource exhaustion when processing specific attestations, resulting in their inability to respond to validator requests in a timely manner. The impact range was from epoch 411439 to 411480, with 248 blocks lost over 42 epochs, a missing rate of 18.5%. The network participation rate dropped to a minimum of 75%, and validators lost approximately 382 ETH in attestation rewards. The root cause of the failure was that Prysm beacon nodes received attestations possibly sent by unsynchronized nodes, which referenced block roots from previous rounds. To verify these attestations, Prysm attempted to reconstruct compatible states, leading to repeated processing of past round blocks and costly round transition recalculations. The team temporarily resolved the issue by guiding users to use the --disable-last-epoch-target parameter, and subsequent versions v7.1 and v7.1.0 include long-term fixes.

- 03:50This week, 16 crypto startups raised $176 million, bringing the total funding this year to over $25 billion.Jinse Finance reported that this week, 16 crypto startups raised $176 million in investment and financing, bringing the total investment this year to over $25 billion, far exceeding analysts' expectations. According to DefiLlama data, this figure is more than double that of last year. Major investors this week included Pantera Capital, a certain exchange, and DCG. Despite the crypto market dropping $1 trillion from its October peak, investors continue to increase their stakes. Sebastián Serrano, CEO of Argentine crypto exchange Ripo, stated that investors are "moving away from hype and increasingly rewarding projects with solid business models." The largest funding projects this week include: cross-chain infrastructure protocol LI.FI raising $29 million, layer-1 blockchain Real Finance focused on real-world asset tokenization raising $29 million, and institutional-grade staking service provider TenX Protocols raising $22 million and listing on the Toronto Stock Exchange.

- 03:50Data: Jeffrey Huang increases ETH long position by 25 times to $12.2 million, with an entry price of $3,190.92According to ChainCatcher, monitored by HyperInsight, Jeffrey Huang (Huang Licheng) increased his Ethereum long position by 25 times to $12.2 million, with an entry price of $3,190.92 and a liquidation price of $3,056.19, currently holding an unrealized loss of $274,000.