News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Bitcoin, due to its decentralized nature, the privacy of the Lightning Network, and its security, is considered a preferred option for driving the digital dollar. It can serve as the operational infrastructure for USD stablecoins, offering lower conversion costs and protecting users' rights.

The article discusses the challenges faced by the US dollar and the rise of stablecoins, highlighting that bitcoin, with its decentralized nature, has become the preferred choice in the global digital dollar revolution. It also analyzes the weakness of the US bond market and the impact of a multipolar world on the US dollar. Summary generated by Mars AI Model: The content produced by the Mars AI Model is still undergoing iterative updates, and its accuracy and completeness may not be fully guaranteed.

MetaMask specifically mentioned its sibling project Linea and its own stablecoin product mUSD, and has clearly stated that additional points bonuses will be given to the Linea chain.

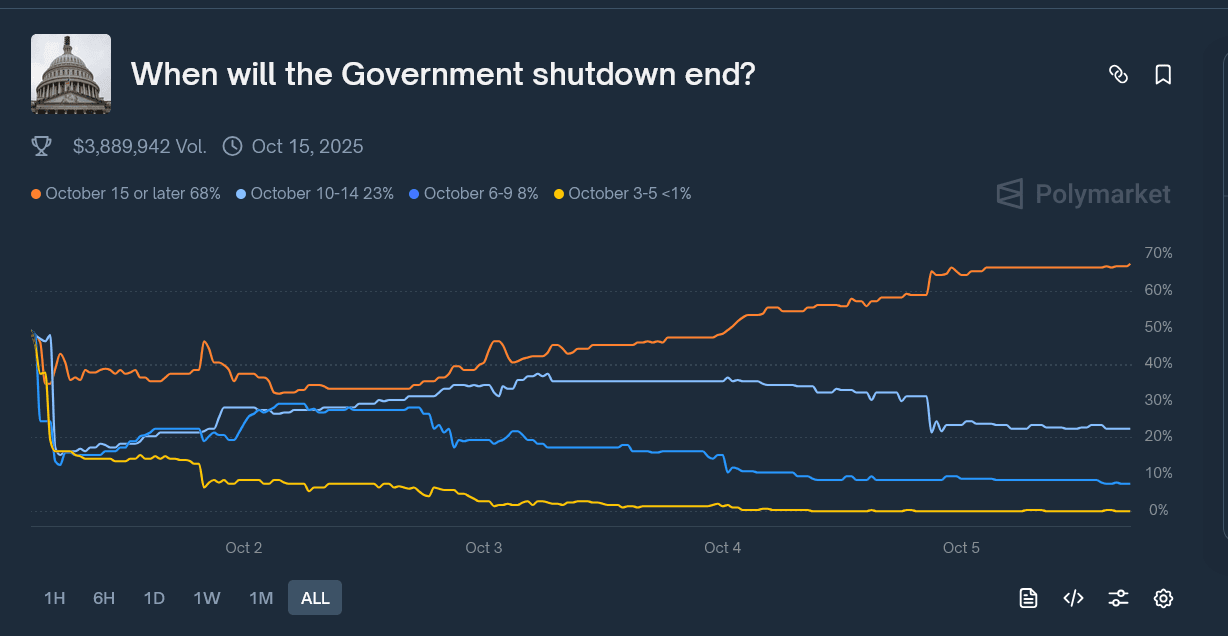

Quick Take Summary is AI generated, newsroom reviewed. Crypto Rover (@rovercrc) reports large-cap altcoins are surging, signaling the onset of Altseason. The UK’s Financial Conduct Authority (FCA) plans to lift its Bitcoin ETF ban this week (Oct 6–12, 2025), aligning with the Financial Services and Markets Act 2023. Altcoins like Solana and Avalanche have surged 85–120% in recent months, reflecting large-cap momentum. Infographic highlights crypto market phases: Bitcoin rally → Ethereum rise → Large-cap su

Bitcoin reached a record high of $125,646, pushing its market capitalization to $4.26 trillions. With "Uptober" and global tensions fueling the rally, analysts are speculating on what will happen next.

- 02:29Data: US Solana spot ETF sees single-day net inflow of $45.77 millionAccording to ChainCatcher, citing SoSoValue data, the total net inflow of Solana spot ETFs is $45.77 million. The SOL spot ETF with the highest single-day net inflow is Bitwise SOL ETF BSOL, with a single-day net inflow of $29.45 million. Currently, BSOL's historical total net inflow has reached $574 million. Next is Fidelity SOL ETF FSOL, with a single-day net inflow of $6.92 million, and FSOL's historical total net inflow has reached $39.22 million. As of press time, the total net asset value of Solana spot ETFs is $930 million, with a Solana net asset ratio of 1.2%. The historical cumulative net inflow has reached $651 million.

- 02:29Renowned analyst: Whether Ethereum can break through $3,700 will determine if the bull market is overChainCatcher News, renowned crypto analyst @IamCryptoWolf posted on X, stating that if the bull market ends, ETH should fail (end its rebound) around the $3,700 range (iHS neckline). However, if the bull market continues, ETH will directly break through $3,700 and then surge all the way up. @IamCryptoWolf shared his analysis on the Tradingview platform in 2014 and currently has 113,000 followers on X. Earlier in November, the analyst stated, "Ethereum will see another correction in November, and if it falls below $3,100, the bear market will begin."

- 02:13SEC suspends approval of high-leverage ETFs, citing concerns over excessive riskJinse Finance reported that the U.S. Securities and Exchange Commission (SEC) has issued a series of warning letters to some of the country's most prolific leveraged exchange-traded fund providers, effectively blocking the launch of products aimed at offering double or triple the daily returns of stocks and commodities. In nine nearly identical letters released on Tuesday, the SEC informed companies including Direxion, ProShares, and Tidal that it would not proceed with the review of proposed product issuances until key issues are resolved. The regulator's core concern is that these funds' risk exposure may exceed the SEC's limits on the risk a fund can take relative to its assets. The letters instruct fund managers to either modify their investment strategies or formally withdraw their applications.