News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

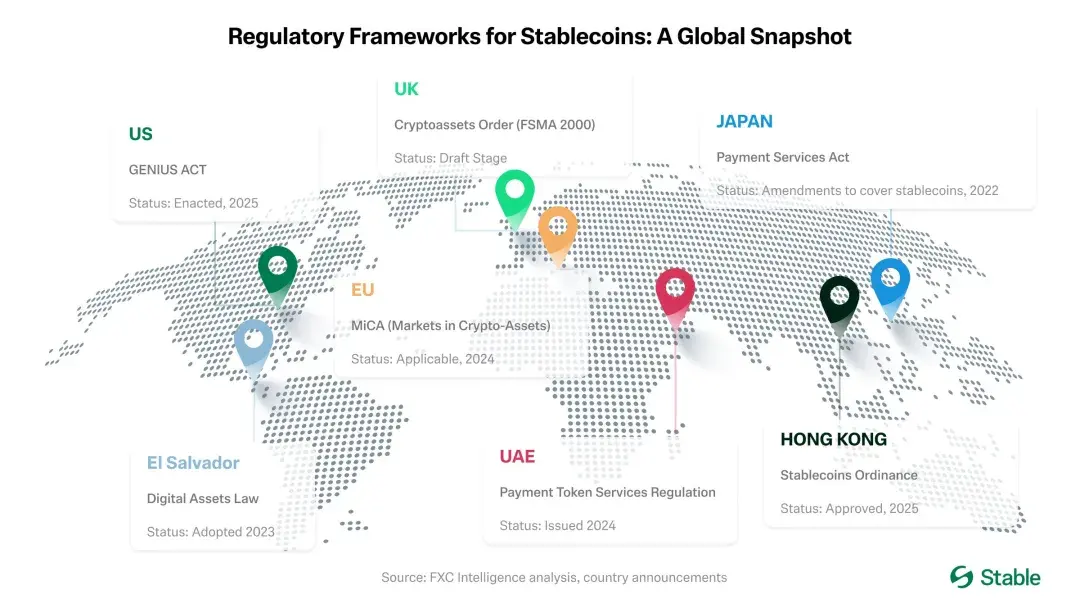

The article analyzes the underlying reasons why the duopoly of Circle (USDC) and Tether (USDT), which still dominate about 85% of the stablecoin market, is beginning to break down. It points out that various structural changes are driving the stablecoin market toward "substitutability," challenging the core advantages of the existing giants.

Public blockchains centered on stablecoins have already achieved the necessary scale and stability. To become everyday currencies, they still need: a consumer-grade user experience, programmable compliance, and transactions with imperceptible fees.

Enterprises are increasing their investments in bitcoin and ethereum, with DAT strategies setting a new paradigm in the capital market.

Can Tether evolve from an offshore issuer to a multi-chain, compliant infrastructure provider without compromising its core advantages in liquidity and distribution?

Based on multiple historical and on-chain indicators, the article's author Michael Nadeau conducts a scenario analysis of the potential peak price of Ethereum in the current bull market, aiming to provide a quantitative reference for Tom Lee's "supercycle" hypothesis. By tracking the 200-week moving average, price-to-realized price ratio, MVRV Z-score, Ethereum-to-Bitcoin market cap ratio, and its ratio to the Nasdaq Index, the article presents a range of specific potential price targets, mainly concentrated in the $7,000 to $13,500 range.

It may not be as exaggerated as Tom Lee’s $60,000 prediction, but can we look forward to $8,000?