News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Schrodinger to offer Eli Lilly's AI drug discovery platform on its software

101 finance·2026/01/09 12:12

Gold holds steady as investors await US non-farm payrolls

101 finance·2026/01/09 12:12

USD gains momentum on favorable data before payroll release – BBH

101 finance·2026/01/09 12:12

Polestar's quarterly EV sales jump as Europe pivot pays off

101 finance·2026/01/09 12:06

UK Crypto Firms Face Reauthorisation as FCA Details New Licensing Roadmap

Coinpedia·2026/01/09 12:03

Zcash (ZEC) Bounces 7% After Core Developer Exit Selloff: What’s Next?

Coinpedia·2026/01/09 12:03

South Korea Signals Bitcoin ETF Launch by 2026 in Major Crypto Policy Shift

Coinpedia·2026/01/09 12:03

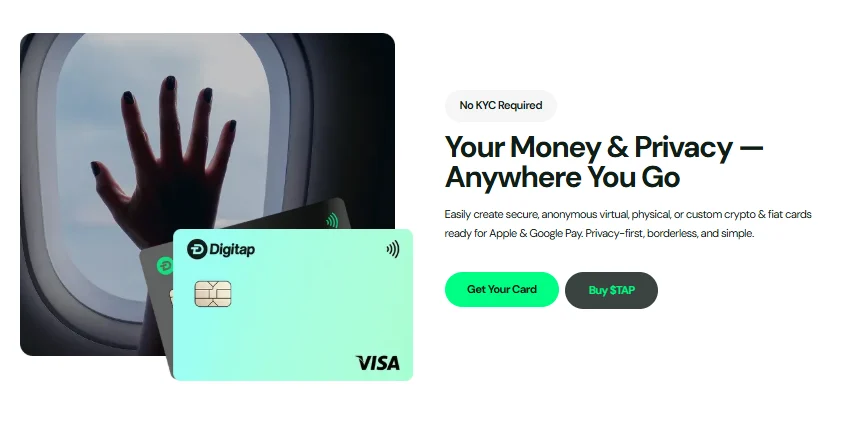

ETH Smashes $3,200: Why Whales Are Moving Profits Into the Digitap ($TAP) $3.7M Crypto Presale

BlockchainReporter·2026/01/09 12:00

Flash

16:47

WLFI officially transferred 500 million WLFI tokens to Jump Trading, worth approximately $83.12 million. according to Onchain lens monitoring, World Liberty Finance has just transferred 500 million WLFI to Jump Trading, worth approximately 83.12 million USD.

16:24

Spot Gold and Silver Continue to Rise, Hitting New HighsBlockBeats News, January 13th, according to Bitget market data, spot gold reached up to $4630 per ounce, hitting a new all-time high, with a 2.67% increase during the day.

Spot silver surged $6.00 intraday, breaking through $86 per ounce, hitting a new all-time high, with a 7.59% increase during the day.

16:23

Jump Trading, the official WLFI Foundation transferred 500 million WLFI, worth approximately $83.12 millionBlockBeats News, January 13th, according to Onchain lens monitoring, World Liberty Finance transferred 5 billion WLFI to Jump Trading 5 minutes ago, worth approximately $83.12 million.