News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.16)|CME to Launch ADA, LINK and XLM Futures on Feb 9; Bitmine Purchases 24,068 ETH; Polygon Lays Off 30% to Pivot Toward Stablecoin Payments2Atomic Wallet raises red flags in viral $479k Monero loss claim3Bitcoin Sheds 30% of Open Interest: Is a Rebound Imminent?

Solana DEX Jupiter Unveils JupUSD, Returning Native Treasury Yield to Users

BlockchainReporter·2026/01/18 03:00

ChatGPT suddenly announces ads, $8 subscription plan can't avoid them

爱范儿·2026/01/18 02:40

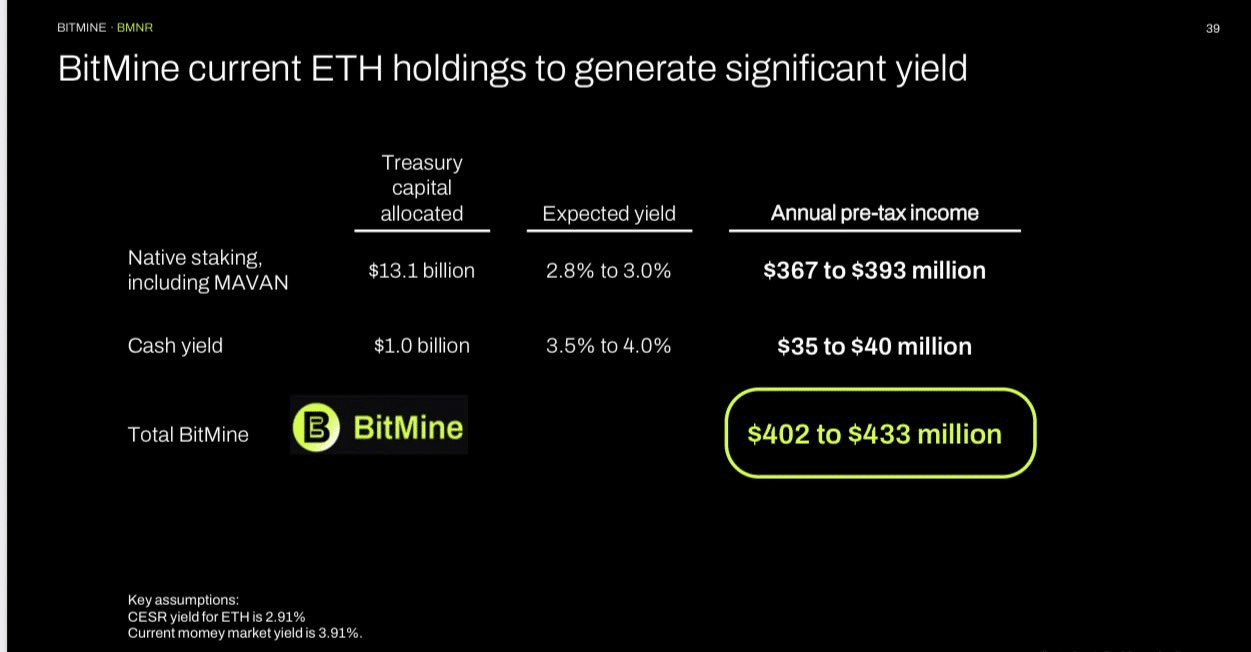

From $3.5K to $12K? Here’s why BMNR’s Ethereum forecast makes sense

AMBCrypto·2026/01/18 02:03

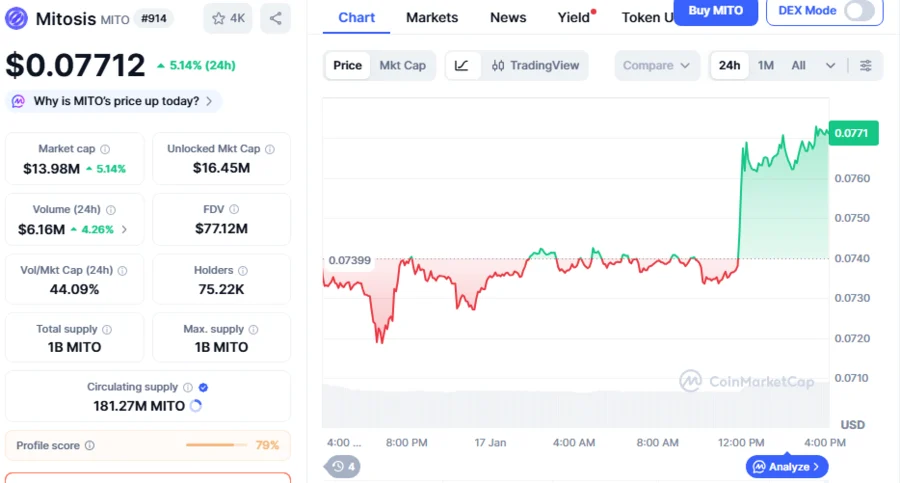

Mitosis Price Flashes a Massive Breakout Hope; Cup-And-Handle Pattern Signals MITO Targeting 50% Rally To $0.115305 Level

BlockchainReporter·2026/01/18 01:00

Recent financial moves by Trump spark renewed worries about possible conflicts of interest

101 finance·2026/01/18 00:39

Why Quant (QNT) Price Is Rising Today: Can It Hit $100 This Weekend?

Coinpedia·2026/01/18 00:30

XRP Price Prediction January 2026: Onchain Signals Elevating XRP Rally Odds

Coinpedia·2026/01/18 00:30

Polkadot (DOT) Breakout Has Paused: Why The Silence Around DOT Matters

Coinpedia·2026/01/18 00:30

Flash

04:18

A trader made a single-day profit of $6.12 million on Polymarket, recovering nearly 90% of previous losses.According to Odaily, Onchain Lens monitoring shows that trader beachboy4 made a single-day profit of $6.12 million on Polymarket. The trader recovered almost all previous losses within one day, with the remaining loss to be recovered now reduced to $687,000.

04:01

Paul Chan: Hong Kong is accelerating efforts to establish a central gold clearing system, aiming to launch a pilot within the year.BlockBeats News, January 18, Hong Kong Financial Secretary Paul Chan Mo-po published a blog post titled "Seizing Development Opportunities Amidst a Complex International Landscape," in which he pointed out: The role of gold as a central bank reserve, investment product, and risk-hedging tool has been further strengthened. The price of gold accumulated an increase of more than 60% by 2025, marking the largest rise since 1979. As of the third quarter of last year, the total global demand for gold increased by 44% year-on-year to reach $146 billions. Hong Kong's spot gold trading market has become significantly more active. As of November last year, the average daily turnover of 9999 gold at the Hong Kong Gold Exchange more than tripled year-on-year, reaching HK$2.9 billions. Hong Kong is expediting the establishment of a central gold clearing system as an important financial infrastructure to enhance the reliability and efficiency of gold trading and physical delivery in Hong Kong, reduce transaction costs, and increase its liquidity. The goal is to launch a pilot operation within this year and invite the Shanghai Gold Exchange to participate.

04:00

Paul Chan: Hong Kong is stepping up efforts to establish a Gold Central Clearing System, aiming to conduct a trial run within the yearBlockBeats News, January 18th, Financial Secretary of Hong Kong, Paul Chan Mo-po, published a blog post titled "Seizing Development Opportunities in a Complex International Environment," in which he pointed out: The role of gold as a central bank reserve, investment product, and risk hedging tool has been further strengthened. The price of gold has cumulatively risen by over 60% in 2025, marking the largest increase since 1979. By the third quarter of last year, the total global gold demand value saw a 44% year-on-year increase to reach $146 billion. The Hong Kong gold spot trading market has become significantly more active, with the average daily trading volume on the Hong Kong Gold Exchange rising by over two times year-on-year as of November last year, reaching HK$2.9 billion. Hong Kong is actively promoting the establishment of a gold central clearing system as a critical financial infrastructure to enhance the reliability and efficiency of gold trading and physical delivery in Hong Kong, reduce transaction costs, and increase liquidity. The goal is to launch a pilot run this year and invite the Shanghai Gold Exchange to participate.

News