News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

Stocks, bonds, and cryptocurrencies support each other; gold and BTC jointly back US Treasury bonds as collateral, and stablecoins support the global adoption rate of the US dollar, making the losses from deleveraging more socialized.

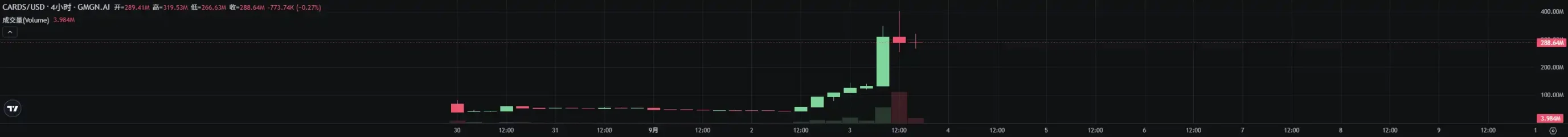

The demand is real, but it's not for the trading of Pokémon cards itself.

The U.S. August non-farm payroll report is expected to confirm that the labor market is "losing momentum" and to solidify the case for a Federal Reserve rate cut in September. However, even more striking is the upcoming revised report next week...

Is the U.S. labor market sounding a full "alarm"? The latest non-farm payroll data has once again fallen short of expectations, and most concerning is that the June employment data has been revised to show "negative growth"...

Real revenue flows to holders, and the next step is to conduct buybacks more intelligently while maintaining transparency.

The BRC2.0 led by Domo has launched. Can native Bitcoin assets become popular again?

The US non-farm payroll report will have a significant impact on the bitcoin market. The market expects that weak data may accelerate a Fed rate cut, while strong data could trigger a pullback. Bitcoin is at the top area of the halving cycle, with a double-top pattern in the technical analysis and a key support level at $112,000. Summary generated by Mars AI. The accuracy and completeness of the content generated by the Mars AI model are still in an iterative update stage.

- 15:22A whale who made $73.96 million in profits from swing trading ETH sold 10,000 ETH.According to Jinse Finance, on-chain analyst Yujin has monitored that a whale/institution, which previously made a profit of $73.96 million from ETH swing trading, sold 10,000 ETH through Wintermute in the past hour, exchanging them for 44.31 million USDC and making a profit of $960,000.

- 15:22A whale lost over 10 million USD by chasing long positions on ETH after the non-farm payroll data.According to ChainCatcher, as monitored by Ember, a whale who sold HYPE and then went long on ETH chased the rally following the non-farm payroll data. After ETH's price retraced, the whale closed out 52,800 ETH at a stop-loss price of approximately $4,265, incurring a single-day loss of $10.67 million. Since May 25, the cumulative loss has reached $35.84 million.

- 15:13Data: In the past hour, total liquidations across the network reached approximately $124 million, with $123 million being long position liquidations.ChainCatcher news, according to Coinglass data, in the past hour, the total amount of liquidated contracts across the entire cryptocurrency market reached $124 million, with short positions liquidated amounting to $1.9164 million and long positions liquidated amounting to $123 million. The total amount of ETH liquidations was $34.51 million, while BTC liquidations totaled $63.1724 million.