News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

The report shows that North Korean agents are deeply infiltrating the crypto industry using fake identities, accounting for up to 40% of job applications. They are obtaining system access through legitimate employment channels, and the scope of their influence far exceeds industry expectations.

Another VC has already lost $50 million.

Etherscan's decision to stop offering free APIs across multiple chains has sparked an industry debate, reflecting a deeper contradiction between the commercialization and decentralization of blockchain data infrastructure.

The report indicates that North Korean agents are actively infiltrating the cryptocurrency industry using forged identities, with job applications accounting for up to 40%. They are gaining system access through legitimate employment channels, and their impact extends well beyond industry expectations.

Another VC has already lost 50 million USD

Perpetual Contract Eats Wall Street

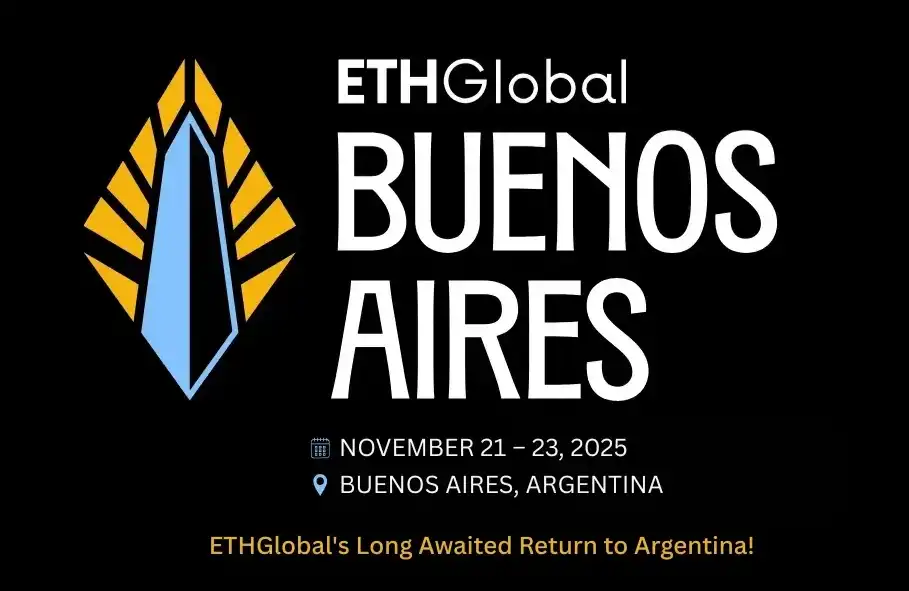

475 teams competed for a $500,000 prize, and 10 Web3 innovative projects emerged as the final winners.

Bitcoin has successfully held the $84,000 support level and may rebound to $94,000 this week. If it falls below $80,000, it could further drop to $75,000. Although market sentiment is extremely bearish, a short-term oversold condition may trigger a rebound. Summary generated by Mars AI This summary was generated by the Mars AI model, and its accuracy and completeness are still being updated iteratively.

Dogecoin's price is being suppressed by resistance at $0.1495, with short-term support at $0.144. Grayscale's DOGE ETF debut failed to boost the price, and continued whale sell-offs are exerting further pressure. Technical analysis indicates a neutral-to-bearish trend, lacking clear reversal signals. Summary generated by Mars AI. This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still undergoing iterative updates.

- 06:41Total crypto industry venture capital in Q3 reached $4.65 billion, marking the second highest record since the FTX collapse.Jinse Finance reported, citing Cointelegraph, that according to a research report released by Galaxy Digital on Monday, the total amount of venture capital in the crypto industry reached $4.65 billion in the third quarter of 2025, a quarter-on-quarter increase of 290%, marking the second-highest record since the collapse of FTX in 2022 (the highest being $4.8 billion in the first quarter of this year). A total of 414 deals were completed this quarter, with seven large transactions—including Revolut’s $1 billion financing and a $500 million financing by an exchange—accounting for half of the total funding. U.S. companies received 47% of the investment, while companies in Singapore and the UK received 7.3% and 6.8%, respectively. Research director Alex Thorn pointed out that sectors such as stablecoins, AI, and blockchain infrastructure continue to attract capital, but as the industry matures, the proportion of pre-seed investments is gradually declining. Venture capital activity in the past two years remains below the levels seen during the 2021-2022 bull market. Thorn analyzed that the cooling of sectors like gaming and NFT, the diversion of funds to the AI track, and factors such as the interest rate environment have collectively led to a stagnation in venture capital. Meanwhile, compliant investment channels such as spot ETFs are now competing with traditional venture capital for institutional funds.

- 06:41glassnode: Bitcoin has entered a deeply oversold state, and the market may be forming an early bottom structureJinse Finance reported that glassnode released its weekly market analysis report, stating that although the current bitcoin trend remains clearly downward, the recent defense of the mid-$80,000 level suggests that if selling pressure continues to ease, the price may show signs of stabilization. The spot market is quiet, with weak trading volumes and continued ETF outflows, indicating that the market is shifting from an aggressive sell-off phase to a more orderly de-risking stage. The options market remains defensive, with high skew and narrowing volatility spreads, suggesting that while the market expects continued volatility in the future, panic sentiment has eased. On-chain activity remains sluggish. Transfer volume, fee income, and realized capital movement have all slowed, indicating relatively calm network operations. Profitability indicators have further deteriorated: unrealized losses and realized P&L reflect deepening unrealized losses and a rising concentration of short-term holder supply, a pattern consistent with late-stage corrections. In summary, bitcoin continues to retreat within a controllable range and has now entered a deeply oversold and high-stress state. Although profitability remains under pressure, the slowdown in outflows, stabilizing momentum, and lack of speculative leverage accumulation suggest that the market may be forming an early bottom structure in the $84,000 to $90,000 range.

- 06:29Economists raise U.S. economic growth forecast for next year, expect the Federal Reserve to slow down rate cutsJinse Finance reported that a new survey by the National Association for Business Economics (NABE) shows that the U.S. economy is expected to grow moderately in 2026, but job creation is expected to remain sluggish. The survey, conducted from November 3 to 11, covered 42 professional forecasters. The median expectation for economic growth in 2026 is 2%, higher than the 1.8% in the previous survey in October. According to Reuters, this stands in sharp contrast to the 1.3% growth forecast in the June survey. The respondents’ median forecast also shows that this year’s inflation rate is expected to end at 2.9% (slightly lower than the 3% predicted in October), and will only fall slightly to 2.6% in 2026. Economists attribute a significant portion of inflation to tariffs. Meanwhile, economists expect job growth to remain weak, with an average monthly increase in nonfarm payrolls projected at 58,000, lower than the 60,000 in the October survey. They also predict that the average monthly increase in nonfarm payrolls in 2026 will be 64,000, down from the 75,000 forecast in the October survey. The unemployment rate is expected to rise to 4.5% at the beginning of 2026 and remain at that level throughout the year. Regarding the Federal Reserve’s interest rate path, a 25 basis point rate cut is expected in December, with only another 50 basis points cut in 2026, bringing the policy rate closer to a neutral level. (Golden Ten Data)