News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

CrowdStrike defeats shareholder lawsuit over huge software outage

101 finance·2026/01/14 15:57

Chinese chip designer Montage lines up Alibaba and JPMorgan for $10 billion Hong Kong IPO

Cointelegraph·2026/01/14 15:51

Southeastern Freight Lines partners with other regional carriers to expand operations into the Mexican market

101 finance·2026/01/14 15:36

Dutch court hears arguments in Nexperia mismanagement case that upset the global auto industry

101 finance·2026/01/14 15:36

Ramsden: How the Bank’s strategy for resolution has developed over time

101 finance·2026/01/14 15:36

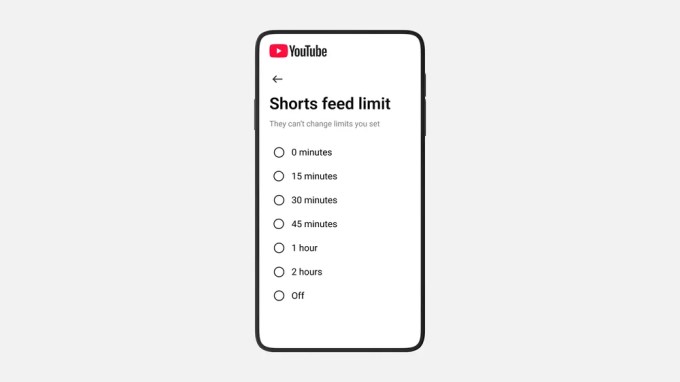

YouTube now has a way for parents to block kids from watching Shorts

101 finance·2026/01/14 15:33

Ingenico Launches Stablecoin Acceptance at Physical Checkouts via Payment Terminals

Coinspaidmedia·2026/01/14 15:24

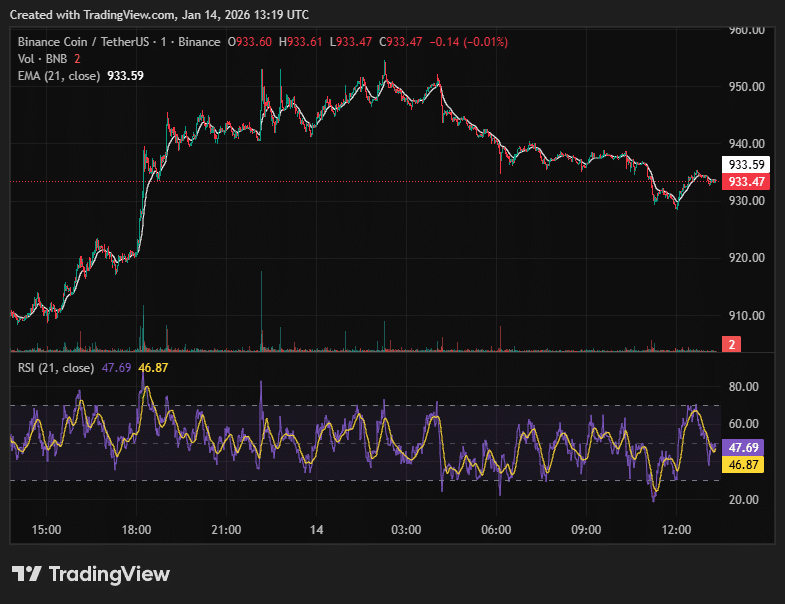

BNB Chain Hits 0.45s Block Times with Fermi Hard Fork to Rival High-Speed Chains

Coinspeaker·2026/01/14 15:18

Ethereum Price Strengthens Amid Shifts in Crypto Market

Coinspeaker·2026/01/14 15:12

You can place wagers on virtually everything in Trump's America. Those with inside knowledge are profiting.

101 finance·2026/01/14 15:09

Flash

15:57

Federal Reserve Governor Milan: "Ambitious" U.S. deregulation supports further Fed easing. Federal Reserve Board member Stephen Milian claimed that the Trump administration's deregulation agenda provides an additional reason for the Federal Reserve to continue cutting interest rates. "I believe that the comprehensive deregulation currently underway in the United States will significantly boost competition, productivity, and potential growth, thereby allowing faster economic growth without generating inflationary pressures," Milian said at an event in Athens, Greece. He supported his view by citing various factors, including his expectation that housing inflation will slow down and his lower estimate of the so-called "neutral rate" (the level at which Federal Reserve policy neither stimulates nor restrains the economy). "This will support the continued easing of restrictive monetary policy, but ignoring these (decoupling) effects will lead to unnecessary tightening of monetary policy," he said when discussing deregulation. Milian stated that based on the pace of deregulation in the first half of 2025 under the Trump administration, he estimates that 30% of regulatory restrictions in the Code of Federal Regulations will be eliminated by 2030.

15:50

A "traditional asset trader on-chain" invests in PAXG, silver, and synthetic US stocks, with unrealized profits exceeding $330,000According to Odaily, as monitored by Coinbob, a certain "on-chain traditional asset trader" is focusing on PAXG (gold PAX Gold), xyz:SILVER (silver), TSLA and other US stock synthetic assets and precious metals. The account's total value is $1.3896 million, with unrealized profits of $330,000. The core holdings are as follows: PAXG long position: valued at $3 million; current floating profit of $127,000 (+42.49%); xyz:SILVER long position: valued at approximately $1.82 million, current floating profit of $230,000 (+41%); There are also long positions in xyz:GOLD and xyz:TSLA.

15:48

Federal Reserve Governor Waller: Regulatory easing will put downward pressure on prices, providing a rationale for rate cutsBlockBeats News, January 14th, Federal Reserve Board Governor Milan stated that relaxing regulation should bring downward pressure on prices, which is another reason for the US Federal Reserve to cut interest rates. By 2030, perhaps 30% of the regulations can be eliminated, potentially reducing inflation by half a percentage point annually. Relaxing regulation is equivalent to a positive supply and productivity shock, providing the economy with more capacity and alleviating price pressures. (FXStreet)

News