News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Federal Reserve Rate Cut in September: Which Three Cryptocurrencies Could Surge?2Is XRP about to break through $3?3Bitcoin Cash Breakout Eyes $776, $960, and $1,157 as Key Resistance Levels

Ethereum Could Break Out After Triple Bottom With $4,540 Resistance in Focus Toward $5,000

Coinotag·2025/09/08 02:00

Top Altcoin Movers: Mythos Rallies 9%, Immutable Holds $0.51, Cardano Pushes Toward $0.85

Cryptonewsland·2025/09/08 01:35

5 Best Layer 1s to HODL — Breaking Down Real Trade-Offs in 2025

Cryptonewsland·2025/09/08 01:35

Solana Trades at $202 as Rising Wedge Targets $160 Breakdown Level

Cryptonewsland·2025/09/08 01:35

SUI vs AVAX: Which Altcoin Wins 2025? Analysts Also Back MAGACOIN FINANCE

SUI and AVAX lead the altcoin race, but MAGACOIN FINANCE is gaining strong momentum, making investors rethink the next big move in crypto.

Coinomedia·2025/09/08 01:30

Trump family's wealth grew by $1.3B following ABTC and WLFI debuts: Report

CryptoNewsNet·2025/09/08 01:20

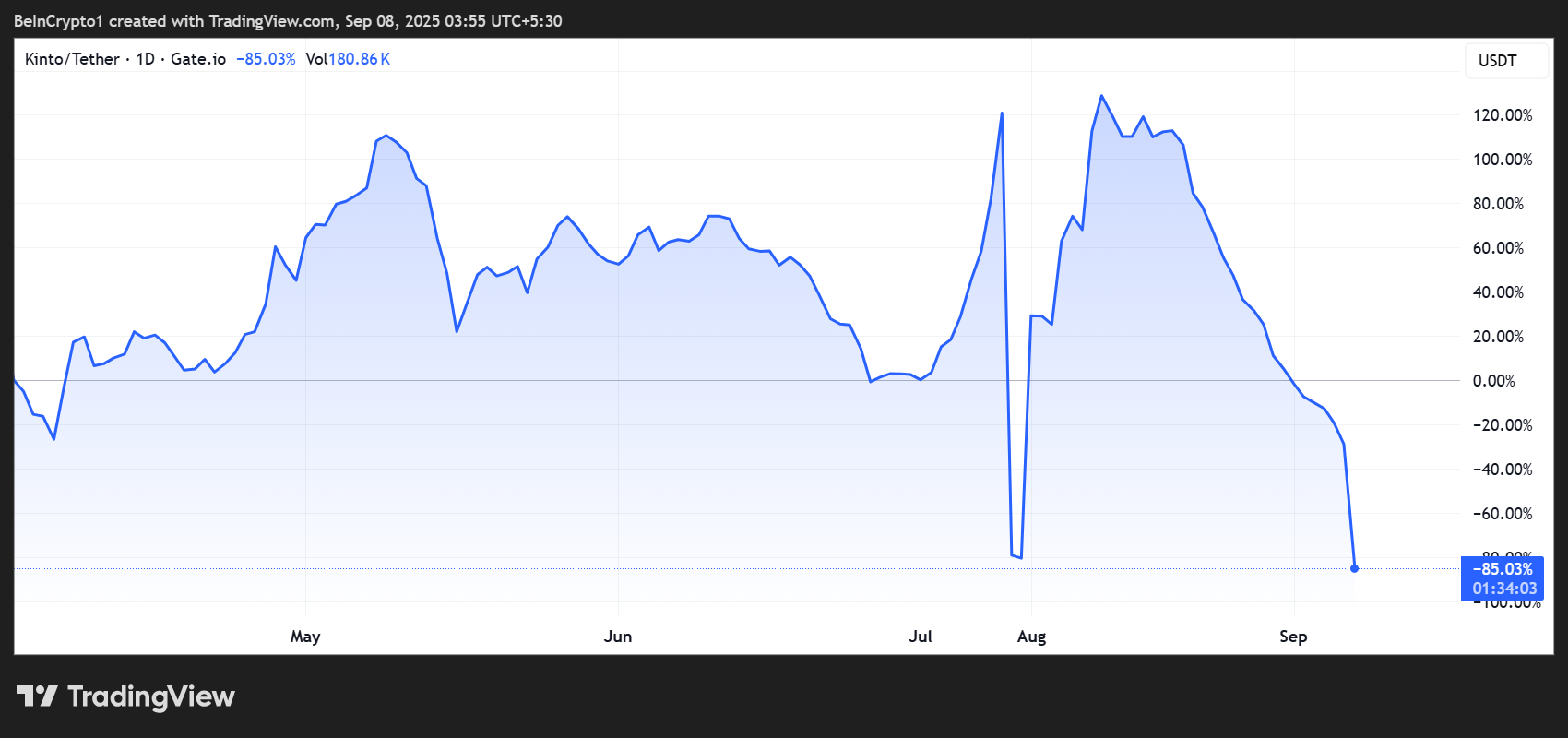

Why Kinto’s K Token Collapsed Before Unlocking

CryptoNewsNet·2025/09/08 01:20

Sell Everything: A Crypto Market Crash Is Coming

Cointribune·2025/09/08 01:10

Goldman and T. Rowe sign $1 billion partnership as Wall Street targets retirement cash

Share link:In this post: Goldman Sachs is buying a $1 billion, 3.5% stake in T. Rowe Price to push private assets into retirement accounts. The partnership will launch target-date funds, co-branded portfolios, and advice services by mid-2025. Citigroup also announced a deal giving BlackRock $80 billion in client assets to manage starting in Q4.

Cryptopolitan·2025/09/07 23:50

Flash

- 02:13Analysis: The difference in contract long and short trading volumes has reversed, and traders' short-selling tendency is gradually weakeningBlockBeats News, on September 8, on-chain data analyst Murphy released a market analysis stating that the Volume Delta Balance (VDB) of perpetual contracts measures the short-term trend (30-day average) of the difference in buying and selling power in the recent futures market relative to the longer-term market benchmark (90-day median), in order to determine whether the current market is more bullish or bearish, and to observe whether this force is strengthening. Since early August, the VDB of a certain exchange and other trading platforms has dropped into negative territory, indicating that perpetual contract traders—a highly speculative group in the market—have shown an increasing tendency to go short during this period. However, this indicator is highly volatile, so comparing the "short-term" and "mid-term" helps to observe the direction and degree of deviation, in order to confirm whether this negative tendency will develop into a sustained trend (as shown by the red arrow in the chart). The current trend of VDB has begun to gradually reverse (as shown by the green arrow in the chart), indicating that bullish sentiment is recovering and traders' inclination to go short is gradually weakening. According to past data, if this trend continues, the market is likely to see a rebound. This analysis is for educational and communication purposes only and does not constitute investment advice.

- 02:12Smart money "qianbaidu.eth" has accumulated $13 million worth of HYPE purchases over the past weekAccording to Jinse Finance, monitored by Lookonchain, smart money "qianbaidu.eth" deposited another 6.06 million USDC into its own account today to purchase more HYPE tokens. Over the past week, this address has accumulated a total purchase of 276,834 HYPE tokens, valued at 13 million USD.

- 02:04Data: Smart money that made $9.56 million from ETH swing trading is now accumulating HYPEChainCatcher news, recently, according to monitoring by @ai_9684xtpa, a smart money address that made a profit of 9.56 million USD from ETH swing trading between June and August 2025 is currently accumulating HYPE. In the past 9 hours, this address has deposited 4.01 million USDC into Hyperliquid, of which 2.996 million USDC has been used to purchase 63,197 HYPE at an average price of 47.41 USD. The remaining 1.02 million USD has been placed as a limit buy order at 47.17 USD.