News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 12)|World launches a “super app” featuring payments and chat; US initial jobless claims reach 236,000; Satoshi Nakamoto statue installed at the NYSE2Ether vs. Bitcoin: ETH price poised for 80% rally in 20263Prediction markets bet Bitcoin won’t reach $100K before year’s end

Bitcoin bounces on Fed rate cut with bigger rally ahead predicted

Cointelegraph·2025/12/12 06:06

From the Only Survivor of Crypto Social to "Wallet-First": Farcaster’s Misunderstood Shift

Wallets are an addition, not a replacement; they drive social interaction, not encroach upon it.

BlockBeats·2025/12/12 03:20

a16z: 17 Major Potential Trends in Crypto Forecasted for 2026

Covers intelligent agents and artificial intelligence, stablecoins, tokenization and finance, privacy and security, and extends to prediction markets, SNARKs, and other applications.

深潮·2025/12/12 02:38

Hex Trust will issue and host wXRP to expand its DeFi applicability across multiple blockchains.

Cointime·2025/12/12 02:36

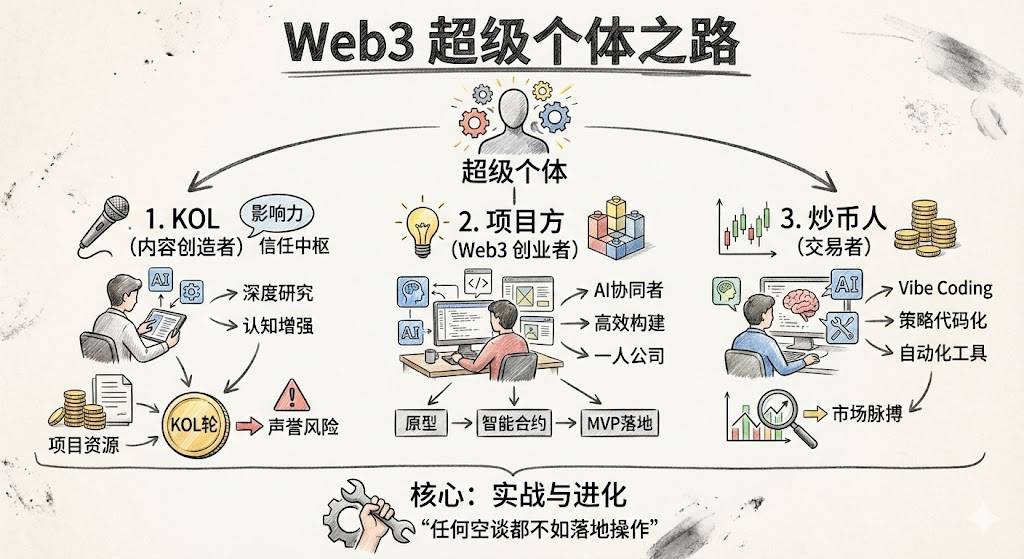

How to Become a Web3 Super Individual?

A Personal Awakening Guide for the AI+Crypto Era.

深潮·2025/12/12 02:36

Big Short Burry warns: Fed's RMP aims to cover up banking system vulnerabilities, essentially restarting QE

Michael Burry warned that the Federal Reserve has effectively restarted quantitative easing under the guise of "reserve management purchases," exposing that the banking system is still reliant on central bank liquidity for survival.

ForesightNews·2025/12/12 02:12

Crypto : Trading Volumes Collapse as the Market Stalls, According to JPMorgan

Cointribune·2025/12/12 01:57

Bitcoin : After the Rate Cut, Traders Prepare for an Explosive 2026

Cointribune·2025/12/12 01:57

Flash

- 07:00AllScale: A total of $5 million in invoice settlements has been completed.Jinse Finance reported that the self-custody stablecoin digital bank AllScale announced on the X platform that it has settled a total of $5 million in invoice payments. This milestone was achieved thanks to more than 150,000 registered users from multiple regions using AllScale to issue invoices and receive payments in stablecoins. AllScale also stated that it will soon launch its next feature, which aims to enable even smoother global invoice payments.

- 06:47Analyst: The market tends to view $85,000 as a BTC pullback buying point, with some funds betting that $90,000 will be short-term support.ChainCatcher news, crypto analyst Murphy stated on social media, "A summary of traders' (institutions') views and forecasts on the current market: 1. On one hand, funds are using in-the-money Calls at 85,000 to leverage long positions, while on the other hand, they are selling Puts to collect premiums. This means they are expressing with real money that even if there is a correction, they are more inclined to treat 85,000 as a buy-the-dip point rather than the start of a new deep decline. 2. A large number of Puts are being sold at 90,000, indicating that funds are betting this is a short-term support level. 3. The simultaneous surge in buying both Calls and Puts near the current price suggests that funds are preparing for the next major volatility."

- 06:40Banmuxia: Bitcoin's planned take-profit targets are $98,000, $103,300, and $112,500, with dynamic adjustments based on judgment.Jinse Finance reported that Chinese crypto analyst Ban Muxia stated, "On the daily chart for bitcoin, the MA5, MA10, and MA30 have formed a golden cross, thus establishing a subsequent support zone between $90,500 and $91,300. If you have previously gone long on bitcoin in the $89,000–$90,000 range, $98,000, $103,300, and $112,500 can be considered as planned take-profit points, and you should adjust your judgment based on market dynamics. However, these take-profit levels are no longer suitable entry points for going long, as the risk-reward ratio is now very low."

News