News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec. 3) | Trump Strongly Hints at Hassett as Next Fed Chair; Elon Musk Predicts a $38.3T “Crisis” Could Trigger a BTC Price Surge2Bitcoin mispricing deepens as BTC trades below $100K, but not for long: Bitwise3BitMine buys $70M ETH while Tom Lee revises Bitcoin prediction

BlackRock buys over $600 million of these two cryptocurrencies

CryptoNewsNet·2025/10/03 12:30

Bitcoin Could Reach $135,000 Soon: Standard Chartered

CryptoNewsNet·2025/10/03 12:30

Zcash Rockets to Three-Year High, But Overheating Risks Loom

Cointribune·2025/10/03 12:27

Is Avalanche (AVAX) Set to Rise Higher? This Emerging Fractal Setup Says Yes!

CoinsProbe·2025/10/03 12:24

Fartcoin (FARTCOIN) Following Potential Reversal Setup – Will It Rise Further?

CoinsProbe·2025/10/03 12:24

XRP price outlook: why whales, ETFs, and rate cuts could send XRP soaring

Coinjournal·2025/10/03 12:18

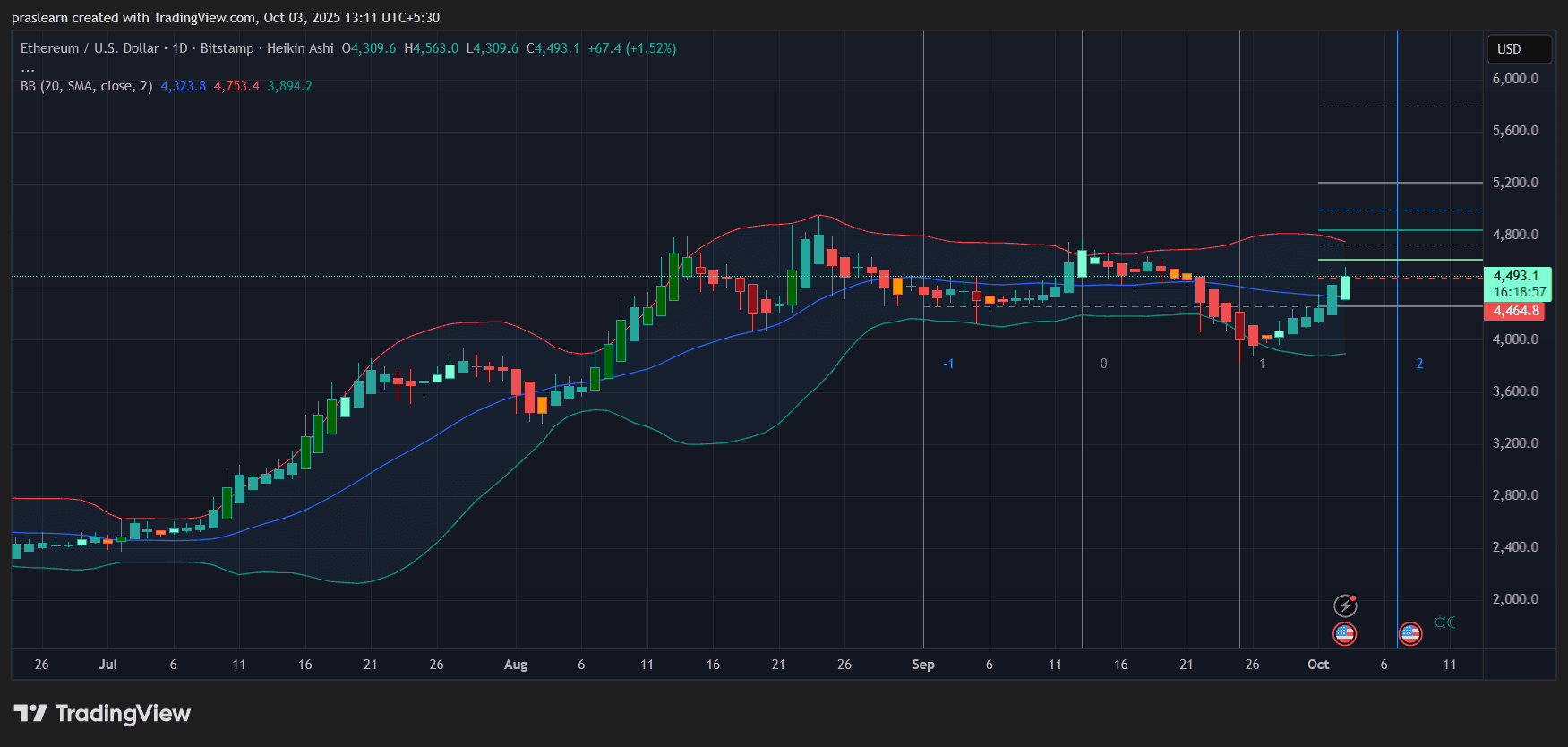

How a Shutdown Could Affect ETH Price?

Cryptoticker·2025/10/03 12:12

StanChart reaffirms $200k year-end projection for Bitcoin as US gov shutdown becomes tailwind

CryptoSlate·2025/10/03 11:55

SuiFest Spurs Sui Ecosystem Growth, AIA Token Surges

Coinlineup·2025/10/03 11:24

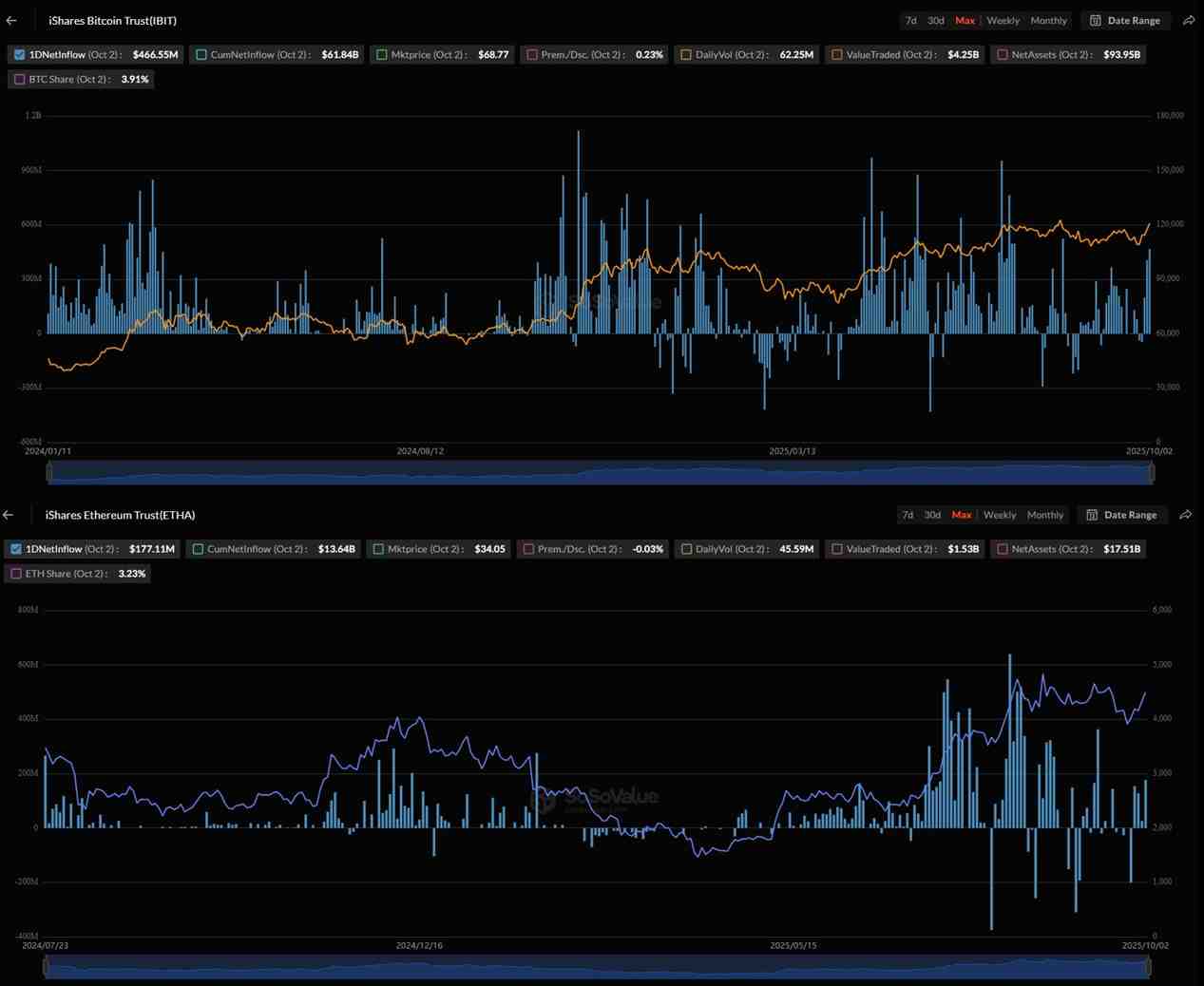

Institutions Diverge on Bitcoin and Ethereum Investments

Coinlineup·2025/10/03 11:24

Flash

- 01:08ETHZilla acquires 20% stake in Karus to advance AI car loan tokenizationChainCatcher news, ETHZilla Corporation (NASDAQ: ETHZ) announced the acquisition of a 20% fully diluted equity stake in AI automotive finance decision platform Karus, Inc., with a transaction amount of $8 million (comprising $3 million in cash and $5 million in stock). According to the agreement, ETHZilla will integrate Karus's AI-driven loan evaluation technology into its blockchain infrastructure to enable the tokenization of auto loan assets. Karus's AI decision engine is based on more than 20 million historical auto loan data points, analyzing over 1,000 variables, and has processed more than $5 billion in auto loans. The first batch of tokenized portfolios is expected to launch in early 2026 and will be traded on the Liquidity.io platform.

- 01:08BlackRock Report: US Debt Growth Will Drive Cryptocurrency Market ExpansionChainCatcher news, according to CoinDesk, BlackRock, the world's largest asset management company, pointed out in its latest report that U.S. federal debt will swell to over $38 trillion, leading to a fragile economic environment and the failure of traditional hedging tools, which will accelerate the adoption of cryptocurrencies by Wall Street institutions. The report emphasizes that increased government borrowing "creates vulnerabilities to shocks, such as bond yield spikes related to fiscal concerns or policy tensions between inflation management and debt servicing costs." Samara Cohen, BlackRock's Global Head of Markets, stated that stablecoins "are no longer niche products and are becoming a bridge between traditional finance and digital liquidity." The company's CEO, Larry Fink, described tokenization as the next generation of financial markets, a trend already reflected in BlackRock's $100 billion bitcoin ETF allocation, which has become a major source of its revenue.

- 01:00Trump’s CFTC and FDIC Chair Nominees Advance Toward Confirmation, Potentially Reshaping Crypto Regulatory LandscapeChainCatcher news, according to CoinDesk, the U.S. Senate is advancing confirmation votes for two key financial regulatory officials nominated by President Trump: Mike Selig, who will serve as CFTC Chairman, and Travis Hill, who will officially become FDIC Chairman. Both are considered crypto-friendly and will play important roles in the regulation of the U.S. crypto market. Once in office, Selig will become the sole commissioner of the CFTC and lead the implementation of crypto regulatory legislation; Hill has emphasized lifting previous government restrictions on banks engaging in crypto business and addressing the issue of "de-banking."

News