News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.15)|Bitget partners with World Cup champion Julián Álvarez to launch a promotional video; nearly 30% of Ethereum’s total supply is now locked in staking; FOGO will begin trading on the secondary market today2Bitget UEX Daily | White House Imposes 25% Chip Tariff; Trump Signs Rare Earth Security Order; Rare Earth Stocks Surge Against Trend;TSMC to Release Earnings (Jan 15, 2026)3$46B Flows Into ETF, But Bitcoin Struggles

Inflation Concerns Resurface as Officials Dampen Sentiment!

美投investing·2026/01/15 03:09

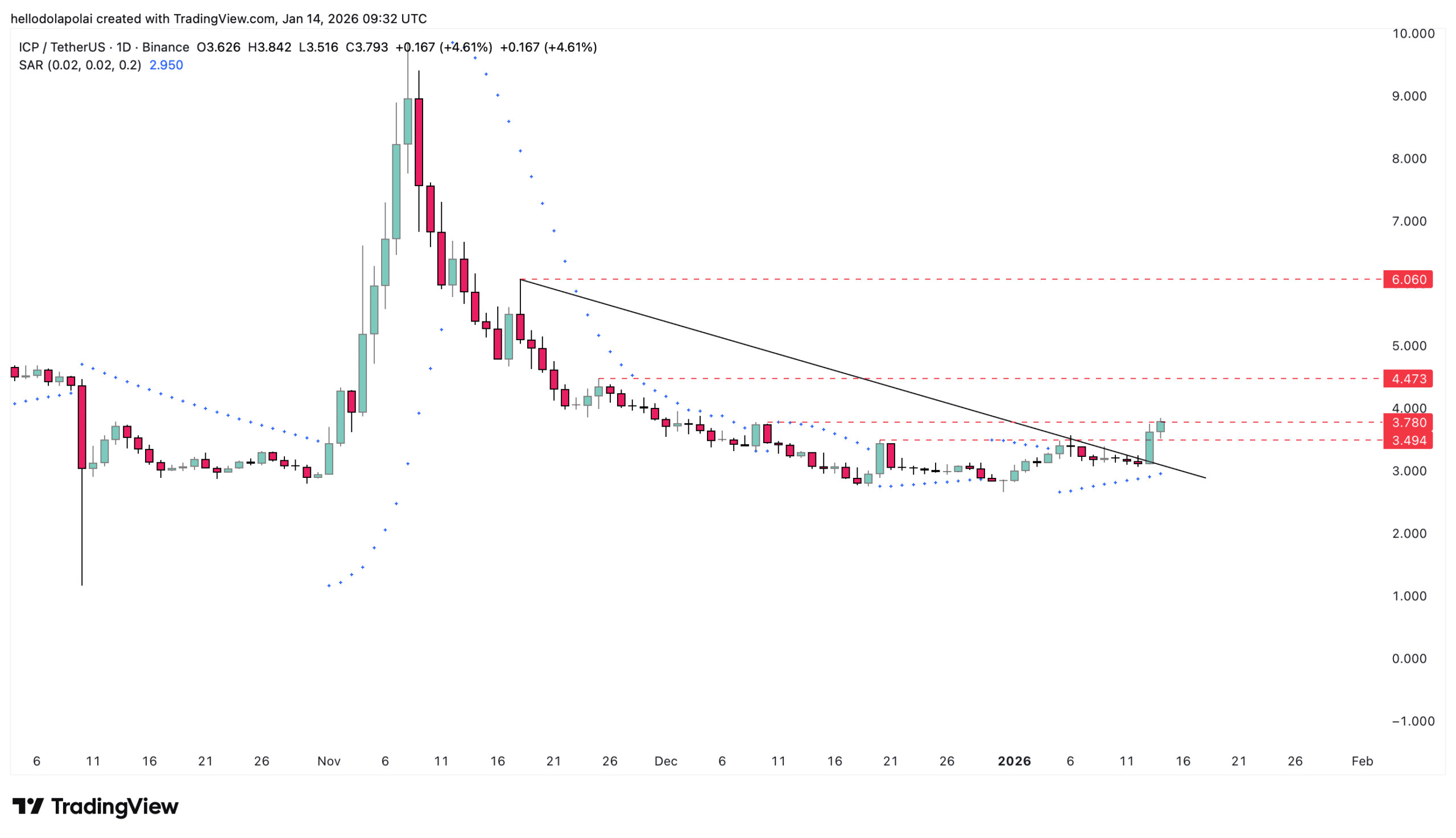

Internet Computer rallies 12% – But THESE levels still stand in ICP’s way

AMBCrypto·2026/01/15 03:03

AbbVie Plans to Expand in the Obesity Treatment Market

格隆汇·2026/01/15 02:36

Mira Murati’s company, Thinking Machines Lab, is seeing two of its co-founders depart to join OpenAI

101 finance·2026/01/15 02:36

Amazon Criticizes Saks Investment Agreement, Claims Its Shares Have ‘No Value’

101 finance·2026/01/15 02:30

Senator Lummis indicates that the hearing on the crypto market structure bill could be delayed

101 finance·2026/01/15 02:21

Bitcoin approaches the $100,000 mark amid unexpected rally

101 finance·2026/01/15 01:30

Robinhood CEO Says AI Could Spark a ‘Job Singularity’

101 finance·2026/01/15 01:03

Flash

03:16

Fed's Kashkari: Cryptocurrency is "basically useless"PANews, January 15—According to Cryptopolitan, Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, expressed sharply contrasting views on cryptocurrency and artificial intelligence during a virtual event. He stated that cryptocurrency is "basically useless" for ordinary people, believing it lacks practical use for average consumers; in contrast, he held a positive attitude toward artificial intelligence, saying it is practical, even though most companies are still in the testing phase. Kashkari expressed optimism about the outlook for the U.S. economy, expecting continued growth and noting that inflation is moving in the right direction, especially pointing out signs of cooling in housing prices. On monetary policy, he dismissed the recent view that the Federal Reserve's balance sheet expansion is equivalent to a new round of quantitative easing, and emphasized that the independence of the central bank is crucial. Regarding tariffs, he stated that their impact has not been as severe as expected, but the long-term effects remain to be seen.

03:12

Bitunix Analyst: Brown Paper Release Signals Key Message — Economic Recovery but Inflation Risk LoomingBlockBeats News, January 15, The latest release of the Fed Beige Book shows that since mid-November of last year, economic activity in most U.S. regions has been rebounding at a "slight to moderate" pace, a significant improvement from the previous few periods. However, the momentum in the labor market is weak, with 8 of the 12 regions reporting almost flat employment levels and wage growth retreating to a "normal, moderate" range, indicating a cooling labor market but not yet in disarray.

Of note, the source of inflationary pressure is undergoing a structural shift. The Beige Book points out that as pre-tariff inventory is gradually depleted, businesses have found it difficult to continue absorbing costs on their own and have begun passing on tariff-related expenses to final prices. Regions like New York and Minneapolis further reported that the upward pressure on prices has significantly squeezed business profits, with particularly prominent increases in service costs such as healthcare and insurance.

This phenomenon aligns with the recent stance of several Fed officials: the economy has not yet entered a recession, employment remains resilient, but the path of inflation decline is not smooth, especially under the disruption of tariffs and policy uncertainty, making it difficult to accelerate the rate cut pace. The market currently generally expects that the Fed may need to wait until at least mid-year to adjust rates again.

Bitunix Analyst:

The core signal released by the Beige Book is not "economic strength," but "inflation pressure shifting." When costs are formally reflected in the PPI and CPI, the Fed's policy space will once again be constrained, which is a key background for the ongoing global market revision of expectations towards easing.

03:12

Genius responds to platform vulnerability: Gas costs for transactions have dropped significantly, and BNB cross-chain swaps have been optimized.According to Odaily, Genius announced on the X platform that, in response to community feedback regarding platform trading issues, some vulnerabilities have now been fixed, including: -Significantly reduced Gas fees: Fixed issues with EIP-1559 on-chain Gas limit overestimation and maxPriorityFeePerGas being set too high; -Optimized BNB cross-chain swaps: Added a small Gas buffer to prevent transaction failures due to insufficient Gas, without significantly increasing Gas fees; -Resolved cross-chain transaction fee sponsorship issues using EIP-7702: Updated the process to correctly execute cross-chain transactions sponsored by third parties (no longer experiencing issues present in the previous version).

News