News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Jan.15)|Bitget partners with World Cup champion Julián Álvarez to launch a promotional video; nearly 30% of Ethereum’s total supply is now locked in staking; FOGO will begin trading on the secondary market today2Bitget UEX Daily | White House Imposes 25% Chip Tariff; Trump Signs Rare Earth Security Order; Rare Earth Stocks Surge Against Trend;TSMC to Release Earnings (Jan 15, 2026)3$46B Flows Into ETF, But Bitcoin Struggles

Apple expands Apple Pay cross-border payment support for Mainland China users

格隆汇·2026/01/15 03:40

Duke Energy Activates 50-MW Grid Battery at Former Allen Coal Facility

101 finance·2026/01/15 03:24

Inflation Concerns Resurface as Officials Dampen Sentiment!

美投investing·2026/01/15 03:09

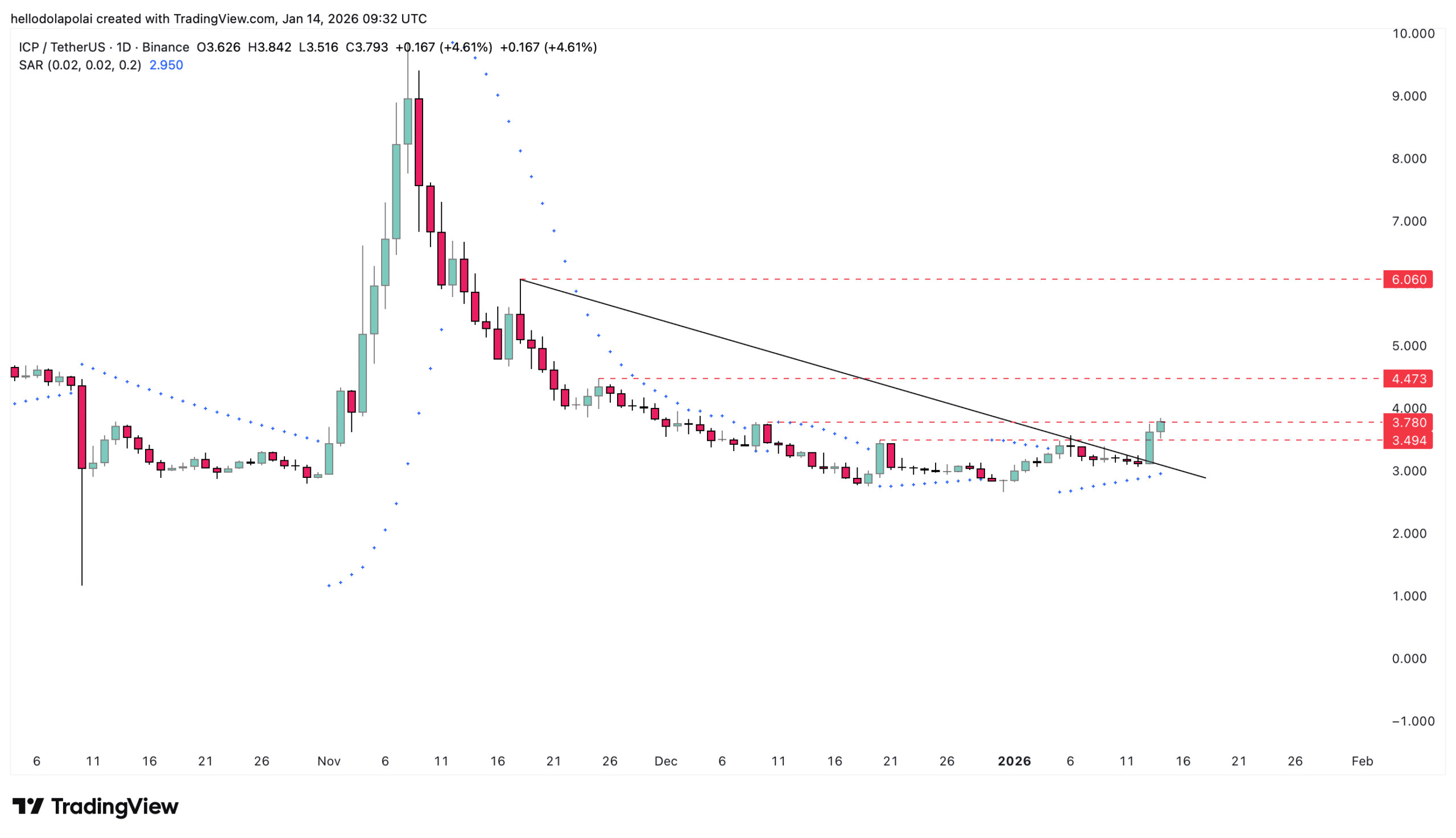

Internet Computer rallies 12% – But THESE levels still stand in ICP’s way

AMBCrypto·2026/01/15 03:03

AbbVie Plans to Expand in the Obesity Treatment Market

格隆汇·2026/01/15 02:36

Mira Murati’s company, Thinking Machines Lab, is seeing two of its co-founders depart to join OpenAI

101 finance·2026/01/15 02:36

Amazon Criticizes Saks Investment Agreement, Claims Its Shares Have ‘No Value’

101 finance·2026/01/15 02:30

Senator Lummis indicates that the hearing on the crypto market structure bill could be delayed

101 finance·2026/01/15 02:21

Flash

04:12

PUMP tops the liquidation rankings across the network in the past hour, as the second largest on-chain PUMP long position was liquidated for $14.3 millionBlockBeats News, January 15, according to HyperInsight and CoinGlass monitoring, PUMP dropped about 8.4% in a short period and is now quoted at $0.00264; FARTCOIN fell more than 13%, now quoted at $0.373. In the past hour, about 99% of the liquidation orders for both tokens on the Hyperliquid platform were long positions, accounting for 97.6% and 95.5% of the total liquidation volume for each token across the network, respectively. This large-scale liquidation was mainly caused by a whale address (0xbaa). This address is simultaneously the second largest long holder of PUMP and the largest long holder of FARTCOIN on-chain. Monitoring shows that its PUMP long positions suffered two large liquidations within half an hour, totaling approximately $14.32 million, with a loss of about $470,000. The next liquidation price is around $0.00218; FARTCOIN long positions were also liquidated for about $11.16 million, with the next liquidation price expected to be around $0.348. Currently, the total position size of this whale account has been reduced to about $5.86 million.

04:11

PUMP Tops All Networks in Last Hour Liquidations, $14.3M Longs Liquidated on Chain's PUMP Leaderboard IIBlockBeats News, January 15th, according to HyperInsight and CoinGlass monitoring, PUMP experienced a short-term drop of about 8.4%, currently trading at $0.00264; FARTCOIN plummeted over 13%, currently trading at $0.373. In the past hour, about 99% of the liquidation orders on the Hyperliquid platform for both were long positions, accounting for 97.6% and 95.5% of the coin's total liquidation volume, respectively.

This large-scale liquidation was mainly caused by a whale address (0xbaa). This address is the second largest long on-chain for PUMP and the largest long for FARTCOIN. Monitoring shows that its PUMP longs suffered two consecutive large liquidations within half an hour, totaling about $14.32 million, with a loss of about $470,000, and the next liquidation price is around $0.00218; FARTCOIN longs were also liquidated simultaneously for about $11.16 million, with the next liquidation price expected to be around $0.348. Currently, the total holdings of this whale account have been reduced to around $5.86 million.

04:08

YO releases review of yoUSD incident: automatic swap operation caused a $3.7 million shortfall, which has been fully covered by the treasuryPANews reported on January 15 that the DeFi protocol YO released a review of the yoUSD incident, stating that the yoUSD vault has fully resumed operations and funds are secure; the incident originated from an unfavorable automatic swap operation, resulting in a $3.7 million funding gap, which has been fully covered by YO's vault; user balances were not affected, and the protocol's solvency was not impacted. Previously, on January 13, it was reported that YO Protocol experienced an abnormal Swap transaction, where approximately $3.84 million worth of stkGHO was exchanged for only $122,000 USDC.

News