News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest(Nov 29)|All Major U.S. Stock Indices Closed Lower; Next Year’s FOMC Voters Emphasize Inflation Risks and Oppose Further Rate Cuts; 72 out of Top 100 Tokens Down More Than 50% from All-Time Highs2Bitcoin’s Current Correction: At the End of the “Four-Year Cycle,” Government Shutdown Intensifies Liquidity Shock3Zcash Price Prediction 2025: Why ZEC Might Hit $360, Shedding 35% From ATH?

Ray Dalio Voices Concern Over the Fed’s Policy Direction

Cointribune·2025/11/08 12:57

Crypto: Donald Trump's Company Suffers Heavy Losses Despite Its Investments

Cointribune·2025/11/08 12:57

Stablecoins Offer Relief To Citizens, Risk To Entire Economies

Cointribune·2025/11/08 12:57

Towards a Dogecoin ETF as early as this month? Bitwise reignites speculation

Cointribune·2025/11/08 12:57

Bitcoin accumulation reaches an unprecedented peak according to on-chain data

Cointribune·2025/11/08 12:57

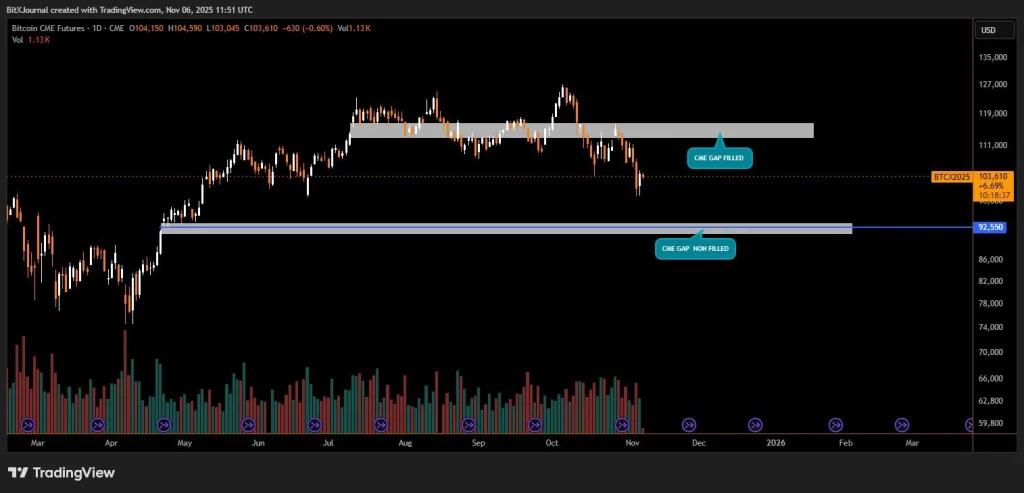

Three Reasons Why Bitcoin Price Will Drop to $92k in the Coming Weeks

Coinpedia·2025/11/08 12:42

Whales and Banks Secretly Loading Up on Bitcoin During Fear

CryptoNewsFlash·2025/11/08 12:33

Arthur Hayes Puts Zcash Right Behind Bitcoin in His Portfolio

CryptoNewsFlash·2025/11/08 12:33

Litecoin Leads Altcoin Rally with Whale Accumulation and Explosive On-Chain Growth

CryptoNewsFlash·2025/11/08 12:33

Flash

- 13:36Fortune: CoreWeave's financial situation is a typical reflection of the AI infrastructure bubble, with debt burden potentially becoming a hidden riskAccording to a report by Jinse Finance, Fortune magazine has revealed that CoreWeave recently signed an AI agreement worth $1.17 billion with Vast Data, a company invested in by Nvidia. However, bitcoin mining company Core Scientific has terminated its cooperation with CoreWeave. Through analysis of documents submitted by the company to the US SEC, Fortune magazine found that the company's business model carries significant risks, with the documents filled with warnings and cautions. The latest quarterly report disclosed a total debt of $11 billion, indicating that CoreWeave's fundamentals are currently not optimistic and profitability is still a long way off. Furthermore, due to a lack of ability to issue debt, the company is facing a severe cash flow shortage. Short sellers believe that CoreWeave is highly likely to run into trouble due to its continuously increasing debt, potentially becoming the first domino to fall in the artificial intelligence ecosystem.

- 13:33Pakistan plans to consider issuing a rupee-backed stablecoin and is developing a CBDC pilot.According to ChainCatcher, citing a report from Cointelegraph, Faisal Mazhar, Deputy Director of the Payment Systems Department at the State Bank of Pakistan, stated that with the assistance of the World Bank and the International Monetary Fund (IMF), a central bank digital currency (CBDC) prototype is under development and is planned to undergo a pilot phase before full-scale rollout. Additionally, according to Zafar Masud, Chairman of the Pakistan Banks’ Association (PBA), the country is seriously considering issuing a Pakistan Rupee-backed stablecoin and will promote improvements in digital asset regulation. He noted that delays in digital asset regulation could result in the loss of up to 25 billions USD in economic development opportunities.

- 13:15This week, US spot Ethereum ETFs saw a total net outflow of $507.7 million.According to ChainCatcher, citing monitoring data from Farside, the cumulative net outflow from US spot Ethereum ETFs this week reached $507.7 million.