News

Stay up to date on the latest crypto trends with our expert, in-depth coverage.

1Bitget Daily Digest (Dec.26)|Whales Accumulate ~$660M in ETH Over a Week; Trust Wallet Extension Suspected of Supply Chain Attack; Uniswap’s UNIfication Proposal Passes by a Landslide2Why Bitcoin shorts look confident now, even as $90K looms3Monad up 19% a day – But is MON’s current rise sustainable?

BTC Weekly Watch: Bearish Sniper Battle!

Bitpush·2025/09/22 21:48

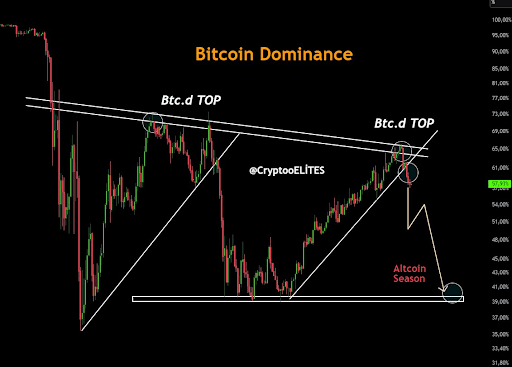

Bitcoin Dominance Nears 57.5% as Altcoin Momentum Fades and Ethereum Volume Drops

Coinotag·2025/09/22 21:39

U.S. Lifeline May Stabilize Argentina’s Peso and Spur Bitcoin Adoption

Coinotag·2025/09/22 21:39

Dogecoin (DOGE) Drops Over 5% – Is This the Start of a Bigger Crash?

Newsbtc·2025/09/22 21:39

Aster Price Jumps 16% in 24 Hours As Investors See Opportunity

Aster rallied 16% to $1.62 on strong investor inflows, but technicals show caution. Holding $1.58 or breaking $1.71 will decide if it advances toward its all-time high.

BeInCrypto·2025/09/22 21:38

LayerZero Foundation Boosts Crypto Market with Massive Token Buyback

In Brief LayerZero has repurchased 50 million ZRO Coins from early investors. The move represents a strategic intention to stabilize ZRO Coin's price. Market confidence may grow as a result of this buyback initiative.

Cointurk·2025/09/22 21:21

Over $80K in Profits from ASTER Shorts as Whale Activity Drives $10.5M Token Inflow

Cryptonewsland·2025/09/22 21:18

Pepe Drops 8% to $0.059731 as RSI Hits Oversold Zone and Support Holds

Cryptonewsland·2025/09/22 21:18

Dogecoin Consolidates at $0.2647 as Recurring Channel Pattern Tests Resistance

Cryptonewsland·2025/09/22 21:18

Flash

16:18

In 2026, US crypto regulation may adopt a dual-track frameworkOn December 27, it was reported that in the second year of the Trump administration, the landscape of US crypto regulation began to shift. The US Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) moved from a jurisdictional struggle to close cooperation, jointly advancing crypto regulation. SEC Chairman Paul Atkins promoted a token classification system, Project Crypto, and an innovative exemption mechanism, and approved listing standards for multiple types of crypto ETFs, making asset tokenization a regulatory focus. The CFTC accelerated rule clarification through Crypto Sprint, and the new chairman, Michael Selig, is expected to play a key role in the regulation of crypto commodities such as bitcoin. Industry insiders believe that by 2026, US crypto regulation will present a dual-track pattern of SEC institutional innovation and CFTC-led market expansion.

16:15

2026 U.S. Crypto Regulation Outlook: SEC Drives Reform, CFTC’s Influence RisesBlockBeats News, December 27th, as the Trump administration enters its second year in office, a shift in the US crypto regulatory landscape is occurring. The US Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), after previous jurisdictional games, are now moving towards closer collaboration to advance crypto regulation together.

SEC Chairman Paul Atkins is promoting the "Token Classification Framework," Project Crypto, and an innovation exemption mechanism, and has approved listing standards for multiple crypto ETFs, while also prioritizing asset tokenization in regulation.

The CFTC is accelerating rule clarification through "Crypto Sprint" and is expected to play a more central role in regulating crypto commodities, such as Bitcoin, under newly appointed Chairman Michael Selig.

The industry believes that in 2026, the US crypto regulation will present a dual-track pattern of SEC institutional innovation and CFTC-led market expansion. Former SEC senior lawyer Howard Fischer pointed out that this is the first time in his memory that the two major institutions have advanced crypto regulation in a highly cooperative manner, and they expect this collaboration to dominate the regulatory agenda in 2026.

16:05

Bitcoin falls below $87,000 as precious metal prices hit record highsIn early U.S. trading on Friday, major cryptocurrencies and related stocks generally declined, with bitcoin prices falling below $87,000 and bitcoin mining company stocks dropping more than 5%. Meanwhile, prices of precious metals such as gold, silver, platinum, and copper reached new highs, as geopolitical tensions drove capital flows into the precious metals market.

News